Monday, Nov 6, 2023

the bigger message in the Coinbase results, how BTC is acting differently now, bankruptcies and more

“Habit is stronger than reason.” – George Santayana ||

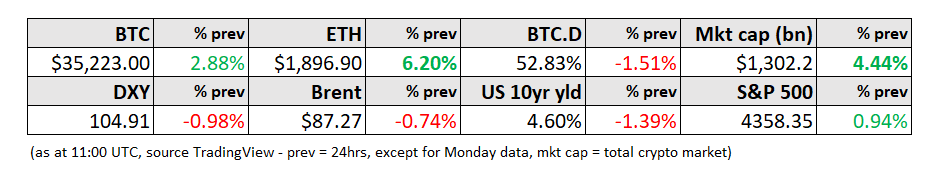

Hello everyone, and happy Monday! This week already feels different. Traditional markets are still acting irrationally, geopolitics is still marching toward a scary place, democracy is still waging a battle of superficial sound-bites… BUT it’s the first sunny Monday in a while where I live, I’m seriously excited about seeing less SBF coverage, and there is solid rather than speculative optimism building in crypto markets. Like I said, it feels different.

You’re reading the daily premium Crypto is Macro Now newsletter, where I look at the growing overlap between the crypto and macro landscapes. There’s also usually some market commentary, but NOTHING I say is investment advice. For full disclosure, I have held the same long positions in BTC and ETH for years, and have no intention to either buy more or sell in the near future.

If you’re not a subscriber, I do hope you’ll consider becoming one! It would help enable me to continue to share what I learn as I work on figuring out where we’re going. It’s only $8/month for now, with a free trial.

And if you find this newsletter useful, would you mind hitting the ❤ button at the bottom? I’m told it boosts the distribution algorithm.

Also, I’m now host of the CoinDesk Markets Daily podcast – you can check that out here.

Oh, I forgot to tell you last week that Scott Melker kindly invited me on his show The Wolf of All Streets on Wednesday, along with Mike Alfred – you can see that here.

IN THIS NEWSLETTER:

Two notable things about BTC’s recent rise

What the Coinbase results say about markets and blockchains

Bankruptcies climbing

Stock exchanges thinning

WHAT I’M WATCHING:

Two notable things about BTC’s recent rise

This market environment definitely feels different.

It’s not just the rarefied air up here at $35,000 – it’s been a long time since we were breathing this. Not since May of last year, to be precise, just before the Terra/Luna implosion. Those feel like more innocent times (obviously, they weren’t innocent, but back then we were unaware of the extent of the rot and the shakiness of the leveraged structure).

It’s not just the different narratives in play. I’ve been talking about these in recent editions, but last time we were at these levels, we didn’t have this level of global interest in safe havens. Few thought the Ukraine war would draw on this long, and that it would be joined by another conflict with superpowers positioned on each side.

No, it feels especially different now because BTC is behaving differently.

Take a look at the recent slope. It’s gentle. It’s orderly. It’s organic. BTC is known for sharp jumps and steep drops, often triggered by leveraged covering or other structural factors. The recent drift upward suggests that steady new buying is coming in. This is much more encouraging, as it suggests a more widespread shift in investor sentiment.

(chart via TradingView)