"There will come a time when it isn't 'They're spying on me through my phone' anymore. Eventually, it will be 'My phone is spying on me'." – Philip K. Dick ||

Hello everyone! I hope you all had a glorious weekend, and that today is quiet for those of you biding time until tomorrow’s July 4 holiday.

You’re reading the premium daily Crypto is Macro Now newsletter, where I focus on the growing overlap between the crypto and macro ecosystem. Thanks so much for being a subscriber! Nothing I say is investment advice. Nevertheless, I hope you find it useful – if so, please consider hitting the Like ❤ button at the bottom, I’m told it boosts the distribution algorithm.

If you’re not yet a subscriber, I hope you’ll think about becoming one to support my work. It would REALLY (really, really) make my day! 😊 It’s currently only $8/month (with a free trial!), although I will be raising the price soon.

Programming note: The daily Crypto is Macro Now will take a break tomorrow for the July 4 holiday – back on Wednesday! To all US readers, happy Fourth of July!

WHAT I’M WATCHING

The US yield curve. The 10yr2yr yield curve inversion has steepened to an eye-watering 106bp, its steepest inversion since September 1981. More on this below.

Bank stocks. The KBW bank index had its first up month in some time. This is good for liquidity conditions, and could push the recession out even further. More on this below.

Yellen in China. The US Treasury Secretary is heading to China later this week in her first official visit in that role. This is a big deal, as stronger ties between the two economies is a key factor in the outlook for long-term inflation.

Two consecutive hikes? The market-priced probability of another 25bp hike in US fed funds in September is climbing and now sits at over 20%. Not a sure thing, but not nothing, and surprising given the encouraging data. More on this below.

Gensler is not resigning. A rumour swept through Twitter over the weekend that SEC Chair Gary Gensler was stepping down. This was a fake news plant (I mean, if he were to resign, I doubt he’d let this leak on the weekend before July 4), but the commotion it caused is a symptom of how disillusioned parts of the public are with his administration. I still think that he will be asked to step down soon, as intensifying scrutiny of his decisions as well as of SEC processes could start to turn him into a political liability, especially if the SEC starts losing high-profile court cases.

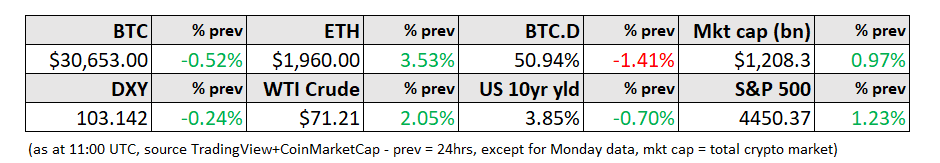

MARKETS

Just one more piece

Keep reading with a 7-day free trial

Subscribe to Crypto is Macro Now to keep reading this post and get 7 days of free access to the full post archives.