Monday, July 17, 2023

“The surest way to corrupt a youth is to instruct him to hold in higher esteem those who think alike than those who think differently.” – Friedrich Nietzsche ||

Hello all! I hope you had a great weekend, heat domes and Cerberus heatwaves notwithstanding… May I point out that Spain produces some excellent tennis players, just sayin’.

You’re reading the premium daily Crypto is Macro Now newsletter, where I focus on the growing overlap between the crypto and macro ecosystem. Thanks so much for being a subscriber! Nothing I say is investment advice. Nevertheless, I hope you find it useful – if so, please consider hitting the Like ❤ button at the bottom, I’m told it boosts the distribution algorithm.

If you’re not yet a subscriber, I hope you’ll think about becoming one to support my work. It would REALLY (really, really) make my day! 😊 It’s currently only $8/month (with a free trial!), although I will be raising the price at the end of the summer.

WHAT I’M WATCHING

Consumer confidence. On Friday, the latest University of Michigan figures told us that consumers were feeling good, delivering the strongest reading in two years. Yet this could be misleading. More on this below.

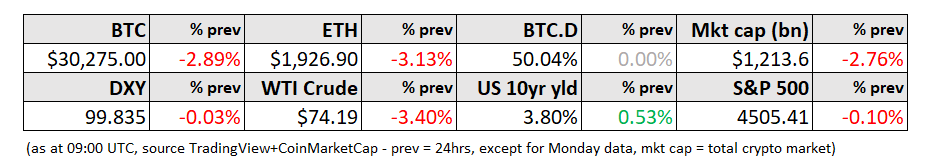

US dollar weakness. Last week’s DXY performance was the worst since last November. Why isn’t BTC reacting more? More on this below.

What drives the gold price? And does that also drive the BTC price? More on this below.

Continued pressure on the SEC. Congressman Ritchie Torres (D, NY) has called for an official investigation into the SEC’s approach to digital assets, accusing the SEC of preferring to rule by enforcement rather than by guidelines. This is the highest profile case so far of a Democrat raising public criticism of the current SEC chair. And several publications are (correctly, in my opinion) focusing on the political loss from last week’s Ripple ruling. The time may soon come that the Democrats decide that Chair Gensler is a liability, especially if the regulator notches up any more high-profile losses.

Currency realignments. India has been busy. Eager to get its currency more “out there” in global finance, it has been struggling to gain traction on boosting rupee trade settlement – Russia and India recently walked back plans to settle bilaterally, bypassing the dollar system. But over the weekend, agreements were announced with two other key trading partners. Indonesia and India are planning to settle bilateral transactions in local currencies and link up their fast payments systems. And India and the United Arab Emirates have agreed to use their respective local currencies for cross-border transactions, and to link their respective payment, messaging and card systems. This agreement is especially significant, as it could position the UAE as a settlement nexus for trade between Russia and other partners such as India. I’ll come back to this more another day, lots to discuss here.