Monday, Feb 20, 2023

BTC's reaction to economic releases, regulation as a competitive advantage, stablecoin wars and more...

“A subtle thought that is in error may yet give rise to fruitful inquiry that can establish truths of great value.” – Isaac Asimov ||

Hello everyone! Happy President’s Day to all those who have the day off. 😊 You’re reading the premium daily Crypto is Macro Now newsletter, where I focus on the growing overlap between the crypto and macro ecosystems. Nothing I say is investment advice! Nevertheless, if you find this useful, do please consider liking, and sharing with friends and colleagues.

If you landed here from somewhere other than your inbox, or if this was shared with you, I hope you’ll think about subscribing to support my work (or try a free trial!). It would make my day!

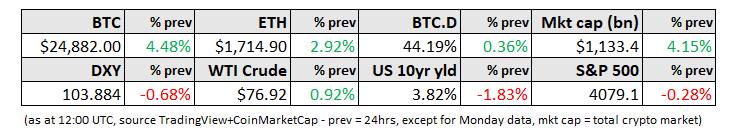

MARKETS

Rates on the move

After a weak start to Friday trading, the S&P 500 rallied to almost close the day flat, perhaps as a reaction to the 10-year yield giving up most of its Thursday gains. The dollar also fell on Friday, adding support to most commodities, including oil, copper and gold.

The moves in yields and the DXY came in spite of a strong ratchet upwards of rates expectations, given recent data highlighting the resilience of the US consumer as well as unusually hawkish comments from some Fed officials. This week we get the latest FOMC minutes, which should reveal clues as to the level of consensus (or what seems like a lack of it) as to the path forward. Last week, Cleveland Fed President Loretta Mester, known to be a relatively centrist voice, said she saw a strong case for a 50bp rate hike at the last meeting – it’s unlikely she’s alone in this view.

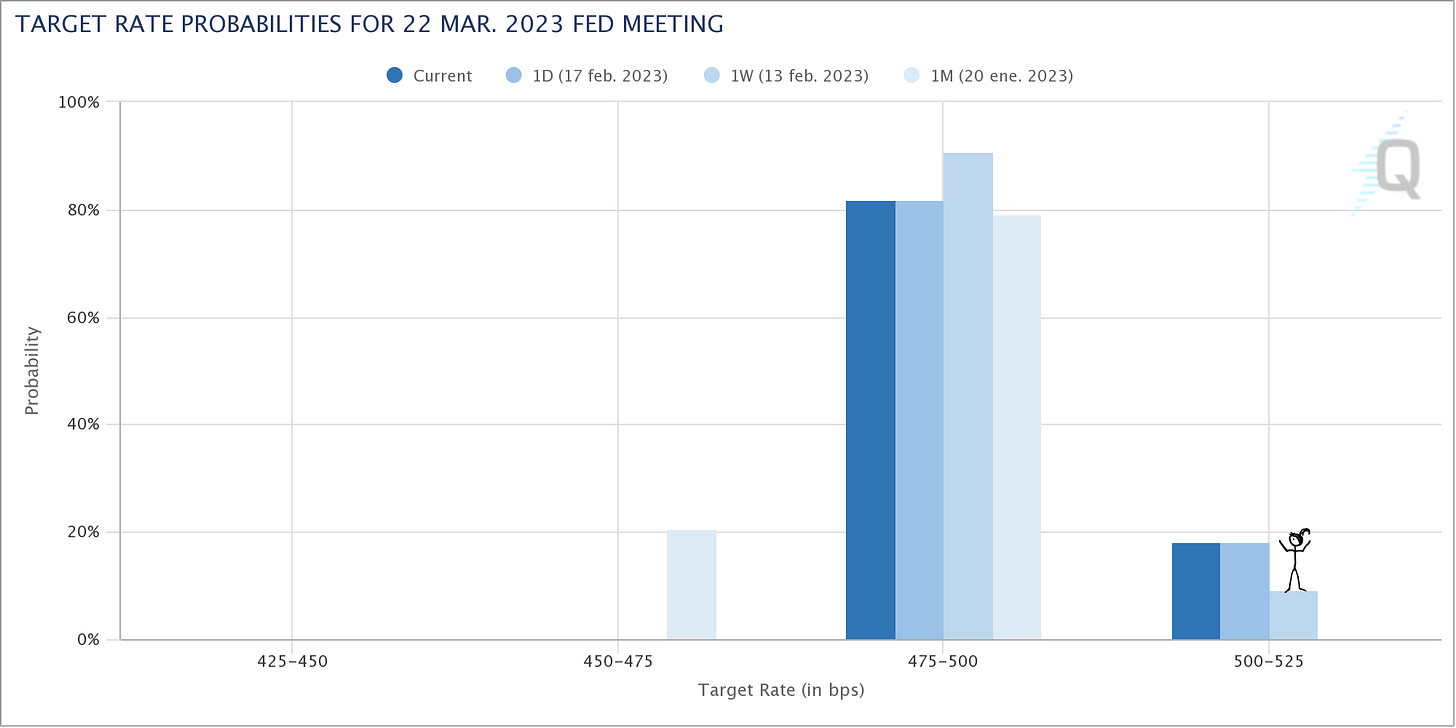

Indeed, odds are climbing for a 50bp hike in March, whereas just a week ago a 25bp hike was a shoe-in.

(chart via CME FedWatch)

In my opinion, a 50bp hike is much less likely than the almost 20% probability assigned by market pricing, for the following reasons: