Monday, June 12, 2023

Geopolitical crypto, bitcoin's dominance, US exit and more

"Risk means more things can happen than will happen." – Elroy Dimson ||

Hi all! I hope you all had a great weekend, touched grass and/or looked at the sky, stretched your legs and got a sense that the world keeps inexorably turning…

You’re reading the premium daily Crypto is Macro Now newsletter, where I focus on the growing overlap between the crypto and macro ecosystem. Thanks so much for being a subscriber! Nothing I say is investment advice. Nevertheless, I hope you find it useful – if so, please consider hitting the ❤ button at the bottom and sharing with friends and colleagues.

If you’re not yet a subscriber, I hope you’ll think about becoming one to support my work. It would REALLY make my day! 😊 It’s currently only $8/month (with a free trial!), although I will be raising the price soon.

WHAT I’M WATCHING

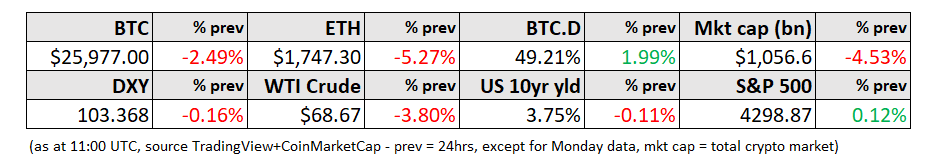

Bitcoin dominance. This has now broken through 49% for the first time since April 2021. More on what this means below.

Russia and crypto. The country has been accused of using crypto to evade sanctions, and while that is probably happening to some extent, there are some not-unrelated structural moves going on that set the stage for a more sophisticated crypto market even when sanctions are no longer necessary. More on this below.

A16z crosses the ocean. The venture capital firm, famous not only for its size (with ~$35 billion in assets under management) but also its focus over the years on blockchain technology, is opening an office in London. This will probably not only invest in crypto firms, but they will be a focus, judging from the somewhat pointed remarks by partner Chris Dixon about the advantage of a supportive regulatory approach (which the US clearly does not have), and by the announcement that the firm’s Crypto Startup School accelerator will launch in the UK next spring. While not explicit in the statement, the message couldn’t be clearer: money will be flowing out of the US as a result of the SEC’s anti-crypto stance.

An opportunity. Hong Kong legislator Johnny Ng took to Twitter over the weekend to invite global crypto exchanges to consider setting up in his region. It’s very unlikely that he would say something like that publicly without vetting by a team and without China’s tacit approval. The message is that crypto markets will continue to evolve with or without the US, and the transmission channel (Twitter, rather than private messages) suggests that Hong Kong wants to remind the US of that.