Monday, Feb 13, 2023

The SEC action against Paxos (I mean, IS there any other news today?)

“The way that organizations and organisms anticipate the future is by taking signals from the past, most of the time.” – Kevin Kelly ||

Hi everyone! I hope you all got some rest over the weekend, because this week is starting off pretty intense. More details below. You’re reading the premium daily Crypto is Macro Now newsletter, where I focus on the growing overlap between the crypto and macro ecosystems. Nothing I say is investment advice! Nevertheless, if you find this useful, do share with friends and colleagues.

I’m making this one open-access to all today, but I do hope you consider subscribing to support my work and to get these daily. Or try a free trial!

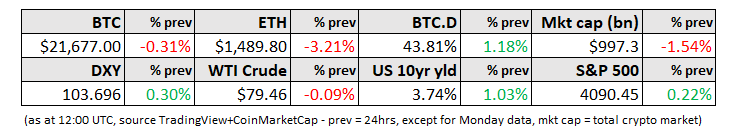

MARKETS

Risk-on feels a chill

With the stock and bond markets likely to hover nervously today in anticipation of tomorrow’s key CPI reading, I’ll spend most of this newsletter talking about the SEC move against a leading stablecoin.

I will say quickly, though, that the phrase “inflation concerns” is popping up with increasing frequency in market reports, which is usually enough to trigger inflation concerns if they didn’t already exist.

Yields have continued to climb, with the 2-year treasury back at November levels, and the 3-month yield hovering around levels last seen in 2007.

(chart via TradingView)

This week we also get US retail sales, industrial production, PPI and housing data, all of which should give us more insight into the state of consumer demand – strength in any combination of the above could entrench the phrase “inflation concern” in our news feeds, at least for the short-term. We also get a host of Fed officials speaking in public to continue to stress “higher for longer”. In sum, risk-on sentiment might continue to weaken.

The SEC goes for Binance, I mean Paxos

Earlier today, the Wall Street Journal broke the story that the SEC had issued a Wells notice to crypto asset service provider Paxos for violating investor protection laws and for issuing unregistered securities in the form of the Binance stablecoin BUSD. In theory, this shouldn’t have been a surprise, since:

1) we knew that Paxos was under some regulatory pressure,

2) we knew that Gensler saw stablecoins as securities, and

3) we’ve had the feeling that the SEC has wanted to get Binance on something for some time.

Nevertheless, the news is startling in that it is further evidence that the SEC is going after large market participants. That this comes hard on the heels of its action against Kraken late last week is disconcerting, to say the least. Paxos has been operating in the crypto markets since 2012, is regulated by the New York Department of Financial Services, and BUSD is the ecosystem’s third largest stablecoin, with over $16 billion in circulation. The SEC is definitely baring its teeth.

Some common misconceptions regarding the move and the potential impact:

1) The fact that stablecoins do not have an expectation of profit on the part of the user does not mean they are obviously not securities. The expectation of profit prong of the Howey test is a significant one, but is not essential. In 2019, Valerie Szczepanik – then head of the crypto division at the SEC – said she thought stablecoins could be securities, because someone was “holding a profit, or guaranteeing a profit, or holding the price at a certain level” (my emphasis). In 2021, SEC Chair Gary Gensler also said he thought stablecoins could be securities, even though obviously there was no direct expectation of profit. In sum, that particular prong is not a key issue here. (Below I mention a couple of legs the SEC might lean on for the security classification of stablecoins.)

2) The SEC is not banning stablecoins. It doesn’t have the power to do so. It can go after all stablecoin issuers for issuing unregistered securities, but it would have to do so on a case-by-case basis, and be prepared to litigate each one. That would consume a lot of resources. It can dampen the enthusiasm for stablecoins by creating a thick cloud of uncertainty (hardly anybody wants to intentionally anger the SEC, not least because it’s expensive to do so), and can effectively quelch future issuance from US-based entities – but it can’t stop stablecoins from being traded in the US, nor can it stop them from being issued in other jurisdictions.

3) The SEC is not likely, just yet, to go after Tether (USDT) or USDC, in my opinion. Should it want to go after USDT, how would it do so? Tether is not domiciled in the US, and could double down on its efforts to block US users from using it. USDT would probably continue to be the dominant stablecoin, given its strong presence in Asia.

And if it were to go after USDC, it could get pushback – Coinbase, a partner with Circle on USDC issuance, has already signaled its willingness to take the SEC to court if necessary, and the SEC is unlikely to take on a protracted and expensive fight that it is not sure it would win. Circle has tried to play by the regulated book, has been actively talking to regulators for years, and is not exactly an “easy target”.

4) This is not necessarily a death blow for Paxos. The issuance of BUSD on the behalf of Binance is only one of its many lines of business. It also runs an exchange, has other tokenized assets, is a technology developer, offers custody, and more.

5) The end target here is Binance, in my opinion. The exchange has been regarded with deep suspicion throughout the US regulatory establishment for years now, given its market penetration, lack of transparency and uncertain jurisdiction. This seems to be the result of a lot of work by the SEC to come up with something it can curtail Binance’s market activities with. It’s also something that Binance is unlikely to push back on, given that it doesn’t really want to have to open itself up to greater scrutiny as part of the discovery process. Paxos will no longer issue BUSD, but Binance has said that it will continue to trade BUSD while it explores options, which are likely to include finding another issuer.

Another objective here is probably the theatre. The SEC is upping its profile and wants to be seen as proactive and firm. I wouldn’t be surprised to see another cringe video around this action, as we saw after last week’s action against Kraken.

But there’s no profit!

Now, on what grounds could stablecoins be considered securities? I can think of two, and there are probably many others that people who know more about US securities laws than I do will be able to explain over the coming days.

1) An asset that is backed by securities, and takes its pricing from those securities, could be considered a derivative of a security. This would fall under SEC jurisdiction (the CFTC has jurisdiction over derivatives backed by commodities).

2) Given the most common redemption method, a stablecoin could be considered a “demand note”, which are considered securities. Demand notes generally have a yield, so this might be trickier, but Jake Chervinsky and Benjamin Sauter eloquently presented this case here.

There’s so much more to unpack on this, but I’ll start to wind this down since it’s getting late and I need to get this newsletter out. No matter how expected, this move is a big deal. It fits in with the definitely chilly attitude to the crypto ecosystem prevailing in the halls of power these days, and feels like an extension of the escalation we saw last week, with actions against big industry names.

It’s bad news for sure, but there is a glimmer of a silver lining: One way or another, whether Paxos pushes back or not, this sets a precedent for other stablecoin issuers, which will add some welcome clarity to expectations. And, yet again, it’s likely that the crypto market will demonstrate its resilience. Even if BUSD were to disappear (unlikely), the concept of stablecoins is not going away.

Market moves

When the news came out, we saw a strong rotation out of BUSD into USDT as users reacted to the uncertainty and swapped one stablecoin for another. This can be seen in the drop of the BUSD/USDT ratio (which also happens to be the most liquid BUSD pair) – at time of writing, this has partially but not completely corrected. The “depeg” of BUSD is unlikely to last for long as arbitrageurs, at least those who believe Binance’s (and Paxos’) claim that the stablecoin is fully backed, will close the gap.

(chart via TradingView)

The impact this could have on Binance is for now uncertain, and will depend on how levered the exchange is to the value of its token BNB, and how intertwined BNB and BUSD are. I don’t know enough about it to pull on that thread, but I can report that the token price plummeted almost 8% on the news.

(chart via TradingView)

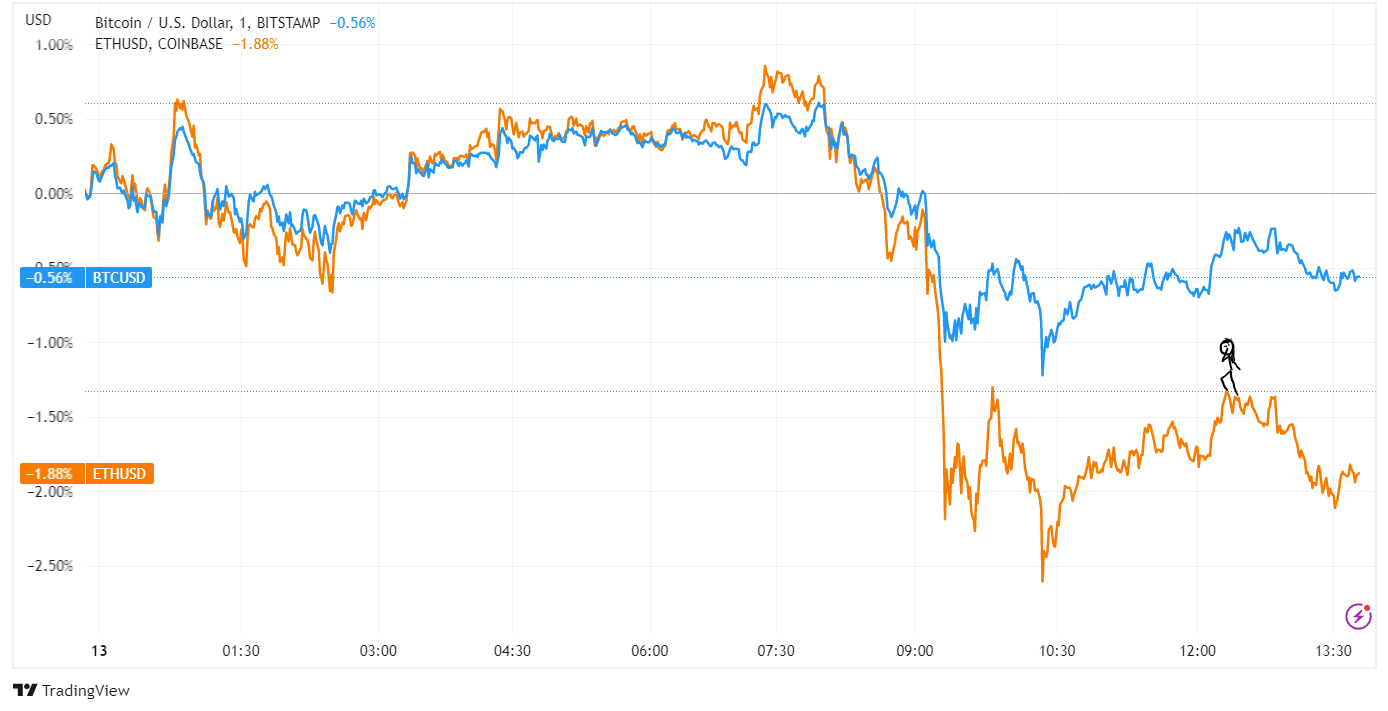

Jitters around Binance tend to spook the market, and indeed, prices are down so far today. Given the rates concern mentioned above, they would probably have been down anyway, but the ETH underperformance suggests that some traders and investors are concerned about any potential impact on DeFi activity. USDC is the most-used stablecoin in the DeFi ecosystem – but that doesn’t mean that some key platforms won’t be affected by volatility in BUSD.

(chart via TradingView)

Coming full circle back to the macro markets, we could see some jitters regarding the possible unwind of BUSD. In theory, it is backed by just over $16 billion of cash and treasuries, but even in the unlikely worst case scenario, a massive amount of treasuries would not be dumped on the market at once. We could see a drop in the amount of BUSD outstanding and the release of the corresponding backing, but it would be gradual and, according to SIFMA, the average daily volume in the treasury market for January was around $620 billion. In other words, yet again, the crypto ecosystem should be able to show that there is little systemic risk at stake.