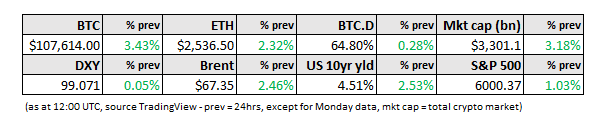

Markets: sideways for now

plus, tariffs, jobs, China and more

“Governments tend not to solve problems, only to rearrange them.” – Ronald Reagan ||

Hi everyone! I hope you all had a good weekend. Gorgeous weather where I am, family visiting, great food, and I can recommend The Accountant 2, almost as good as the first one.

I’m guest hosting Scott Melker’s Macro Monday show at 9amET today – come join us! You can find the livestream here.

IN THIS NEWSLETTER:

Coming up: what to keep an eye on this week

Sideways for now

Macro-Crypto Bits: jobs, markets, China, tariffs

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

Coming up: what to keep an eye on this week

(a new section in which I’ll aim to give you a heads-up on possible market-moving events, as well as those that could shape the geopolitical and crypto stage)

London Tech Week kicks off today, which may surprise us with some crypto-related announcements from large tech firms. I have no insider information here, just saying it wouldn’t surprise me.

And, more tech talk, today is Apple’s Worldwide Developers Conference – there, we’re more likely to get AI integration news than crypto wallet confirmations. But with the recent ruling that they have to allow external payment solutions, maybe there’ll be some good IoS news for crypto service providers?

More directly relevant, later today we have another SEC crypto round table, this time on “DeFi and the American Spirit” – you can watch the livestream here, it runs from 1pm-5pmET.

China and US trade negotiation teams are meeting face-to-face in London (see below).

And we get the results of the latest NY Fed consumer sentiment survey.

Tomorrow kicks off the two-day annual Conference on Financial Stability in Frankfurt, organized by the European Central bank and the NY Fed. There’s no stablecoin panel on the agenda, which suggests that US stablecoin legislation is not yet seen as a global threat, despite the efforts of certain officials.

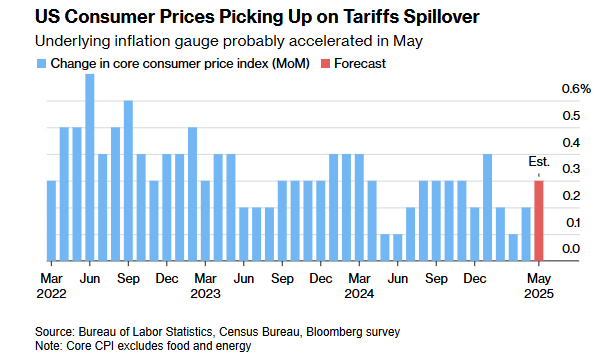

Wednesday brings the big economic event of the week: US inflation for May, with the consensus estimate pointing to a slight acceleration. Headline CPI is expected to have increased by 2.5% vs 2.3% in April, and core inflation is expected to accelerate to 2.9% from 2.8%.

(chart via Bloomberg)

Thursday delivers the latest weekly US jobless claims – people seem to be obsessing over this very noisy data point again, presumably because they think higher unemployment would galvanize Fed rate cuts. (I mean, maybe, but only if inflation is under control, which is not a given.)

On the same day, we get the latest US Producer Price Index, a gauge of wholesale inflation, expected to decelerate slightly from 3.1% to 3.0%. Given tariff pass-throughs, we could be in for an unpleasant surprise here.

Also on Thursday, we have an auction of 30-year treasuries. These have been a tough sell recently, and a “failed” auction (with a higher yield needed to encourage banks to step in) would send a jittery signal.

(chart via the Financial Times)

Friday brings a preliminary read of the latest University of Michigan consumer survey. These aren’t going to move markets, but they do offer an anecdotal window into sentiment – put differently, they’re not directly useful, but nor are they irrelevant.

Sideways for now

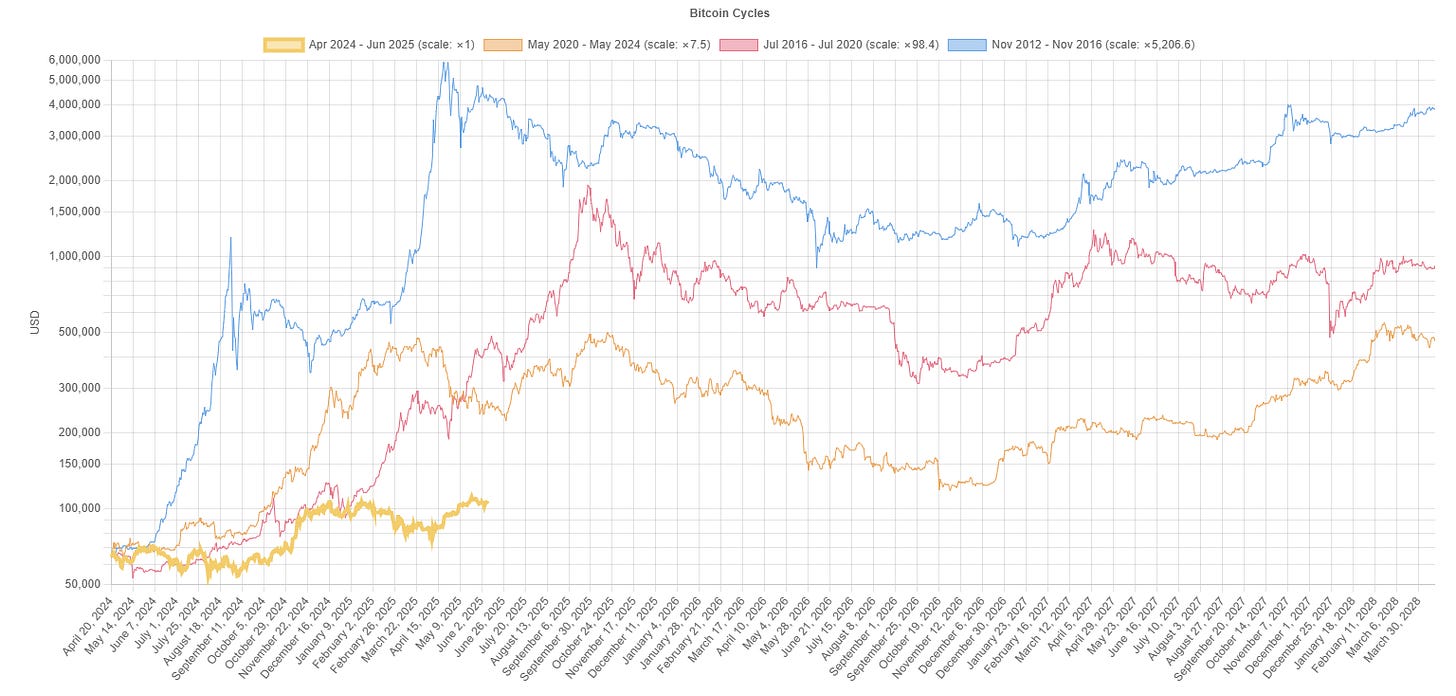

(Note: I wrote this earlier today, before BTC started climbing, but my point still holds – we’re early.)

The holding period continues. I’ve seen many of these “churn sideways” phases in crypto, and generally, just when you start to hear jokes along the lines of “Bitcoin is the new stablecoin”, there’s a sharp move, and not always in the direction you hope for.

(chart via bitcoincyclescomparison.com)

Only, the market is different enough now to throw old patterns out the window.