Monday, Jan 30, 2023

Time to do a 180 degree turn and, rather than analyze drivers of the recent move, take a look at what BTC's rise is telling us - also, inflation worries, ISDA standards and Fed short-sightedness

“Coming back to where you started is not the same as never leaving.” – Terry Pratchett ||

Hi everyone! I hope you all had a good weekend, and aren’t too cold where you are. You’re reading the premium daily version of Crypto is Macro Now, where I look at the growing overlap between the crypto and macro landscapes. Nothing I say is investment advice! If you find this useful, by all means share with friends and colleagues.

And if you arrived here from somewhere other than your inbox, or if it was shared with you, I hope you’ll consider subscribing to support my work.

MARKETS

We might be wrong

Despite a “taking a breather” correction late Friday, what seemed like an amusing anomaly earlier this month now seems to have consolidated into a solid trend: markets are trading as if the US Federal Reserve was already easing. The S&P 500 is set to deliver a more than 6% return this month, one of its strongest January performances so far this century. The 10-year yield has retraced back down to September levels. And the futures market is signalling consensus expectations of a rate cut in the second half of this year, in spite of official Fed protestations to the contrary. According to the CME FedWatch function, futures pricing indicates only a 3% probability of the Fed’s official rate forecast for the end of 2023 being correct.

In some senses, we are in easing conditions:

The Treasury account is being drawn down at the Fed and injected into the economy in an attempt to keep up with key obligations in the face of a freeze on US net debt issuance.

Lower yields on US treasuries are effectively increasing liquidity in the system.

A weakening US dollar indicates a softening supply squeeze.

A lower oil price is putting more money back into people’s pockets.

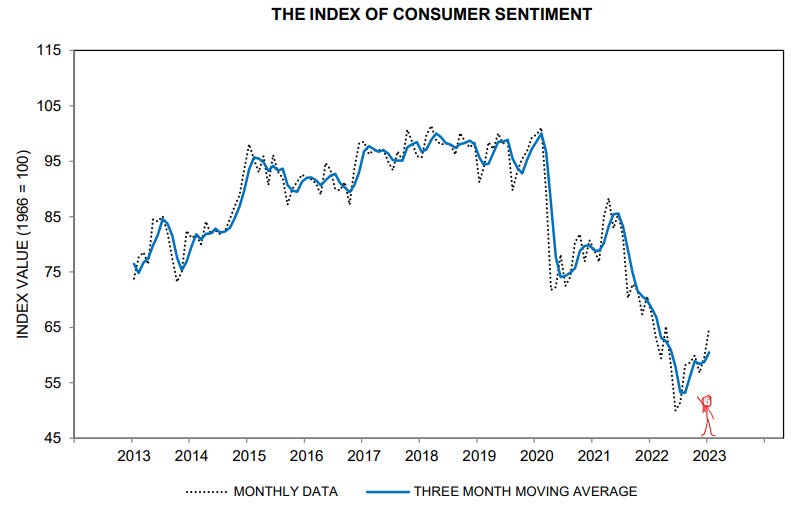

And headline economic figures are boosting the cheer: inflation seems to have peaked by most measures, US PMIs are still contracting but less so, and while wage growth may have moderated slightly, employment is still strong. This is all feeding through to the sentiment data: Friday’s release of the latest University of Michigan surveys showed that the consumer sentiment index for January recovered to 64.9, higher than the 64.6 forecast and well above December’s 59.7. European survey data out this morning shows notable improvement, with consumer confidence at an 11-month high, services sentiment at a 7-month high and industrial sentiment at a 5-month high.

(via the University of Michigan)

This good mood is not what Fed Chair Jerome Powell wants, so we can expect a stern talking-to on Wednesday. He will most likely treat his press conference as an opportunity to dampen expectations, as resilient consumer spending could make the remaining necessary inflation drop that much harder, and could even derail some of the recent progress.

Indeed, this is a key risk we need to keep an eye on: an uptick in inflation figures. With so much optimism now baked into market trends, a bad inflation reading could turn sentiment fast, inflicting enough damage to market spirits that optimism would take even longer to recover.

It’s also not out of the question:

Oil prices have been rising over the past month and there could be some supply glitches ahead as the EU ban on Russian crude shipments extends to refined products at the end of this week, labour unrest in France is impeding deliveries, and as a large Angolan field shuts for maintenance.

China’s COVID spread seems to have peaked, fuelling a reopening demand boost.

European data may be turning: Spanish harmonized inflation rose in January to 5.8%, notably higher than the expected 4.7% and even higher than December’s 5.5%. Core CPI rose from 7.0% in December to 7.5% in January. ☹

Italian industrial producer prices for January rose for the second month in a row, by 31.7% year-on-year in Dec vs 29.4% in November.

So, with growing consensus heading towards a soft landing and even economic pessimists such as myself and Larry Summers acknowledging that things are looking better than we expected, we should definitely be keeping an eye on where we could all be wrong.

Reading the signals

Crypto markets, led by BTC, have continued to trend higher over the past few days although – as if following traditional markets but with a lag – they seem to be taking a breather correction this morning. At time of writing, BTC is still holding above

Keep reading with a 7-day free trial

Subscribe to Crypto is Macro Now to keep reading this post and get 7 days of free access to the full post archives.