Monday, August 5, 2024

a global freak-out, what’s next?, the US employment data

“The fact that an opinion has been widely held is no evidence whatever that it is not utterly absurd; indeed in view of the silliness of the majority of mankind, a widely spread belief is more likely to be foolish than sensible.” – Bertrand Russell ||

Hi all! I’d wish you a happy Monday, but if you’re just checking prices now after the weekend, you’re probably reeling. Things look rough out there, do please take care of your health, it’s the most important thing.

I was going to review CBDC developments over the past month in today’s email but, well, it turns out that there are more dramatic things to cover. I had also written something about employment data discrepancies – in the interests of not breaking Substack due to email length, I’ll share that tomorrow.

And with impeccable timing, I had scheduled a much-needed summer break as of Wednesday. Depending on what happens, I may do a spontaneous send anyway.

On a personal note, today seems like an especially good time to remember that all this is part of the bigger picture change this newsletter focuses on. It’s hard to be cheerful when markets are so rough, but I personally feel privileged to be able to bear witness to the seismic shifts, and to share what I learn with you.

If you find Crypto is Macro Now useful or informative, would you mind sharing it with your friends and colleagues, and maybe encouraging them to subscribe? ❤ I’d really appreciate it!

IN THIS NEWSLETTER:

A global freak-out

What’s next?

The US employment data: just how bad was it?

If you’re not a subscriber to the premium daily, I hope you’ll consider becoming one! You’ll get unique content, interesting links and my eternal gratitude - and there’s a free trial!

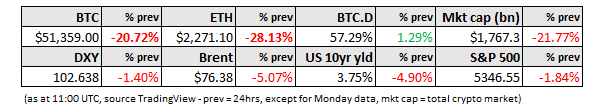

WHAT I’M WATCHING

A global freak-out

Well, that was a lot of carnage to wake up to. 😕

Japan entered into full panic overnight, with the Nikkei and the broader Topix closing down more than 12% – for both, this was their worst day since 1987’s Black Monday (which I guess makes today 2024’s Black Monday?). In Japan’s afternoon session, futures trading in both was suspended.

Europe’s indices are also down today but not quite as dramatic (the Eurostoxx 600 is 3% lower as I type), although NVIDIA trading in Germany at one stage was down 11%, Apple down 8%.

The futures market is suggesting that the Nasdaq 100 will have its biggest opening drop in more than four years – at one stage it was 6% lower in pre-trading, almost reaching the 6.9% circuit-breaker level. It has since pared back to around 4.5%.

And the VIX volatility expectations index has shot up to early 2020 levels.

(chart via TradingView)