Monday, August 12, 2024

markets, censorship and a curious local election

“The day will come when the man at the telephone will be able to see the distant person to whom he is speaking.” – Alexander Graham Bell ||

Hi everyone! I had an amazing few days off, enjoyed the city, got a lot done at home, but it’s good to be back 😊. Although this week will also be a short one – it’s a national holiday here in Spain on Thursday, and I’m going to also skip publication on Friday for another brief summer break. Hopefully things will be quiet and I won’t miss much.

I was going to share the regular CBDC overview today (this is a series in which I post updates on key developments in crypto/macro market segments), but yet again things happened over the weekend that deserve attention, and I don’t want this email to get unmanageably long. So, hopefully there’ll be space for it tomorrow.

On the audio recording, I’ve upgraded my microphone, and holy cow was the previous one bad! The sound should be better going forward, and I did a couple of Audacity tutorials while I was on break – I still feel inept on this, but hopefully there will be some improvements!

If you find Crypto is Macro Now useful or informative, would you mind sharing it with your friends and colleagues, and maybe encouraging them to subscribe? ❤ I’d really appreciate it!

IN THIS NEWSLETTER:

Got the canary, where’s the coal mine?

Think before you post

A solution to dysfunctional politics?

If you’re not a subscriber to the premium daily, I hope you’ll consider becoming one! You’ll get unique content, interesting links and my eternal gratitude - and there’s a free trial!

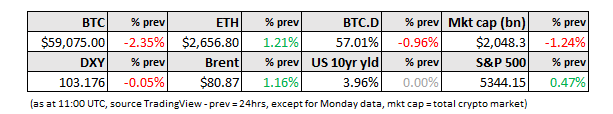

WHAT I’M WATCHING

Got the canary, where’s the coal mine?

Yet again, BTC acted yesterday as an early warning for traditional market trouble ahead, as it is pretty much the only risk asset trading over the weekend.

Or did it?

Yesterday’s almost 7% plunge in the BTC price serves as a reminder that, while asset values have recovered pretty much across the board from Monday’s dramatic falls, more turbulence lies ahead. But is it overall turbulence, or is this specific to crypto?

(chart via TradingView)

At first, I thought that BTC was signalling macro alarm over the fire at the Russian-occupied Zaporizhzhia nuclear plant (which mercifully turns out to not be much of a threat to human life). It could also be nerves about the likelihood of an imminent attack on Israel from Iran. I assumed that stock markets would follow BTC down on Monday’s open.

But that hasn’t happened – Japan is on holiday today, but other Asian markets closed higher, European indices headed up, and US stock market futures are flashing green.

The chart above shows that BTC is also recovering much of its drop – but still, the timing suggests that there were some crypto-specific factors in play. I think we’re largely overlooking the impact of US presidential polls.

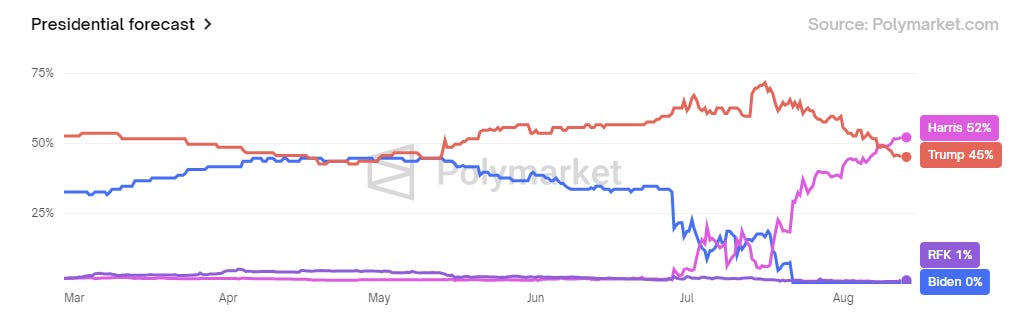

On Saturday, Kamala Harris overtook Donald Trump on prediction platform Polymarket as the likely winner of the upcoming US election.

(chart via Polymarket)

This is an astonishing and rapid reversal from what looked like a sure Trump win that many crypto investors were already celebrating, given the Republican candidate’s loud (albeit at times incoherent) pro-crypto stance.

What’s more, Polymarket has the odds of Harris winning the popular vote (as opposed to the electoral college vote) at a significant 76%.

Even in the traditional polls, which are less about who will win than who participants will vote for (not the same question at all), Harris is now ahead – an Ipsos poll published last Thursday gives her a five point lead, a New York Times/Siena poll published on Saturday shows her leading in three key swing states, and an FT Michigan Ross survey published yesterday shows the Democratic Party leading on economic issues for the first time since the survey started tracking this a year ago. The embarrassing hack of Trump campaign emails revealed by Politico on Saturday hasn’t helped.

Perhaps what we’re seeing is crypto investor disappointment. Although, rather than disappointment, I think what we’re seeing is the uncomfortable return of uncertainty. A strong likelihood of a Trump victory would have been good for the crypto ecosystem in the US. That likelihood is no longer strong. Of course, it’s early days yet and polls will fluctuate over the next three months. But the mood has shifted, and judging from what seem like increasingly shrill posts on X, public crypto figures who have gone all-in on Trump are getting rattled.

There’s also the thin market liquidity. Europe is really quiet, Japanese markets are closed today, and even US investors are in holiday mode. Markets do weird things with thin liquidity.

In sum, yesterday’s move reinforces what I’ve been saying for a while: the summer will be choppy as narratives fluctuate, but the tailwinds are still there. Taking a few days away from the screen is not a bad idea ‘round about now. And, as I can confirm 😁, it does wonders for one’s mood.