Monday, July 22, 2024

crazy US politics, what that means for crypto, China’s policy shift

“The most basic question is not what is best, but who shall decide what is best.” – Thomas Sowell ||

Hi everyone, I hope had a good weekend!

Ok, so, you know, I chose Monday as the day to publish the monthly roundup of key crypto/macro impact trends (tokenization, stablecoins, etc.) because usually not a lot happens over the weekend, so generally Mondays are quiet news days. Yes, well, about that…

Apologies, as yet again I am bumping the stablecoin review to tomorrow, since today I want to discuss what we learnt from BTC’s reaction to Biden’s exit from the presidential election, and what another Trump presidency could mean for crypto beyond regulatory support. Also, what did we learn from China’s Third Plenum, and how might that affect crypto markets?

I hope you find Crypto is Macro Now useful or informative or even maybe just fun for the music links – if so, would you mind sharing it with your friends and colleagues, and encouraging them to subscribe? ❤

IN THIS NEWSLETTER:

On to the next political phase

Trump, the dollar and the Bitcoin Strategic Reserve

China’s policy focus

If you’re not a subscriber to the premium daily, I hope you’ll consider becoming one! You’ll get unique content, interesting links and my eternal gratitude - and there’s a free trial!

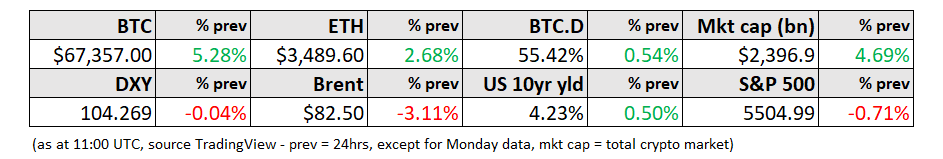

WHAT I’M WATCHING:

On to the next political phase

Well, we all knew it was coming, but Biden’s official exit from the US presidential race still jolted commentary and markets. BTC, which had been climbing as a Republican victory looked increasingly certain, took a dive as any Democrat but Biden could have a better chance of winning.

It didn’t help that his initial statement avoided throwing support to Vice President Kamala Harris as a substitute. This was soon rectified, however, and BTC started to recover as expectations of a Harris victory are low.

(chart via TradingView)

The big uncertainty now is who she will pick as her running mate. Will she go even further left, or will she choose a moderate? One issue will be finding someone willing to step forward – two names often cited as potentially powerful partners are California governor Gavin Newsom and Michigan governor Gretchen Whitmer, but both have said they’re not interested. Others may also balk at joining a campaign starting from a position of weakness, and at any association with the “insider” group that essentially lied to the public about Biden’s condition.

Two names I’m hearing in media reports as potentials are Pennsylvania governor Josh Shapiro and Kentucky governor Andy Beshear – I confess I don’t yet know much about either.

There is still a lot of uncertainty in the race, and a lot at stake for both the US economy and crypto (more on this below). At least one layer of guesswork has been removed: it was obvious that President Biden would not be well enough to withstand rigorous campaigning for the next four months, but doubt was creeping in that he would see it that way.

Now, we wait for the next big political surprise to drop (Harris’ VP pick) – and then, of course, the outcome of the Democratic convention in August, which will confirm who the party’s candidate finally is. It’s likely to be VP Harris, especially since Biden is urging his pledged delegates to support her. But they don’t have to.

As for what happens to the money collected by the various Biden-Harris campaign funds in the event Harris doesn’t get the nomination (I’m hearing varying amounts, but most reports point to around $100 million, although the campaign raised $260 million in Q2), this could be refunded to donors or transferred to the DNC, which could run supporting campaigns alongside those of the chosen ticket.