Monday, April 8, 2024

two-sided jobs data, strange market reaction, Yellen in China, new section

“The biggest changes in life occur to variables that no-one watches.” – James Dale Davidson ||

Hello everyone! I hope you all had a great weekend. This week is starting off on a good note, right? Except for the breakdown of my recording mic, can’t get it to connect, and nor can I publish late - I’m co-hosting the Wolf of All Streets Macro Monday show in about an hour. 😞 So, no audio again today, sorry!

If you find this newsletter useful, would you mind sharing it with your friends and colleagues? ❤

IN THIS NEWSLETTER:

The two-sided employment story

The strange market reaction

Meanwhile, in China

If you’re not a subscriber to the premium daily, I hope you’ll consider becoming one! You’ll get ~daily insight into the growing overlap between the crypto and macro landscapes, as well as some useful links, and (usually!) access to an audio read of the content. And there’s a free trial!

WHAT I’M WATCHING:

The two-sided employment story

As usual, Friday’s US jobs data vindicated both the optimists and the pessimists, and left everyone as confused as ever.

The good news:

The increase in the number of jobs easily beat even optimistic forecasts, with a jump of 303,000 in March vs 212,000 expected and 270,000 in February (this last data point was revised down slightly from the originally reported 295,000). This marks the steepest jump in almost a year, and the third increase in a row.

The unemployment rate dipped to slightly below expectations, to 3.8% from February’s 3.9%, clocking up 26 months below 4%, the longest stretch since the 1980s.

(chart via Bloomberg)

Of course, even the good news has two contrasting interpretations: great for the US economy, in that people are still employed (yay!) and should keep on spending. But bad for those counting on interest rate cuts in the short term – it would be a risky move for the Federal Reserve to cut rates with spending still strong, given the possibility inflation could re-accelerate.

Now for the worrying news:

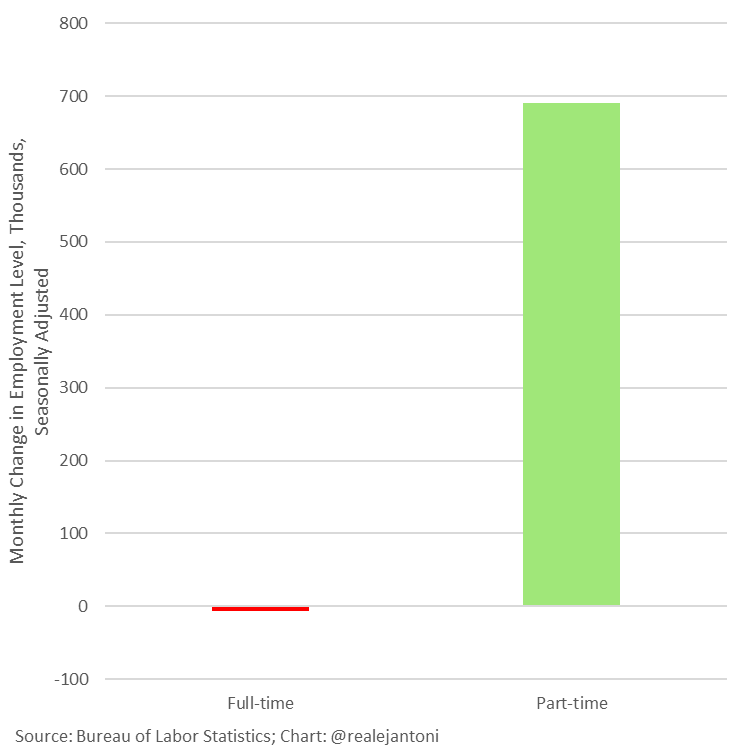

While the number of new jobs grew, the mix is not healthy – all the growth came from part-time jobs, with full-time jobs actually dropping.

(chart via @RealEJAntoni)

What’s more, the number of part-time jobs due to economic reasons (ie. people who can’t find a full-time job, or who are already working another full-time job but can’t make ends meet) is higher than a year ago.

(chart via the St. Louis Fed)

The percentage of the employed workforce holding multiple jobs has been climbing, and is now higher than before the pandemic.

(chart via the St. Louis Fed)

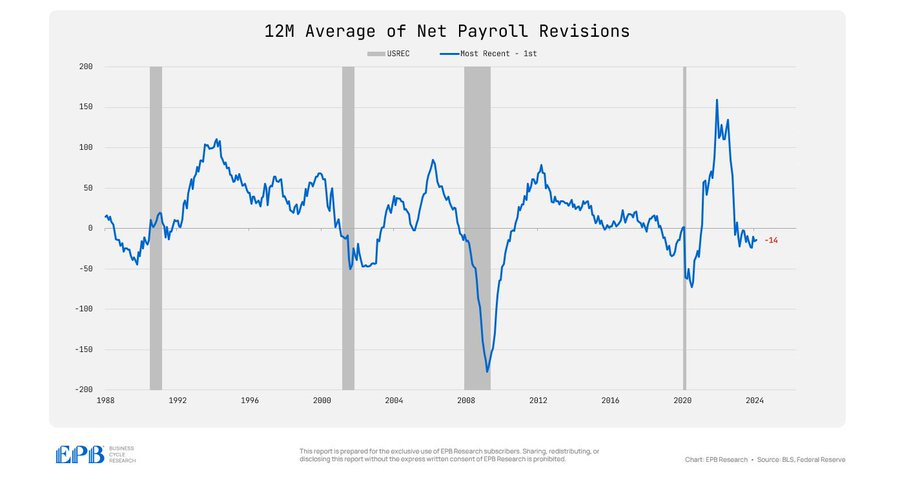

The jobs increase for January+February was revised up by 22,000, but is still negative on a 12-month average. It’s unusual for job revisions to be so consistently toward the downside outside of a recession.

(chart via @EPBResearch)

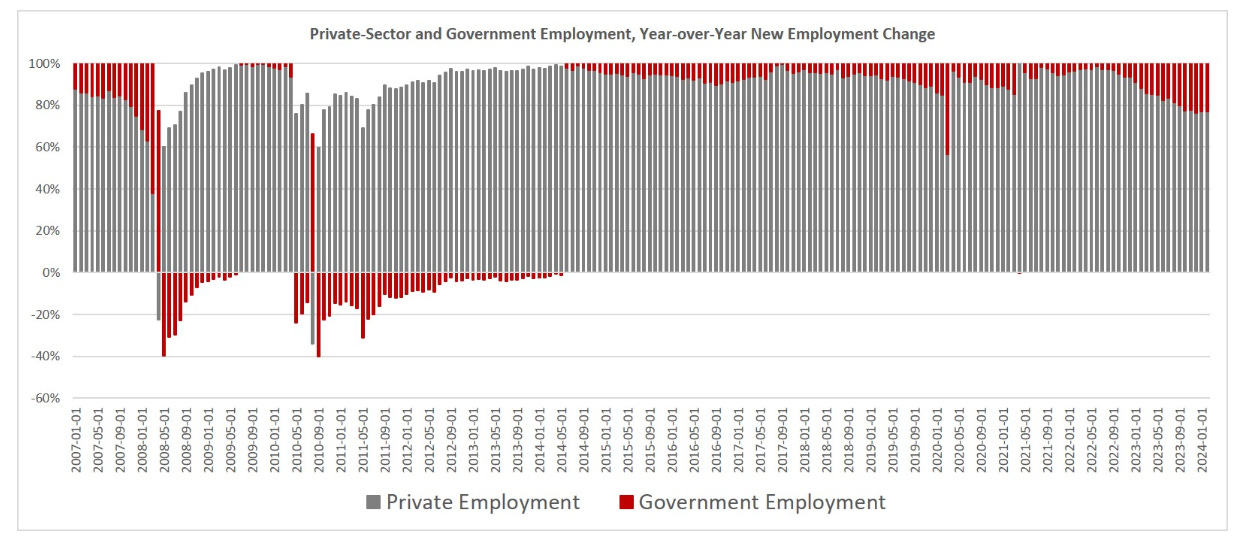

Roughly 23% of the new jobs in March came from the government, the same percentage as in February (going by the revised figures) – this is not great, as they tend to not be “productive” jobs, and they are effectively paid for by the taxpayer. The last time the weighting was this high outside the pandemic was in 2008.

(chart via mises.org)

What’s more, the number of jobs is still well below the pre-pandemic trend. In other words, up is good, but less so when the increase is anaemic.

(chart via @RealEJAntoni)

In sum, the numbers may look great – but they are the worst of both positive and negative narratives, in that they mask underlying weakness while blocking US interest rate cuts in the short term.

Then again, there’s an election coming up, and while I would never suggest that the numbers are influenced by politics (I actually don’t think they are), it sure does help the incumbent’s case that the economy is doing well. Whether that’s a good thing or not will be for each of you to decide.

The strange market reaction

On the release of the US jobs data, the yield on 10-year US treasuries jumped, and as I type is back above 4.45% for the first time since last November. This makes sense through the lens of rate cut expectations being pushed back.

(chart via TradingView)