Military drills and futile sanctions

plus: Fed projections, LSEG tokenization, South Korea, US dollar and more

“Neither a man nor a crowd nor a nation can be trusted to act humanely or to think sanely under the influence of a great fear.” – Bertrand Russell ||

Hi everyone! I hope you’re all taking care of yourselves – September is feeling particularly surreal so far.

A programming note: this newsletter will be taking a break next week – I haven’t been on a holiday, as in an actual trip with husband, for three years. No complaints, we’re homebodies, have two dogs, and anyway, we live in a gorgeous city that itself is a holiday destination. But we’re getting on a plane together next week, to Malta. Neither of us have been before, so recommendations are welcome.

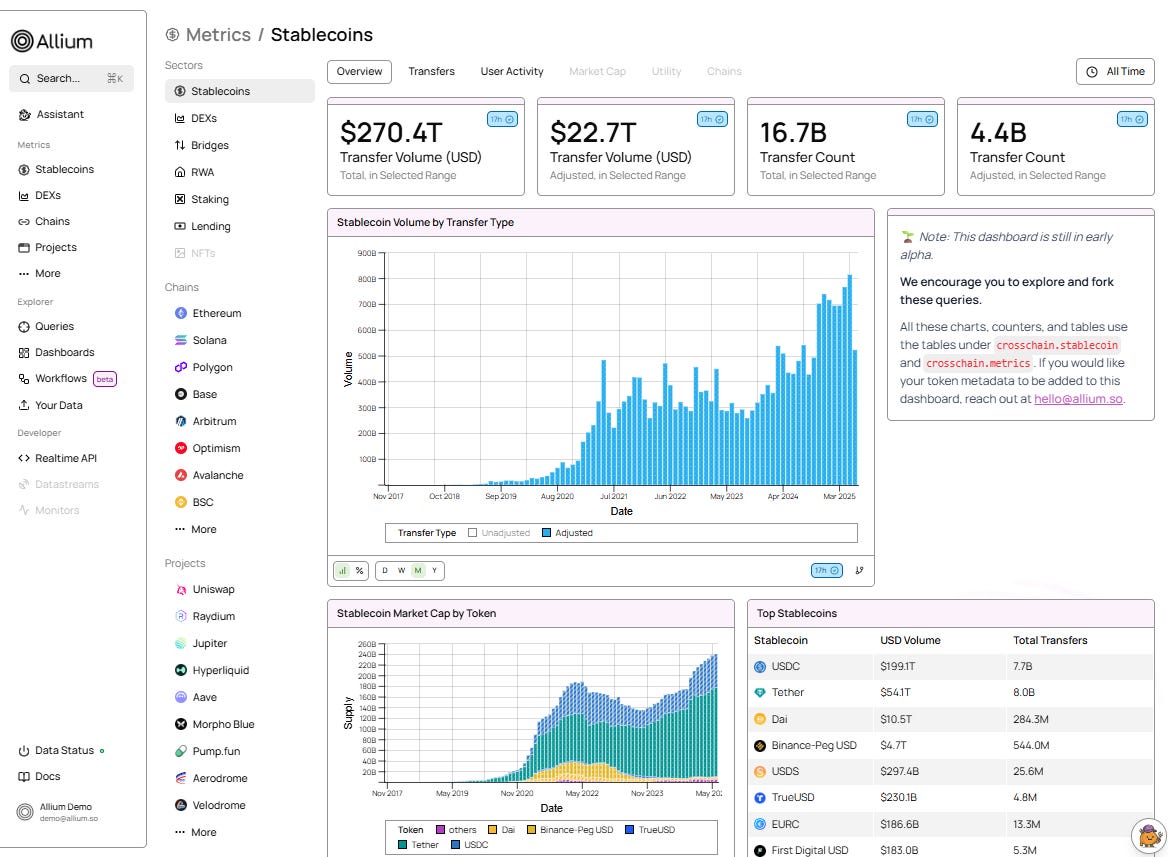

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides blockchain data and analytics for institutions and fintechs, helping teams generate key insights from on-chain activity. Leaders like Visa, Stripe, and Grayscale rely on Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

The sanctions on Russia that aren’t

Military drills and the geopolitical flex

LSEG launches tokenization platform

Macro-Crypto Bits: the USD decline, Fed economic updates

Also: China, Coinbase, CBO, stablecoins and more

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

The sanctions on Russia that aren’t

I’ve seen some media sources report that Trump is seriously considering applying harsh sanctions to Russia, if NATO countries stop buying Russian oil, and if the EU does the same and places tariffs of 100% on some Chinese and Indian goods.

This is incorrect – he not seriously considering it at all. By making his decision conditional on what other nations do, and by making the conditions unreasonable, he’s ensuring he won’t need to follow through.

First let’s look at how ludicrous it is to ask NATO countries to stop buying Russian energy. Türkiye is in NATO, and Russia accounts for roughly 50% of its gas and almost 70% of its oil imports.

Second, asking the EU to do the same is a non-starter, as Hungary and Slovakia get almost 90% and practically 100%, respectively, of their oil imports from Russia.

Third, the EU placing harsh tariffs on China? That would be economic suicide. Leaving aside the credible threat of retaliation, China is the second-largest trading partner for goods.

What we have here is further evidence the US is stepping back from the Russia-Ukraine conflict – the US could go full-bore on Russian sanctions without a huge cost to its domestic economy but it is choosing not to, possibly because it knows they would be futile without broad participation, which it won’t get.

And, possibly, part of the tactic is to push Europe out of the nest, force it to spend more on its own defence.

What does this mean for markets? With defence spending requirements likely to be much higher than forecast (especially after governments divert a chunk of the allocated budget to repaving roads and refurbishing railway stations, good election winners), borrowing needs will be higher, which will not only keep bond yields up but also aggravate already alarming debt situations.

And with higher yields in Europe plus the economic growth boost from hefty fiscal spending, at a time when the US economy is feeling the pain of higher inflation and thinner margins, money could start flowing back into the EU again, contributing to dollar weakness (see more on this below). This will become especially apparent as EU governments realize that high debt loads are not the big problem they thought, because everything’s relative, right?