Monday, Jan 15, 2024

BTC selling, economic data confusion, Taiwan's significance, banks and consumers, Nigeria's stablecoin

‘We must accept finite disappointment, but never lose infinite hope.’ – Martin Luther King Jr. ||

Hello everyone! I hope you all managed to regenerate this weekend – last week was nuts, on so many levels.

You’re reading the daily premium Crypto is Macro Now newsletter, where I look at the growing overlap between the crypto and macro landscapes. There’s also usually some market commentary, but NOTHING I say is investment advice. For full disclosure, I have held the same long positions in BTC and ETH for years, and have no intention to either buy more or sell in the near future.

If you’re not a subscriber, I do hope you’ll consider becoming one! It would help enable me to continue to share what I learn as I work on figuring out where we’re going.

If you find this newsletter useful, would you mind hitting the ❤ button at the bottom? I’m told it boosts the distribution algorithm.

IN THIS NEWSLETTER:

What’s behind the BTC selling?

So much for “data dependent”

Bank executives: the consumer is strong

Taiwan’s significance

Nigeria stablecoin update

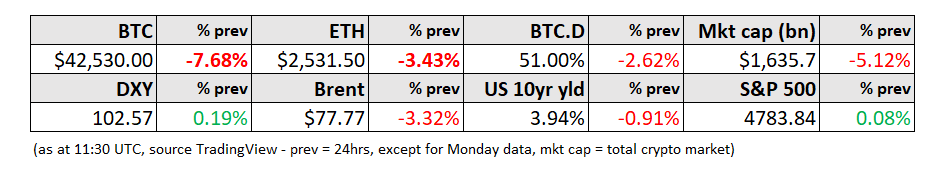

WHAT I’M WATCHING:

What’s behind the BTC selling?

The sharp drop in the BTC price since the spot ETFs started trading – now down almost 9% since 0:00UTC on Thursday – is awakening concerns that perhaps the listing did mark the market “top” after all. If so, it would follow in the footsteps of other key crypto market events such as the launch of BTC derivatives, the listing of BTC futures ETF, and the Coinbase IPO, each of which ended up occurring at a local peak.

(chart via TradingView)

Or, it could just be ETF fundamentals at work. This is more likely.

(chart via TradingView)

On the one hand, this post-listing selling pressure is different from the previous events. A significant amount of it no doubt is from speculators “selling the news”, as in the other key listings. But this pressure is also partly driven by GBTC exits, as investors who had been “locked in” (the trust did not allow redemptions) can now redeem at par, and leave the BTC market. A lot of the GBTC outflows, which reportedly were almost $600 million in the first two days, went into some of the new funds – but not all.

On the other hand, two things suggest the selling pressure will abate. One is that the rush for the GBTC exit will eventually wear itself out, and the fund is unlikely to see significant new inflows with fees orders of magnitude higher than its BTC ETF competitors – in other words, the net exit momentum will slow down.