mBridge gets complicated

plus, yay BTC, conflicting rates messages, and the 1960s

“The lesson is that no amount of sophisticated statistical analysis is a match for the historical experience that ‘stuff happens’.” – Mervyn King ||

Hi everyone, I hope you’re all doing well! Is it just me, or are things starting to feel a bit crazy?

Below, I take a look at signs of some cracks in the mBridge project. There’s also a (very!) brief comment on the BTC price, and on the conflicting market message on rates.

Programming note: it’s a holiday here on Friday (All Saints’ Day), so this newsletter will be taking a break.

IN THIS NEWSLETTER:

mBridge gets complicated

Crypto on the move

Conflicting messages on rates

If you’re not a premium subscriber, I hope you’ll consider becoming one!

WHAT I’M WATCHING:

mBridge gets complicated

Almost a year ago, I profiled a likely competitor to SWIFT, the global messaging platform that is behind most payments. What’s more, it was a competitor born in the cradle of the BIS, the central banks’ central bank, which means this “alternative” came embedded with institutional credibility. It’s time for an update, because the plot line is taking a few twists I didn’t expect. But in retrospect, I should have.

In 2021, the central banks of China, Hong Kong, Thailand and the United Arab Emirates, with support from the BIS Innovation Lab, started work on the mBridge platform. After a successful pilot in 2022, it went live as a Minimum Viable Product (fully functioning but with limited access and reach) in June of this year, and welcomed the central bank of Saudi Arabia to the governance group.

The idea was to build a platform for cross-border payments using local central bank digital currencies. Running on a shared distributed ledger, the payment trigger, transfer and settlement all happen at the same layer, reducing friction and enabling new functionalities.

The big deal here was the economic weight and export characteristics of the participants, as well as their relationships with each other. And the unspoken picture was of an Eastern economic bloc oiling rails to further distance itself from the West. In theory, participating banks would not need SWIFT.

Recently, things appear to have gotten somewhat tense.

Technology troubles

Onstage at an event last week, Mu Changchun – head of the PBoC’s Digital Currency Institute – dropped some hints that the technology has been giving some trouble. He said that the network stability issues had “been sorted out”, which delivered two alarming messages:

There had been downtime, which you just can’t have in international payments systems.

We don’t know much about how mBridge’s technology works.

The platform runs on a new private blockchain, based on Ethereum technology, built by a lab in China. If even public open-source blockchains can give stability issues, it’s not a surprise that the same goes for closed and relatively untested networks.

And if something were to go wrong with the underlying platform, who would be responsible for losses?

Plus, it’s not just the network that needs to be tested – it’s the necessary spread of connections to both fiat and digital systems, all of which run on different technologies.

All this is even before you try to bring on a wide range of legal systems and market frameworks.

These issues can eventually get fixed. But they remind us that distributed ledger networks are a mammoth undertaking, especially when they involve many parties with different motives.

A lack of trust

This brings us to the next emerging crevice in the initial plan.

The above-mentioned event was SWIFT’s SIBOS conference in Beijing last week. Yes, SWIFT invited the platform intended to replace it, and it turns out that SWIFT wants to get involved.

It makes strategic sense – to avoid being disintermediated, an entity must find a way to make itself necessary in the new structure. The idea also ties in to SWIFT’s various DLT-related initiatives, including a CBDC platform, a tokenized securities-fiat connection, and a digital asset FX settlement system.

In his talk, Mu diplomatically said that mBridge was open to working with Swift, which could expand the range of available currencies for participants. Yet former PBoC governor Zhou Xiaochuan, speaking at the same event, warned of likely political barriers ahead. He expressed hope that SWIFT would have “better” governance, no doubt referring to its role as a key tool in the US strategy of weaponizing the dollar by cutting off access to certain banks.

There’s not much chance that will change.

But it does raise the issue of the potential role in mBridge of the US dollar.

Some affiliated with the project are diplomatically saying that the dollar could be one offered payment option – but that would require a US CBDC. Wholesale central bank digital currencies would bring enhanced payments efficiency to the cross-border dollar system, but the term has such political connotations in the US that it would be difficult to get the necessary legislation through Congress. And the US might not want its digital currency used on a platform it can’t control or at least have a governance stake in. China is not likely to be comfortable with that.

Of course, mBridge could connect to fiat currency systems and even SWIFT via APIs – but many of the advantages would be lost, so wouldn’t it just be easier to stick to the current US-dominated system?

Without the dollar, though, where will FX liquidity come from? The US currency is used in almost 90% of FX pairs. This is likely to change with time, but meanwhile what should traders do? The problem is especially acute with CBDCs which have no FX trading liquidity at all – so mBridge participants have to switch in and out of fiat, which erases many of the potential benefits. And, transactions have to be pre-funded from fiat accounts. These frictions become more of a barrier if there is geopolitical risk in getting involved.

Could mBridge dent the global reserve currency status of the USD? Zhou pretty much said “it’s up to the US”. And not just the US:

“The relationship between mBridge and the US dollar, or other currencies, is not only dependent on technological development, but also the policy itself in the Western countries.”

Reading between the lines, you can see a lot of subtext.

The geopolitical web

The thing is, some mBridge members have close trade relationships with China and with the US, and would no doubt like to maintain them both. Diverging priorities can shine a spotlight on structural weaknesses.

(image via Reuters)

On stage at Sibos, the deputy governor of the PBOC Lu Lei stressed that mBridge participants had to “trust each other and have respect for the legal frameworks of their partners”. He went on to say:

“We must reduce new cross-border payment frictions while removing existing ones, and we must avoid creating new barriers while reducing existing market fragmentations. Furthermore, we must also avoid introducing additional geopolitical and compliance costs while reducing existing cross-border payment costs.”

Wait, what new frictions, what new barriers, what additional geopolitical costs? It’s starting to sound like multi-party governance is running into some tension.

This is hardly surprising given China’s commercial support for Russia and the fear across all mBridge participants of secondary sanctions from the US.

What have we done

A third sign that things are changing is a report yesterday in Bloomberg which says that the BIS is considering closing mBridge down.

It turns out that at last week’s BRICS summit, Putin made reference to a BRICS Bridge, a group payment system similar to that of mBridge. This has ruffled many feathers in the halls of US power, with the IMF and World Bank expressing concern at their annual get-together last week.

If the report is correct, this seems surprisingly naïve. Did the BIS really think the mBridge structure if not its exact technology was not going to be replicated elsewhere? And does it really think that cancelling its support for the project will stop that from happening?

BIS chief Agustin Carstens has huffed that his organization would never support working with sanctioned entities – but Russia joining mBridge was never on the table. It doesn’t need to, it can build a new system based on mBridge’s structure, making the tweaks it sees fit. Or, it could focus on drawing up new fiat rail connections. Or a combination.

What’s more, the BIS’s role is to foster international cooperation between central banks and to support their function – it does not have the authority to stop a central bank from joining an alternative system.

BRICS is studying new payments rails, but has not made any decision. And the withdrawal of BIS support for mBridge doesn’t mean the project won’t continue.

The bigger picture

mBridge may be facing some issues. But shutting down the project because another group is considering something similar would signal heightened panic, and underscore the potential impact an alternative system could have.

This level of panic could persuade some platform members to step back, in fear of the consequences. Or it could serve as a reminder that the landscape is changing and the balance of power is shifting.

It also highlights the looming fork in the road. If mBridge goes ahead, members will have to decide whether the potential benefits outweigh the geopolitical risk.

But this situation is about more than just mBridge. It’s about any alternative non-dollar payments system. Up until now, the US has managed to quelch all initiatives to bypass its control of global finance. But blockchain technology does pave a path toward systems that can more easily detach themselves from SWIFT and US banks.

These systems will need to decide whether they go global to harness cross-border efficiencies for everyone, arguably a good goal. Or do they go regional, to preserve some independence?

And members will have to decide whether or not they risk incurring US wrath in exchange for smoother and more liquid trade options with US adversaries, either current or potential – a tough call when building regional platforms is expensive and slow.

Are we heading into a world in which, for the sake of payments, all will have to choose sides?

Probably not – we can hope that diplomacy and an aversion to economic pain will triumph over posturing and playground tactics. Meanwhile, blockchain use cases will continue to be tested, connectivity will find a way to spread, and governance will always be hard but will find a way to work, at least in some cases.

Maybe mBridge will last, maybe not, but either way, its lessons matter.

And given the outlook for both economic growth and geopolitical realignment, the need for more efficient global payments and greater affiliation independence could become less about cost and harnessing new technologies, and more about longer-term national strategy.

See also:

IN BRIEF:

Crypto on the move

So, this is nice:

(BTC/USD chart via TradingView)

Trump trade? Safe haven demand? Probably a mixture of the two – and I have no idea if this rally will hold, we’ve been here before. I also don’t know whether, should Trump win next week, we’ll get a sell-the-news event. Or how much it could correct should Harris win (looking less likely but certainly still possible, polls have been very wrong before).

The way to get through this is to have a longer-term view. And make popcorn.

Conflicting messages on rates

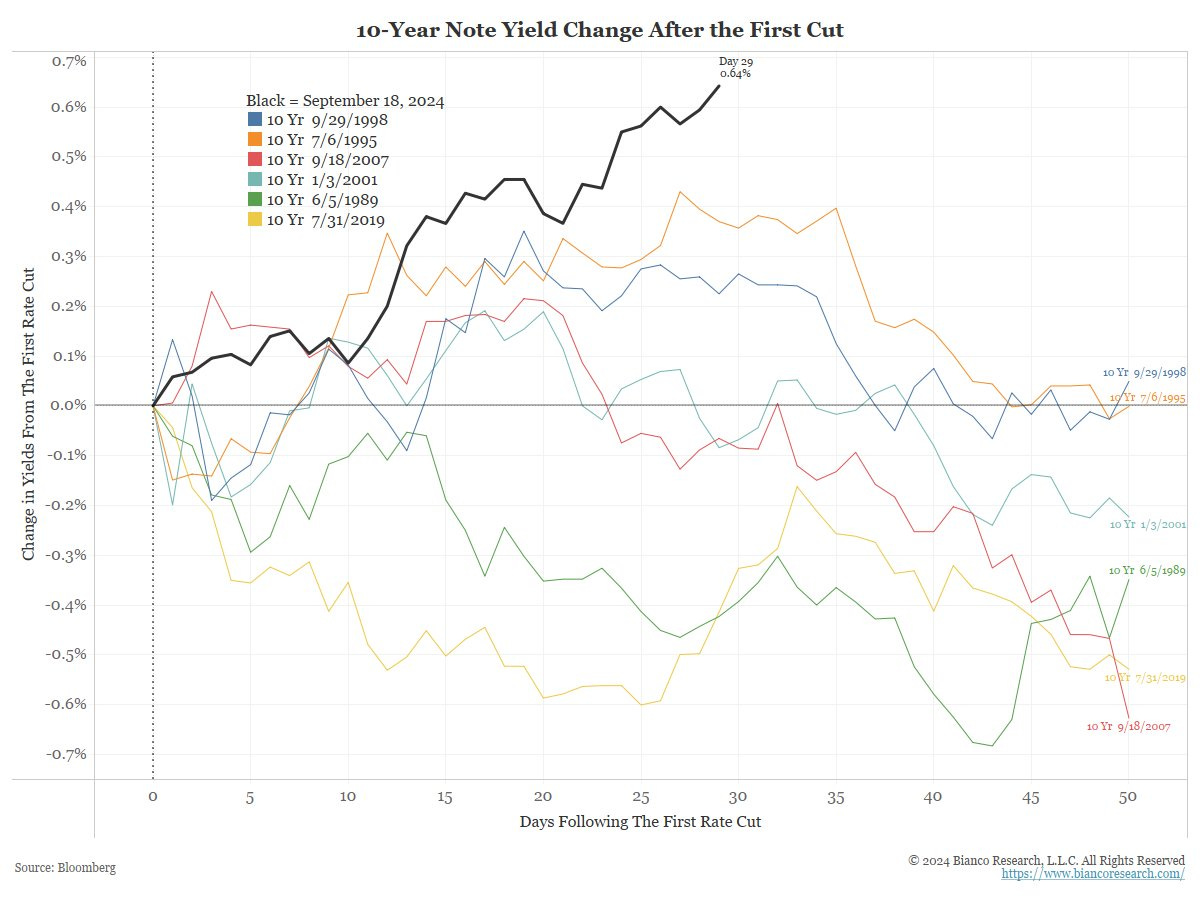

Here’s a good chart from Bianco Research that shows the recent US treasury yield climb in the context of previous easing cycles. It’s the steepest since 1989.

(chart via @BiancoResearch)

The market is sending the Fed a message. We’ll find out next week whether the Fed is listening.

Meanwhile, CME futures are still pricing in an almost 100% probability of one rate cut on Thursday. Not delivering what the market expects would be unusual – but the likely treasury market volatility if it does would be adding fuel to an already volatile week. Keep an eye out for some indirect signalling from Fed officials over the next few days (they can’t speak publicly this close to the FOMC, but that doesn’t mean they can’t send a hint).

LISTEN/READ:

On the latest EconTalk episode, Russ Roberts takes a break from macro and talks to Susan Cain about why we like sad music, cry in the face of beauty (oh I so identify) and enjoy poetry that breaks our hearts. A strong recommend if you want a break from the market noise, to remember the joy of being alive.

After just one episode, I am now hooked on The Rest is History’s new series (Spotify link) about the US in 1968. So far, it portrays colourful characters with both detail and the softening lens of history, paints a picture of the overall fear, and reminds us how “new” the culture of the time felt.

WHAT I’M LISTENING TO: An iconic protest song from the ‘60s that the above series reminded me of and that I’ve been listening to on loop – All Along the Watchtower, by Jimi Hendrix.

“There must be some kind of way outta here

Said the joker to the thief

There's too much confusion

I can't get no relief”

HAVE A GREAT DAY!

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade.

It's interesting that the MOVE index is this high (which puts a chill on global liquidity) and yet BTC is climbing. Seems like China is a factor, JPY/USD is a factor, and investors are always forward-looking and more debt monetization is happening.

Hey did you hear the awesome interview on The Bitcoin Podcast with Maya Parbhoe. I don't normally listen to his podcast but this one was so inspiring and hopeful. If she can get elected president of Surinam and can pull off this big vision that would be like El Salvador but way better. Pretty sure you'll love this one.

Interesting how global payment platforms will develop.

I don't place much trust in the polymarket betting on a Trump win. Gambling markets can be easily manipulated to show one side leading, certainly much easier than tweaking polling numbers., especially by a few foreign whales.

Most importantly, my favorite song every is Hendrix's version of All Along the Watchtower. Another great recent reinterpretation is from Mike Dawes, possible the top fingerstyle guitarist in the world right now. Also, another great version is this live version from Michael Hedges, tragically taken from us too soon. You can find these on youtube in case the links don't work where you are.

https://www.youtube.com/watch?v=nwurCSddFlQ7

https://www.youtube.com/watch?v=XqGHE5GqZ44