Markets: something’s off

Plus: BTC and political drama, gold and the dollar, what’s ahead this week + more

“The more things go on moving, interrelating, conflicting, changing, the less balance there is – and the more life.” – Ursula K. Le Guin ||

Hi everyone! I hope you all had a great weekend, and that this week is not quite as crazy as <checks notes> every week this year so far.

Less crypto today, more macro, as markets are weird… But below I do dive into why BTC is not rising on the back of a weaker dollar, as it used to.

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

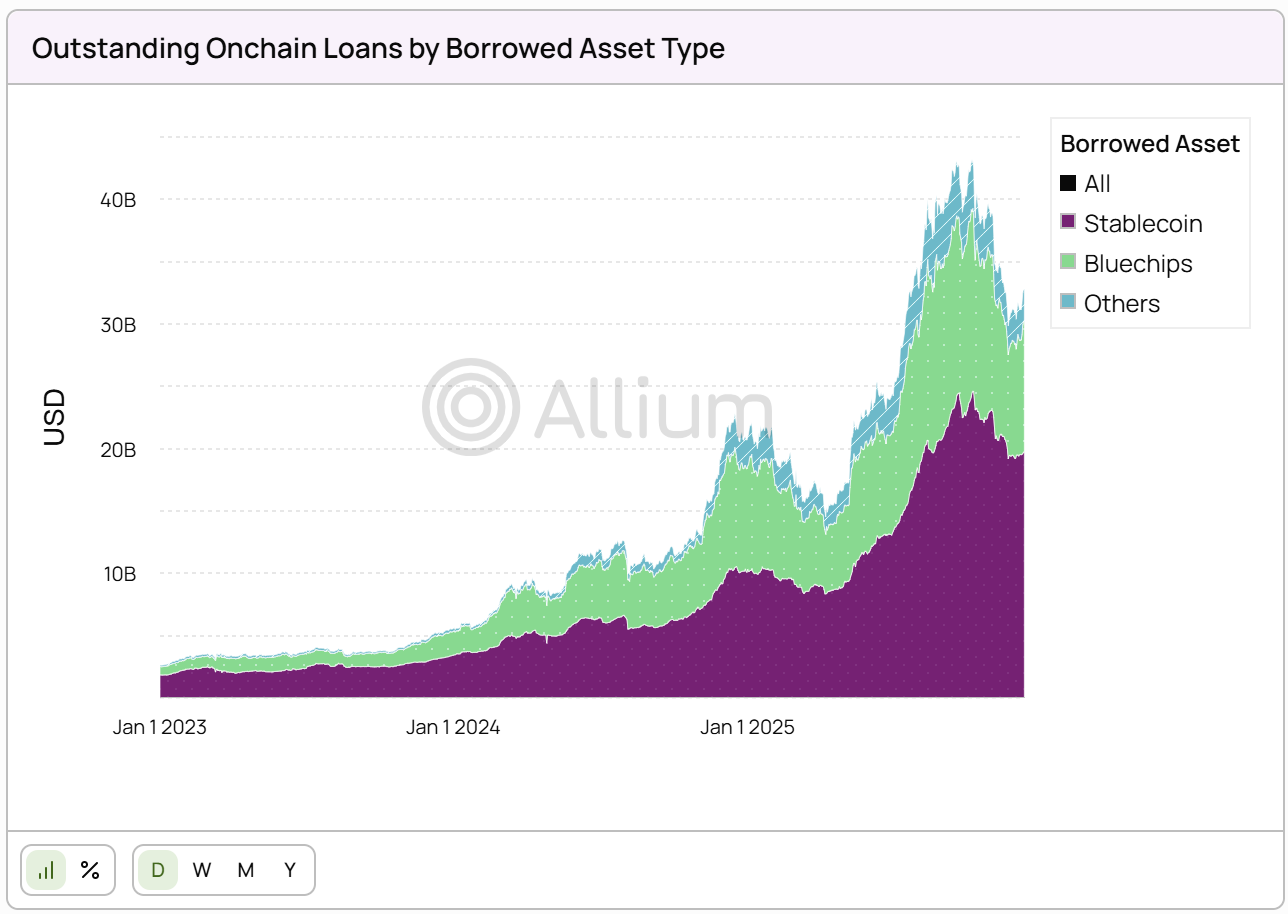

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets. Looking at the data, outstanding onchain loans reached over $40Bn this year, with stablecoins making up more than half of borrowed assets.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

Coming up this week: FOMC, US activity, digital euro

Markets: something’s off

Gold and the dollar

BTC and political drama

Macro: US consumer sentiment

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes. Plus links, a music recommendation (‘cos why not?), and more.

If you’re a premium subscriber, thank you!! ❤

WHAT I’M WATCHING:

Coming up this week: FOMC, US activity, digital euro

It’s Fed week! Not that any interesting movement is expected, although we will all be paying close attention to see if Fed Chair Powell says anything about the DOJ investigation – he’s unlikely to, but as with his video statement, he could surprise us.

On Tuesday, the Senate Agriculture Committee is scheduled to hold its markup session for the CLARITY Act crypto bill. The storm could delay this, however – according to reports, the Banking Committee has pushed its markup session to the second half of February at the earliest.

Also on Tuesday, the Bundesbank hosts an event in Berlin focused on the digital euro.

And we get the US Conference Board consumer confidence report for January.

On Wednesday, we hear the verdict from the two-day FOMC meeting, with no rates move expected. Chair Powell’s press conference could have a touch more spice to it than usual, however, given the pressure on both him and Governor Lisa Cook from the Administration.

Thursday brings US factory orders and trade data for November, as well as Q3 nonfarm productivity and unit labour costs.

On Friday, we get the US Producer Price Index for December, with consensus estimates pointing to a modest acceleration.

And, most likely, the US government shuts down yet again as the continuing resolution that would ensure funding to many administrative departments runs out, and it looks like there is not exactly a cooperative mood on Capitol Hill.