Monday, July 8, 2024

those employment numbers, what’s behind the uneven reaction, what’s going on in CBDCs

“Civilizations in decline are consistently characterized by a tendency towards standardization and uniformity.” – Arnold Toynbee ||

Hi all! I hope that those of you celebrating the 4th of July had a great weekend! And that those of you hit by elections and/or bad weather have had a chance to recover.

It’s good to be back at my desk, but I did have an absolutely lovely ❤ time at the Real Vision RVIP event in Mallorca. It was a relatively small group of smart, fun people interested in markets, technology and geopolitics, in a gorgeous setting with perfect weather. Definitely one of the most enjoyable events I’ve been to, because of the people, the size and the topic, but also because there was no aggressive selling of anything. I don’t know how the economics of the weekend worked out, but it was a refreshing change from the firehose of some larger conferences, whose main value seems to be as a magnet for a stream of face-to-face meetings in loud and crowded settings against a backdrop of increasingly shrill brand positioning. It is good to see formats innovate.

In today’s email (a long one, sorry!), the Monday roundup covers central bank digital currency developments over the past month – there’s some interesting moves going on. I also look at Friday’s jobs numbers and the uneven market reaction.

If you missed them, here are links to the recent monthly roundups for:

I hope you find Crypto is Macro Now useful or informative or even maybe just fun for the music links – if so, would you mind sharing it with your friends and colleagues? ❤

IN THIS NEWSLETTER:

Those employment numbers

What’s behind the uneven reaction

CBDCs: goings on in mBridge, Russia, India, Bahamas, Iran, Ethiopia, Qatar

If you’re not a subscriber to the premium daily, I hope you’ll consider becoming one! You’ll get unique content, interesting links and my eternal gratitude - and there’s a free trial!

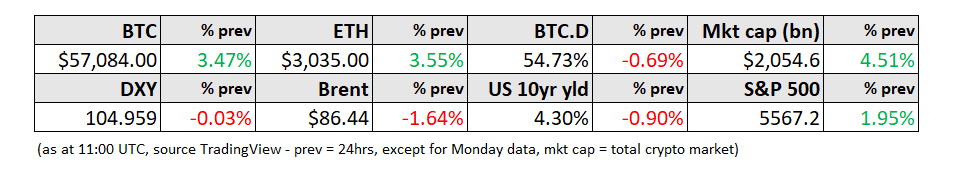

WHAT I’M WATCHING:

Those employment numbers

That felt a bit like a Goldilocks US employment report, didn’t it? It showed a softening labour market, which will comfort the doomsayers, yet jobs growth came in higher than expected.

In the good news bucket (for the economy), US nonfarm payrolls for June increased by 206,000, notably more than the consensus forecast of 191,000.

However, this bucket has a leak. The increase was less than May’s 218,000, which itself was drastically revised downward from the original report of 272,000. Ouch.

The below chart from David Rosenberg shows that, with the exception of the 1986 stretch, consecutive downward revisions have coincided with recessions.

(chart by @EconGuyRosie)

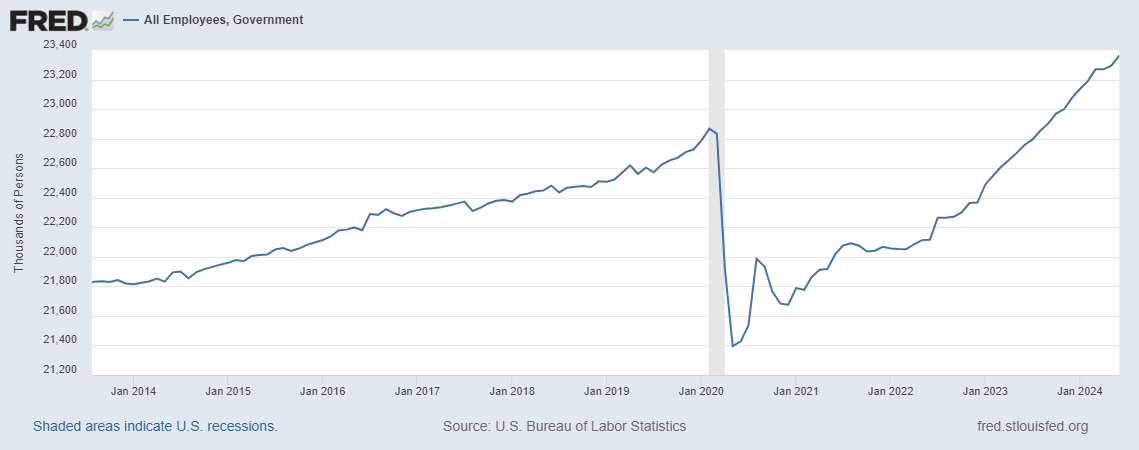

What’s more, 33% (!!) of the jobs added in June came from the government, vs 11% in May. Government jobs surged last month to yet another all-time high, growing by almost three times May’s increase.

(chart via the St. Louis Fed)

In other words, if you take out fiscal stimulus, job creation decelerated much faster than the headline numbers suggest.

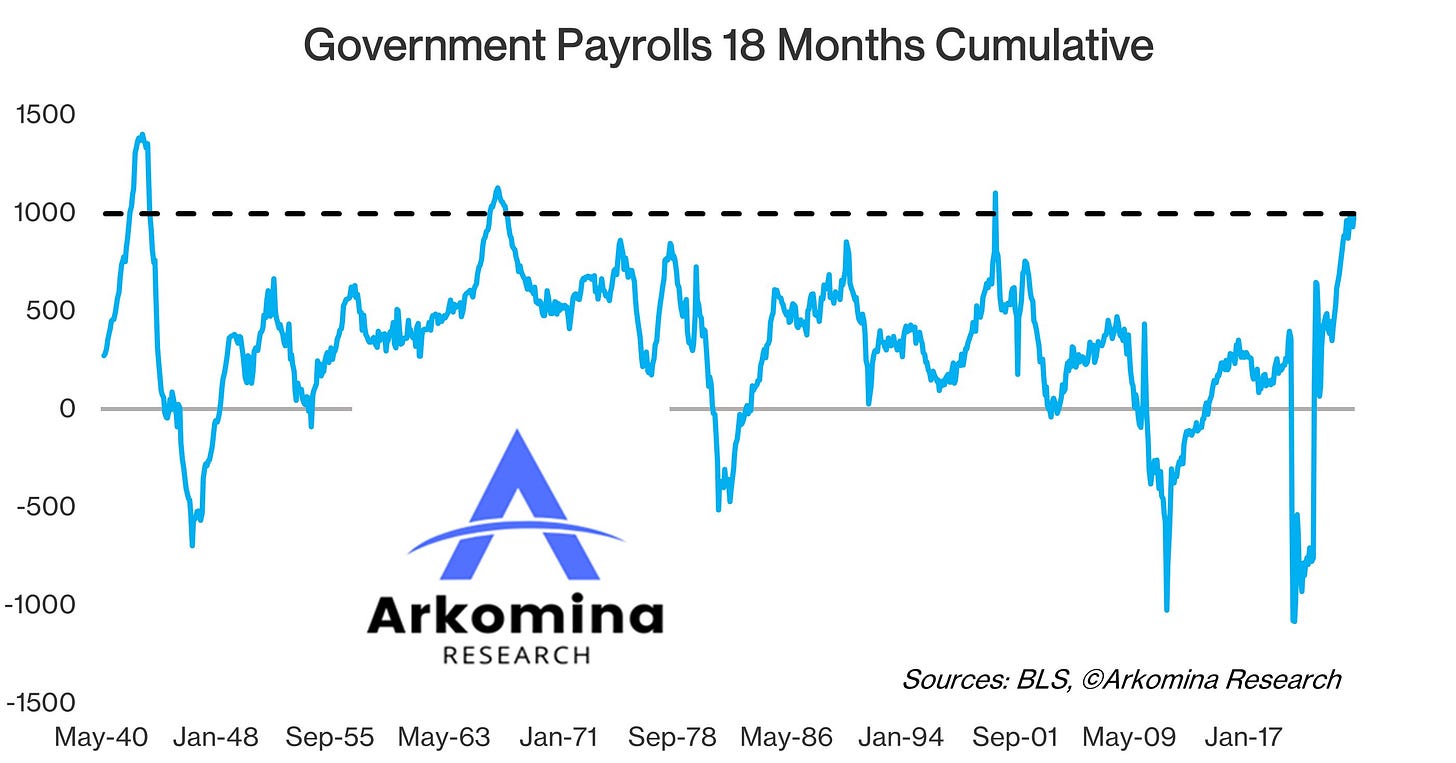

And even more worrying, the increase in government jobs not only distorts the employment numbers – it also continues to feed the budget deficit. And since higher deficits require more management, this is starting to feel like a spiral. Over the past 18 months, the government has increased its number of employees by almost 1 million – this has been surpassed only three times in modern history:

1942-3 (WWII)

1966-7 (Vietnam war, creation/expansion of Medicare and other welfare programs)

2000 (market collapse)

(chart via @MBjegovic)

Removing the fiscal stimulus (which I’m not saying is the government’s attempt to manipulate the data, noooooo), things are starting to look really not great.

Full-time jobs have been declining on a year-on-year basis since February. That’s not good – going as far back as the 1960s, there has not been a multi-month full-time jobs decline that has not coincided with a recession.

(chart via the St. Louis Fed)

And some of the sector breakdowns are also flashing warning signs:

Trucking jobs are plummeting – this also tends to coincide with recessions as demand for goods contracts.

(chart via the St. Louis Fed)

So does a drop in temporary help services employment, as temp workers are often the first to be affected by cuts.

(chart via the St. Louis Fed)

Then there’s the unemployment rate, which came in higher than expected at 4.1%, vs 4.0% expected and 4.0% in May. That’s not too much, you say, a small increase? Yes, but look how fast unemployment moves when it starts ticking up.

(chart via the St. Louis Fed)

This slowdown buried under the headline numbers does increase the likelihood of rate cuts, especially as US average hourly earnings for June came in as expected, with a modest deceleration to 3.9% year-on-year (vs 4.1% in May).