Monday, August 19, 2024

FREE TO READ - holiday introspection, and what happened to the emergency? plus, Brazil, Thailand, and the EU CBDC

“In times of change, learners inherit the earth, while the learned find themselves beautifully equipped to deal with a world that no longer exists.” – Eric Hoffer ||

Hi everyone, I hope you’re all doing well!

I had a great break – Madrid is SUCH a beautiful city, especially in summer when neighbourhoods are sprinkled with local saint’s celebrations and streets/bars/restaurants are less crowded as residents flee the heat.

It’s good to be back, though, I have quite a few newsletter and research-related ideas I’m excited about exploring. More detail to come!

No recording today – I’m struggling with Audacity, thinking of moving to Riverside, any advice is welcome. I do have a new screen pen, though, so I’ll be bringing the drawings back. Because I’ve been away for a bit, today’s email is open to everyone.

The regular (?) Monday rundown of various topics has been pushed to Tuesday often enough now, that I’ll just make it the regular Tuesday rundown. Last week was CBDCs, tomorrow it’s tokenization.

If you find Crypto is Macro Now useful or informative, would you mind sharing it with your friends and colleagues, and maybe encouraging them to subscribe? ❤ I’d really appreciate it!

IN THIS NEWSLETTER:

Holiday introspection

What happened to the emergency?

In Brief: Brazil, the EU retail CBDC, Thailand

If you’re not a subscriber to the premium daily, I hope you’ll consider becoming one! You’ll get unique content, interesting links and my eternal gratitude - and there’s a free trial!

WHAT I’M WATCHING:

Holiday introspection

Here in Europe, the norm used to be to take an entire month off in the summer. When I first moved to Spain, restaurants and shops would shutter for up to four weeks, usually either the entire month of August or the four weeks in the middle. Not so much anymore – now, it’s more common for professionals to take just two weeks, with hospitality businesses following suit. Personally, I like my holidays shorter still.

For me, condensed breaks tend to be more therapeutic, as I’ve found that constant immersion in the noise of economic data and crypto news builds to a paralyzing crescendo without a frequent reset. Throw in a regular rhythm of political idiocy and geopolitical terror, tie it all up in an onslaught of deadlines, and you can understand how the brain starts to forget what it set out to do in the first place.

On that front, the two mini-breaks I took this month did a world of good. I didn’t travel, rather I spent some blissful hours exploring the city I live in; ate a lot of good food; made a dent in my reading list; cleared bookshelves and drawers; and am now back at work with a clearer head and renewed focus.

Regular readers will know that what I want to do is understand the impact the crypto ecosystem is having and will have on the macro economy. I want to study the developments in tokenization, institutional co-option/adoption, enterprise applications, Bitcoin DeFi, and I want to share what I learn with you. I also want to monitor and understand the geopolitical trends that are impacting and will continue to affect global interest in alternative rails. Short-term market narratives are not my thing, but they do often inform story arcs that speak to overall sentiment – I find those interesting, too.

So, I’ll be stepping back from some other projects in order to spend more time on the above. I’m going to make an effort to do less key tapping and more reading/thinking, but I’m Irish and we like to talk so I may struggle with that one. Given the restorative power of short breaks, I will take them every now and then. And I really, really would like to be able to support myself just through the newsletter, which will hopefully insulate me from future distractions. This means I’ll also be thinking about new engagement features (suggestions very welcome!).

Finally, a very, very big thank you – I could not do this without your support, and I want you to know I am grateful. Seriously, thanks for joining me on this journey.

What happened to the emergency?

I’m sure I’m not the only one with whiplash. Just two weeks ago, traders and analysts were so fearful of a steep plunge into immediate recession that my timeline was peppered with calls for the Fed to save markets by enacting emergency rate cuts.

Since then, however, we have seen an astonishing rebound, both in data and narratives.

The S&P 500 has not only recovered lost ground, it has also clawed back all losses since the Fed’s last FOMC meeting at the end of July.

(chart via TradingView)

The VIX expected equity volatility index has totally retraced its explosive climb.

(chart via TradingView)

Even Japanese equity indices, which triggered the panic two Mondays ago, are almost back to where they were just before the Bank of Japan surprised markets with a 15bp rate hike.

(chart via TradingView)

And consensus has taken a step back from the brink and is now back to comfortably predicting a soft landing.

The reasons for the breather from the correction that looked to be underway are multiple:

US jobless claims data since the employment report has been relatively soft, which suggests that the unemployment bump might not be repeated for August – it’s worth remembering that the bulk of the increase in the number of unemployed in July was due to “temporary” factors such as bad weather.

(chart via Bloomberg)

US employment and new orders components of the ISM services PMI came in much stronger than expected, moving back into expansion territory.

(chart via Bloomberg)

US retail sales came in much stronger than expected – the composition is skewing more to basics, but the consumer is still spending.

(chart via Bloomberg)

What’s more, inflation data is confirming the deceleration, which is good. Both headline and core CPI growth for July came in line with expectations, albeit higher on a month-on-month basis – according to the Bureau of Labor Statistics, this increase was largely due to higher housing costs. Year-on-year, headline CPI increased by 2.9% vs 3.0% expected and 3.0% in June. Core CPI decelerated slightly on a year-on-year basis, in line with expectations, to 3.2% to 3.3%. This makes July the fourth consecutive month of easing, and brings core inflation down to the lowest rate since early 2021.

But it is still stubbornly above 3%. Digging into the data, services prices delivered their first increase in three months. That is not the “clear signal” the Fed has often said it is waiting for, and several FOMC members have publicly confirmed their preference for caution over the past few days.

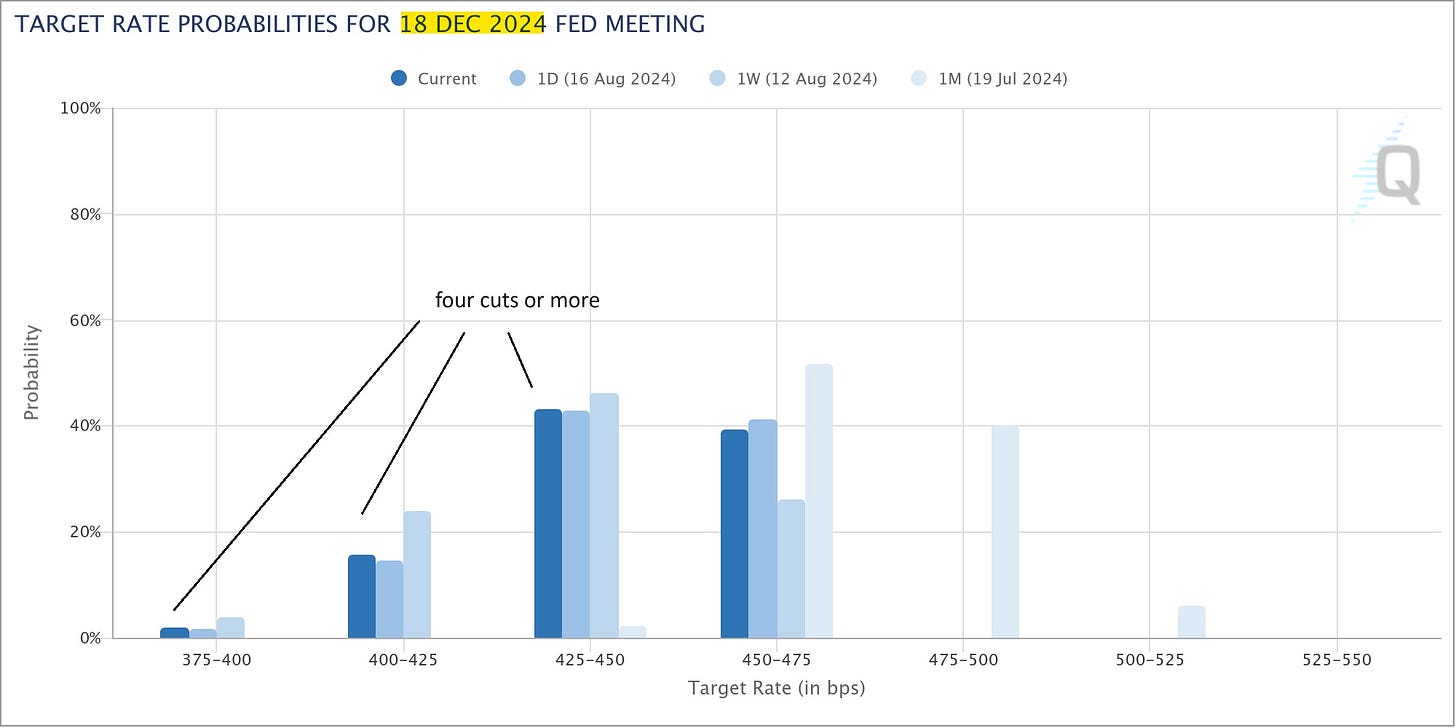

So, yet again, the market should brace for disappointment at September’s FOMC meeting, not so much from the cut that is priced in (it’s likely the Fed is aware of the market ructions that would result in punting on this yet again), but from the revision to the economic projections. These currently show the committee expecting just one cut this year. The market assigns a 0% probability to that scenario, and a 60% probability to four or more cuts.

(chart via the CME FedWatch)

A downward move in the expected fed funds projections with the September update is likely – unemployment is already at 4.3% vs the forecast 4.0%, and July’s core PCE year-on-year increase came in at 2.6%, below the projected 2.8%.

But will the FOMC move its internal projections as much as the market is implying? It’s unlikely, especially since the central bank will want to avoid any sign of panic.

The same can cannot be said of the Bank of Japan, which was another key factor in the collective sigh of relief over the past couple of weeks. Just two days after the market meltdown, Japan’s central bank deputy governor reassured investors that the institution was not planning further rate hikes, at least while markets were unstable. Never mind that another hike would most likely create more instability, here we have what looks like an example of price moves influencing monetary policy.

Understandably, the temptation is significant, and even in the US, a couple of weeks ago many were calling for the Federal Reserve to let markets dictate its actions.

The slippery slope is that climbing stock markets contribute to easing financial conditions, making the job of central banks even harder.

IN BRIEF:

Brazil

Here’s an example of why the US Federal Reserve should be cautious when embarking on rate cuts:

Just over a year ago, Brazil started cutting its rates, one of the first economies to do so. Now there is talk of having to raise them again as the economy is growing faster than expected.

(chart via TradingView)

EU retail CBDC

Here’s an alarming and yet not surprising detail from a Bloomberg report on the European CBDC project, which precisely outlines its threat.

It’s not so much that people don’t want a retail CBDC in the EU, that much is obvious (at least among those who understand what it is, and those that don’t, don’t care). It’s that people are afraid to publicly talk about their opposition. Of all the German citizens interviewed for the Bloomberg story, only one was comfortable giving their name.

Why? Presumably because they know how easy it is today to target those with “unhelpful” publicly voiced opinions. With a retail CBDC, it would be so much easier. Sure, the EU is promising that use of the CBDC will be optional – but 1) adoption will end up being enforced if it doesn’t happen organically (the EU can’t fail at this), and 2) the censorship would come from other financial access gateways as well, since political dissent is not channel specific.

Thailand

On Wednesday, just before I went off on a short break, I wrote about Thailand’s upcoming official token distribution which intended to put spending tokens directly in consumers hands for use in local businesses selling basic goods. This was an extension of my piece on Universal Basic Income, and how politically tempting but also short-termist and fiscally reckless such a move is.

Well, also on Wednesday, the prime minister behind this idea was removed from office. Since the project was running into opposition because of its considerable cost, it is now likely to be shelved.

LISTEN/READ:

In the most recent Macro Hive Conversations episode, Bilal Hafeez talks to Brad Setser about US-China trade, the outlook for the US dollar, tariffs and a whole lot more – there’s some interesting insight on the yen carry trade (eg., what we saw a couple of weeks ago wasn’t an unwinding, it was a reset of some highly leveraged positions).

This episode of the Jacob Shapiro Podcast features Matthew Pines and a conversation about the role of bitcoin in geopolitics, the potential impact of AI, what “type” of an innovation are we looking at, and what does all this mean for the US dollar? A powerful listen.

The latest episode of the China in Africa podcast talks to Samir Puri, author of “Westlessness” (a clever title!), about shifting geopolitical alliances. It’s not so much that China is pushing the “West” out of developing and resource-rich areas such as Africa – it’s more that most of the Global South is not interested in choosing sides.

WHAT I’M LISTENING TO: A breathless Celtic piece by Galicia’s Carlos Nuñez – The Flight of the Earls.

HAVE A GREAT DAY!

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade.

Never knew “… but I’m Irish … and we love to talk…” ☘️ 👏 ☘️ (Also of Irish descent ☘️)

So you asked about New Engagement Features. I’m perhaps too new as a full subscriber, so apologies if this is something you already cover, but I’d love to get your macro take on “money” and sovereign debt.

Of course, it’s already all about money - Bitcoin, CBDCs, tokenisation (tokenised deposits), stablecoins (esp fiat-backed and/or bank issued), new payment rails, etc.

I’m not too deep down the rabbit holes, so by way of a starter, here are some themes to possibly explore …

Commercial bank money creation. ~97% of the total money supply (M4) has been created by banks (when they lend they create corresponding deposit entries on balance sheets creating brand new money out of thin air); the remaining 3% is central bank money. So what?

Why is this not better understood (when NIM or fractional reserve banking models are still widely, but incorrectly, touted)?

retail CBDCs are central banks replacement for cash. But cash may have reached its floor level (won’t decline further in practice) and won’t be easily replaced by rCBDCs. If cash is only 3% of overall supply what, realistically, is the relevance of rCBDCs if the available share for rCBDCs is so small? I get wCBDCs (wholesale reserves for interbank transactions, but what’s the real agenda for rCBDCs when they’ll make little difference to the relevance of central banks?

Moreover, will banks allow even a small proportion of their profitable bank-money to be replaced by rCBDCs? If rCBDCs are forced, Banks have the upper hand - they’ll be needed to manage customer wallets, onboarding, AML, etc. - so with this power influence, will banks restrict rCBDC balances, eg insist on small individual holding limits? (Small Holding limits are already being touted as needed for systemic prudential stability purposes to prevent bank runs). Other considerations may be bank hesitancy because rCBDCs deposits will need separate treatment (to the way existing deposits are lent out, after 10% reserves set aside) so even less reason?

Will this mean banks will focus far more on bank-issued fiat-backed stablecoins, and/or fiat-backed tokenised deposits instead of rCBDCs? Banks will be in control of these, so more scope for furthering their profits, despite the need for keeping reserves aside (which will not be custodial fiat balances but likely only more of their own created bank money on balance sheets)? Will this magnify the probabilty and economic impact of any run on a bank?

The industry still talks about NII income and the importance of customer deposits (even brokered deposits) but customer deposits don’t contribute much to profit. Is this the real reason why regulators fail when banks give near-zero or zero rates to demand savings and PCA accounts? How might rCBDCs, stablecoins, tokenised deposits actually be better for customers?

Prof. Richard Werner’s work on bank money suggests there is good and bad lending linked to money creation - good when lending goes to GDP growth impacting areas (manufacturing), bad when it doesn’t (flows around FS and markets creating polarised wealth). Apologies for oversimplifying. Is there a macro lens on global money creation vs GDP growth or FS market growth (derivatives, securitisation, equity value of firms perhaps)?

Commercial bank-minted fiat money has been growing since the gold standard was dropped, particularly boosted since nearly all central banks were made independent. There is much speculation about a global fiat money bubble, but hard data can be contradictory. A partial bubble burst is suggested as the reason for the 2008 GFC. Since then, QE stimulus (misnamed “money printing” but actually bond issuance) has further added to the money bubble. At the same time sovereign debt has increased, and commentators link these. The impending failure of fiat is also touted as a foundation of bitcoin and its fixed supply. So what?

Is there a macro-level, global fiat money bubble? If so what are the chances of the mother-of-all bubble bursts?

What would the likely outcome if fiat crashed on alternate stores of wealth such as gold, bitcoin or key commodities?

Central banks deny any statistical causal link between QE and inflation, but is there a potential link if this could be modelled differently using the ‘twin valves’ of money supply (bank money & QE) considered together?

Sovereign debt is higher than WW2 levels in many countries. Governments and central banks seem to have no answer other than further QE, with the amount of interest on debt alone increasing let alone actual debt being addressed (QT). Is there a way out of the sovereign debt crisis?

Central banks. So what?

(I’m not an economist, so struggle to understand) why central bankers are so wed to Keynesian and MMT ideas while so dismissive of other thinking. For instance, they seem control-freakishly obsessed with policies such as the shared-global 2% Base Rate target when it has no substantive basis (made as an accidental quip to NZ journalists, subsequently made policy in NZ and then copied globally) while alternate approaches and research that underpin money creation are swept aside because they are from opposing schools of thinking. Are central banks flawed?

Why are central banks so arrogant about fiat money and only fiat money fulfilling the criteria for the singularity of money, whilst ignoring bitcoin or other new forms?

Have commercial banks become too powerful (tail wagging the dog of central banks, in turn wagging the tail of the BIS)?

Should government take back control when central banks deny or deflect the causes of debt, perhaps to also ensure bank lending aligns to real GDP growth, rather than waste taxpayer receipts on debt repayments?

I don’t expect answers directly of course, but it would be great to see some of this included as and when relevant.

Thanks

Richard