Monday, Dec 11, 2023

what happened?, rates expectations, we're early in this cycle

“The art of progress is to preserve order amid change and to preserve change amid order.” – Alfred North Whitehead ||

Hi all! You’re reading the daily premium Crypto is Macro Now newsletter, where I look at the growing overlap between the crypto and macro landscapes. There’s also usually some market commentary, but NOTHING I say is investment advice. For full disclosure, I have held the same long positions in BTC and ETH for years, and have no intention to either buy more or sell in the near future.

If you’re not a subscriber, I do hope you’ll consider becoming one! It would help enable me to continue to share what I learn as I work on figuring out where we’re going. It’s only $8/month for now ($12/month as of January), with a free trial.

And if you find this newsletter useful, would you mind hitting the ❤ button at the bottom? I’m told it boosts the distribution algorithm.

Also, I’m now host of the CoinDesk Markets Daily podcast – you can check that out here.

Programming note: Apologies, but I have to miss Wednesday’s publication.

IN THIS NEWSLETTER:

Crypto markets: A painful leverage cleanse

Rates expectations heading back up

On-chain signals: the market is far from overheated

WHAT I’M WATCHING:

Crypto markets: A painful leverage cleanse

Well, that was not exactly an optimistic start to the week for crypto markets.

During Asian trading hours last night, prices plunged, with BTC at one point dropping almost 6% in 15 minutes. Prices then bounced, as they usually do after sharp moves, but they have yet to recover earlier levels.

(chart via TradingView)

ETH dropped by even more, and has yet to recover by as much, as you can see in the sharp move and then upward trend in the BTC/ETH ratio (when this moves up, ETH is underperforming).

(chart via TradingView)

So, what happened?

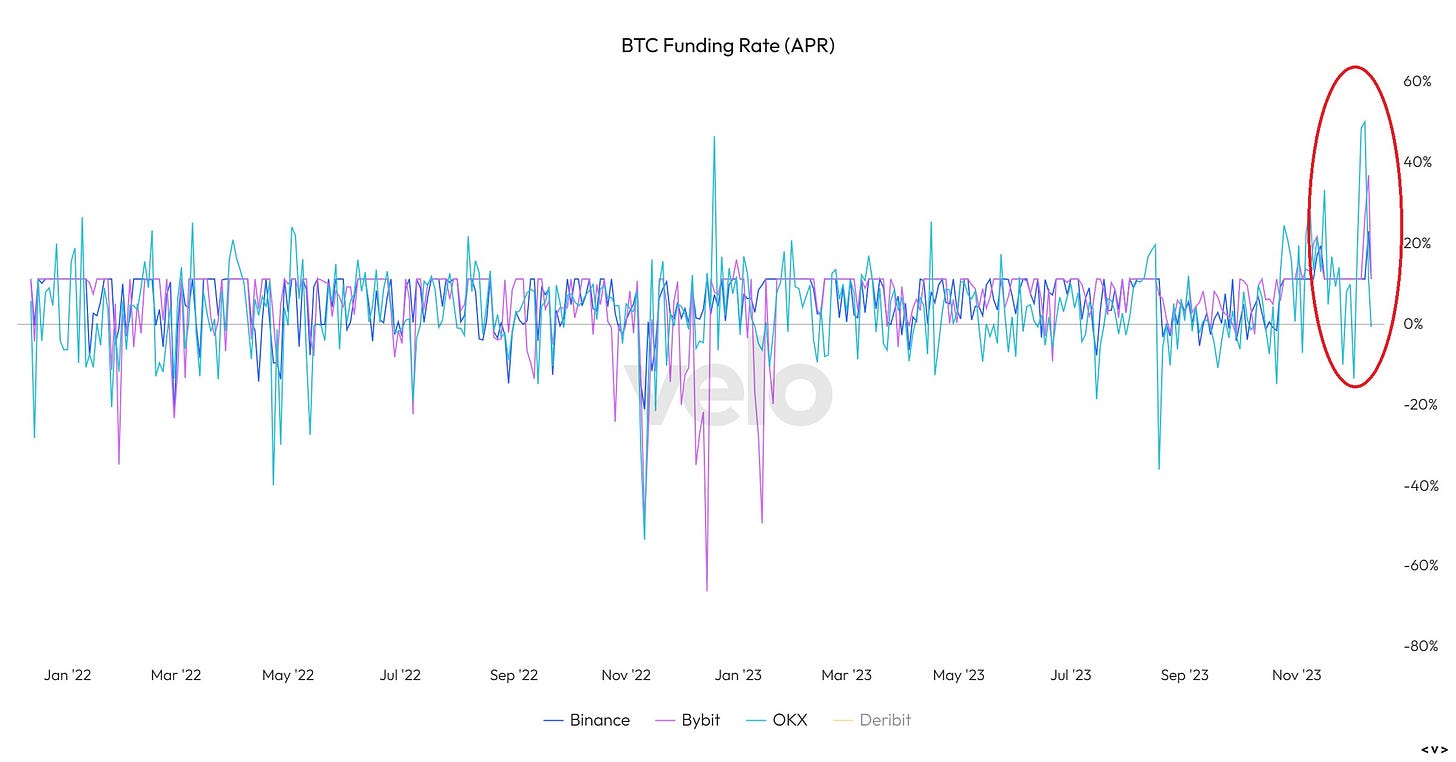

It looks like this is a leverage adjustment, which can be painful but is usually good news. Last week, signals from the crypto futures market were starting to suggest that leveraged speculation was getting heated. We can see this in the funding rates, which are what traders pay to take long or short positions in crypto perpetual futures.

On Saturday, 8-hour bitcoin funding rates spiked to the highest since November 2021 – yes, the same month that marked the top of the last bull run, when bitcoin reached almost $69,000.

(chart via velodata – this chart only goes back as far as Jan ’22, but other charts show funding rates peak in Nov ’21 – I’m not using those because they don’t show the weekend’s move)

Saturday’s funding rate spike triggered some selling, which swiftly led to the unwinding of many leveraged long positions and even more selling.

This happens often in crypto markets, and tends to be exacerbated by their global nature and their 24/7 trading. Usually, prices resume their previous trend once the dislocation has been digested. And these drops can be seen as a healthy cleanse of excess leverage. Indeed, bitcoin funding rates are now back to more normal levels, and the tailwinds for BTC and others are still strong.

Rates expectations heading back up

These tailwinds include the increasing likelihood of a BTC spot ETF, plus growing awareness of the “digital gold” narrative combined with what looks like climbing global international and domestic insecurity.

One headwind to contend with, however, is rates expectations.