Monday, Feb 6, 2023

Safe havens vs rate reactions, ETH dominance and issuance, BTC as a conduit to dollars, state banks and DeFi, unemployment outlook...

“Do the difficult things while they are easy and do the great things while they are small.” – Lao Tzu ||

Hello everyone! I hope you all had a great weekend. Gorgeous weather where I am – chilly but sunny, people thronging street cafés, confused flowers starting to bloom and I even spotted a stall laden with strawberries. It feels way too soon for spring, though – whatever, appreciate the moment, right?

You’re reading the premium daily Crypto is Macro Now newsletter, where I focus on the growing overlap between the crypto and macro ecosystems. Nothing I say is investment advice! Nevertheless, if you find this useful, do share with friends and colleagues.

If you landed here from somewhere other than your inbox, or if this was shared with you, do please consider subscribing to support my work (or try a free trial!). I’d really appreciate it. 😊

Programming note: due to a conflict, I won’t be able to publish this newsletter on Wednesday, Feb 8, apologies! Thursday’s email will catch you up on key market and crypto news developments.

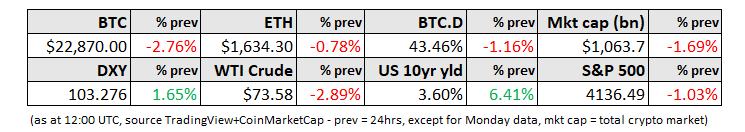

MARKETS

Battle in the skies

An unusual topic to start the week: the shooting down of a Chinese balloon that had been discovered hovering over Montana could end up deflating (sorry) the outlook for closer China-US relations. Discovery of the balloon led to the cancellation of US Secretary of State Blinken’s scheduled trip to Beijing, and China is now vowing retaliation for what it sees as not just an over-reaction but also an aggression.

You would expect growing tension between two key economic powers that has now involved an F-22 fighter jet and an AIM-9X supersonic, heat-seeking, air-to-air missile (for a balloon??) to puncture (cough) the retreat from the US dollar “safe haven” narrative since last September. The DXY index has indeed bounced back, currently hovering around early January levels. But that seems to be more a reaction of a sudden pivot in market expectations of the Fed’s actions.

(chart via TradingView)

According to the CME FedWatch function, expectations of a pause have now been pushed out to the June meeting after another 25bp hike in May, and the probability of a 5.00-5.25% range by year-end, the Fed’s official forecast, has shot up to almost 20% from below 3% just a few days ago.

European rates have also moved, but not by as much, and the DXY spike coincides with a rapid narrowing of the spread between US and German 10-year yields.

(chart via TradingView)

Another factor supporting the “rates” rather than the “safe haven” narrative is that the gold price has dropped sharply over the past few days. True, gold has not been a reliable global tension indicator of late, reaching a local high shortly after the invasion of Ukraine only to drop almost 20% over subsequent months. But it would not be unreasonable to expect some upward move if indeed traders were positioning for an escalation. It seems they’re not.