Markets: The dog that didn’t bark

plus, Coinbase in India

“I believe that banking institutions are more dangerous to our liberties than standing armies.” – Thomas Jefferson ||

Hello everyone, I hope you’re all doing well!

Why oh why oh why can’t Europe and the US change clocks on the same date? If they have to do it at all? Getting this newsletter out an hour early for readers across the ocean is, well, proving to be tough – sorry about that!

Below, I look at why we didn’t see much of a market reaction to yesterday’s CPI print – sometimes what doesn’t happen is as interesting as what does.

I also note the significance of Coinbase’s return to India.

Production note: I have to skip publication on Monday 17th – I know I skipped this past Monday, but the two conflicts are unrelated, and I assure you this will not become a habit!

IN THIS NEWSLETTER:

Markets: The dog that didn’t bark

Coinbase in India

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as audio, relevant links and music recommendations ‘cos why not.

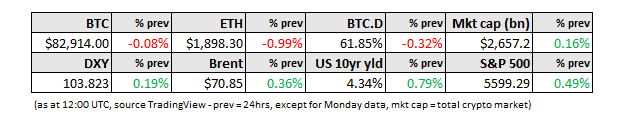

WHAT I’M WATCHING:

Markets: The dog that didn’t bark

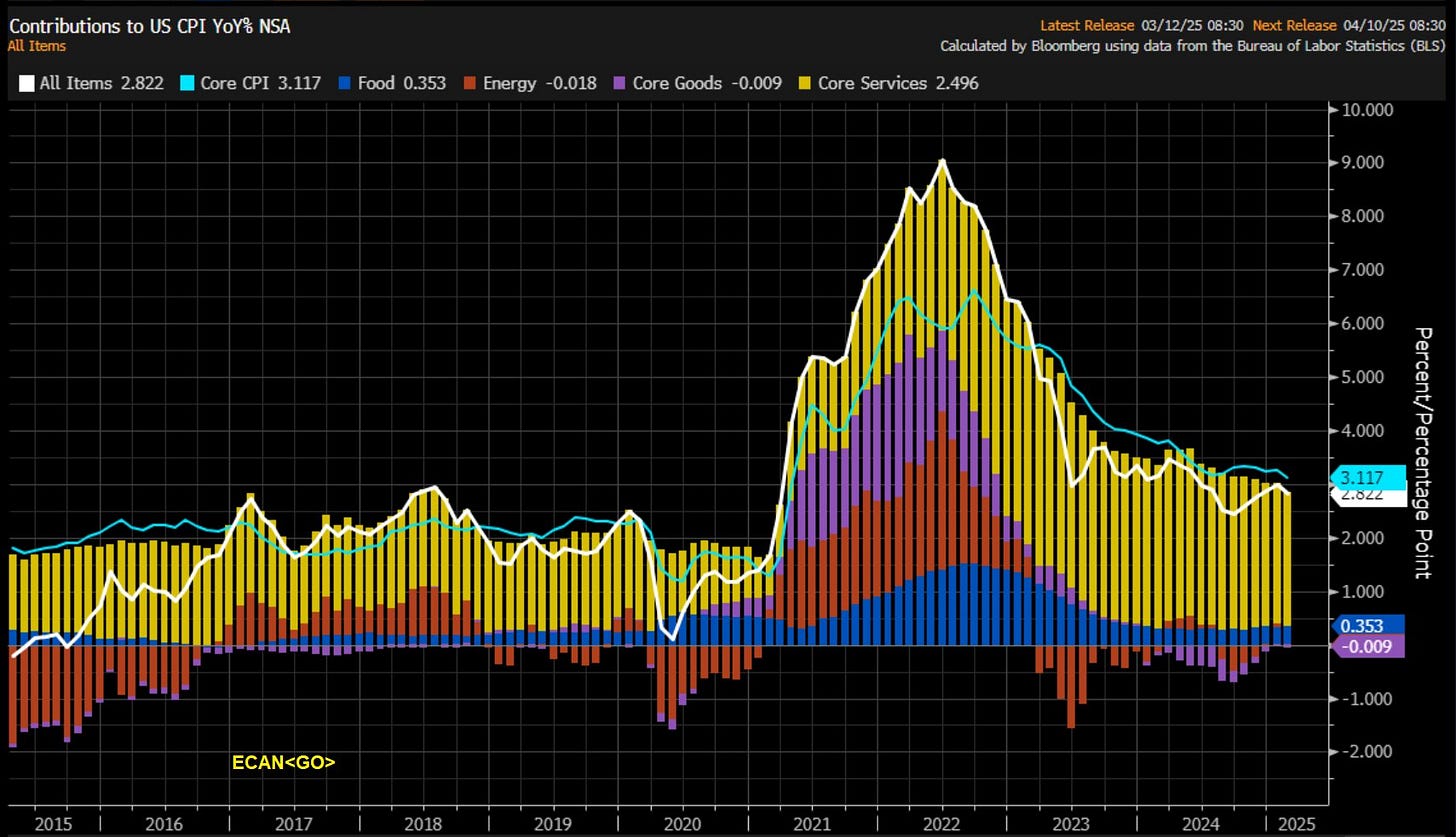

Unsurprisingly, yesterday’s US CPI print for February unwound part of the January upside shock – the first month of the year tends to be relatively “hot” given price reviews and contract updates. Surprisingly, it came in even softer than expected.

The month-on-month core index, which strips out more volatile food and energy components, climbed by 0.2%, lower than the expected 0.3% and January’s 0.4%. The year-on-year increase decelerated to 3.1%, under the consensus forecast of 3.2% and January’s 3.3%.

(chart via @M_McDonough)

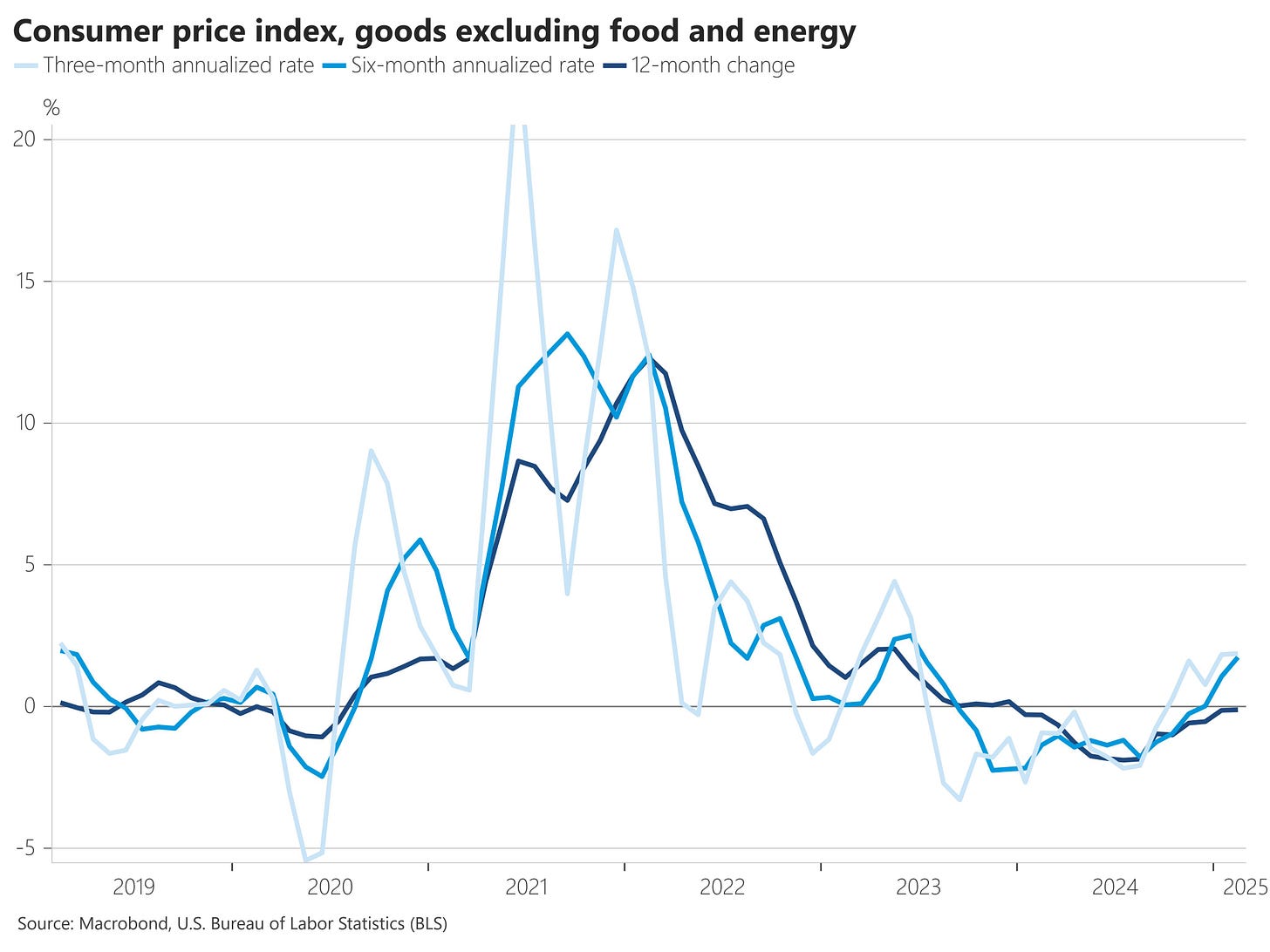

Core goods inflation – the segment most likely to be impacted by tariffs – is accelerating, suggesting that some producers are getting price hikes in early.

(chart via @NickTimiraos)

But, encouragingly, the notoriously sticky supercore index – which strips out food, energy and housing to get a measure more sensitive to monetary policy – continued to decelerate.