Monday, June 3, 2024

the economy, BTC interest, democracy

“The enemy of the conventional wisdom is not ideas but the march of events.” – J. K. Galbraith ||

Hello everyone, and welcome to June! I hope you all had a great weekend!

In today’s newsletter, I squint at the economy, BTC and democracy. A good way to start the week, I think.

If you find this newsletter useful, would you mind sharing it with your friends and colleagues? ❤

IN THIS NEWSLETTER:

Squinting at the economy

BTC interest picking up

Democracy at work

If you’re not a subscriber to the premium daily, I hope you’ll consider becoming one! You’ll get ~daily insight into the growing overlap between the crypto and macro landscapes, as well as some useful links. And there’s a free trial!

WHAT I’M WATCHING:

Squinting at the economy

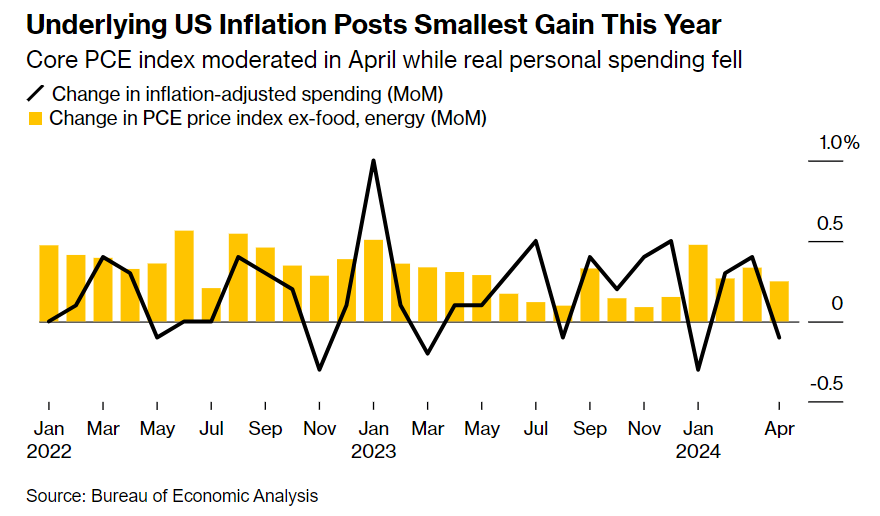

Friday delivered some good news on inflation, if you squint hard enough.

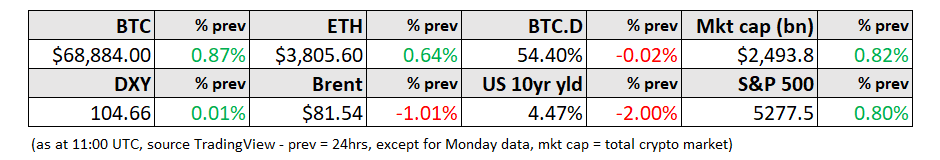

On a month-on-month basis, the core US Personal Consumption Expenditure index for April (ex-energy and food) came in under expectations and grew by the lowest amount in a year, at 0.2% vs 0.3% forecast and previous. The month-on-month headline index growth met the average forecast of 0.3%. On a year-on-year basis, the core and headline indices are growing at 2.9% and 2.8% respectively, in line with March’s read and with what the market was looking for. This is not bad.

(chart via Bloomberg)

What’s more, if you take housing out of the core index (which the Fed likes to do as it gives a better idea of services inflation, which in theory is more sensitive to wages), then we have what looks like moderation in a component that has been particularly “sticky”. This metric rose by 0.3% month-on-month in April, vs 0.4% in March. The year-on-year growth rate eased slightly to 3.4% from 3.5%.

And, consumption showed signs of slowing. Adjusted for inflation, spending on services climbed 0.1% month-on-month, the lowest increase since last August. Spending on goods fell 0.4%. Wages and salaries grew by 0.2% in April, the smallest gain in five months.

The bond market liked what it saw, and the yield on the US 10-year treasury dropped back below 4.5%.

(chart via TradingView)

The main good news here is that the data wasn’t worse than expected, which is encouraging but hardly enough to breathe easy. This stubbornly optimistic market had been walking back fears of a rate hike, despite some officials insisting that the possibility is not zero, and last week’s signs of ever-so-subtle economic easing will no doubt encourage more of this.

But the moderation was slight, and reminds me of a wonderful quote from Fed Governor Christopher Waller a couple of weeks ago (h/t @NickTimiraos):

"What do I mean by good data? What grade do I need to give future inflation reports? I will keep that to myself for now but let’s say that I look forward to the day when I don’t have to go out two or three decimal places in the monthly inflation data to find the good news." 😂

Here’s a chart of the year-on-year growth in the “supercore” index I mentioned above (core less housing):