Monday, Oct 3, 2022

“Never mistake a clear view for a short distance.” – Paul Saffo ✶

You’ve received the premium Crypto is Macro Now newsletter, a daily update on market moves, sentiment shifts and trend-shaping news with a focus on sketching out the deepening overlay between macro and crypto economies. I’m Noelle – I’ve been writing crypto-focused newsletters for over six years, first for CoinDesk in many roles and then for Genesis Global Trading. Excited to be doing this independently now. That said, nothing here is investment advice, and out of respect for your time I will try not to make it too long. Almost everything comes with nuance, though, though that is often difficult! I hope you find this useful – if so, please consider sharing.

MARKETS

Good morning, happy Monday, and welcome to Q4! Rather than the final stretch of a tough year, however, this feels more like the end of the training session for what lies ahead. Inflation concerns are intensifying, chatter around corporate defaults is gathering volume, and energy issues continue to flare up in unexpected places.

But last week’s Bank of England market intervention and today’s walk-back of the UK’s contentious top rate tax cut seems to have given the market a bit of a breather:

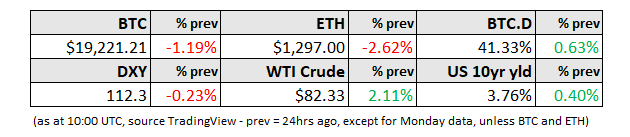

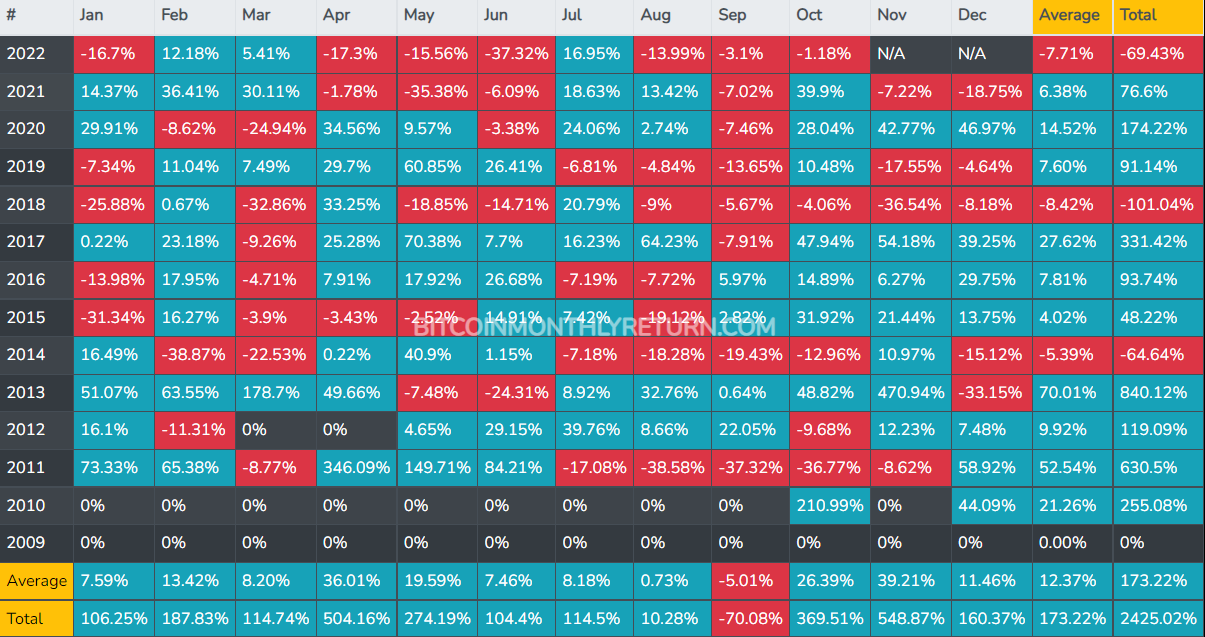

After some volatile moves that pushed it briefly above 4%, the US 10-year yield is now holding just under 3.8%.

The MOVE index, which measures US Treasury market volatility, has sharply corrected from last week’s eye-watering levels.

The UK 10-year yield has pulled back from last week’s post-2008 high of over 4.5% and is now sitting just under 4.1%.

The DXY has retreated from a 10-year high to hover around 112.4.

After a relatively sharp fall from mid-September, gold bounced and seems to be clinging to the $1660 level.

(chart from TradingView)

On the other hand, apart from a brief blip above $20k, BTC barely seemed to register the crisping mood. There are signs interest is picking up, however – more on this below.

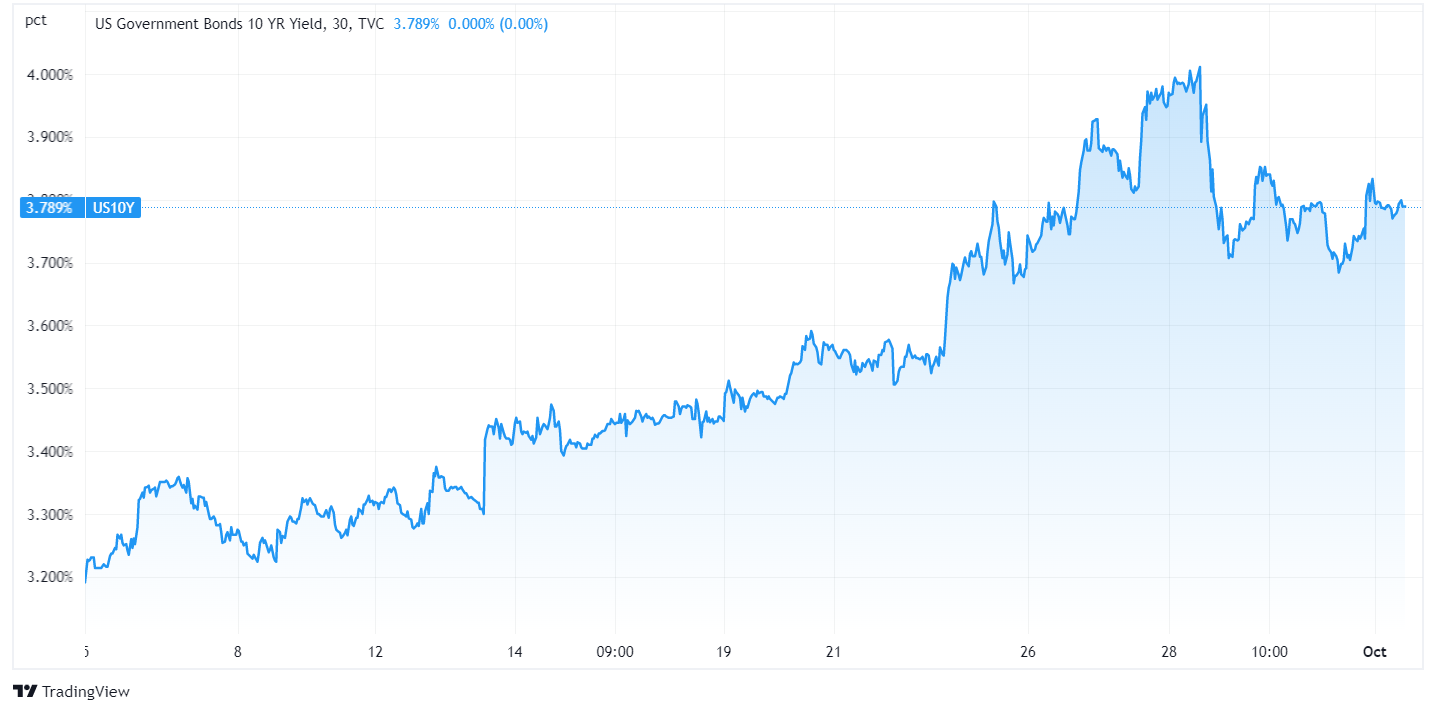

The US PCE deflator for August – the Fed’s preferred measure of inflation – disappointed on Friday, with the core year-on-year figure coming in at 4.9% vs 4.7% previous and 4.7% expected. Even more worrying, the trimmed mean PCE (which removes outliers and averages the rest) had its highest year-on-year increase since 1982. Seen through the eyes of Fed officials, this could hint that inflation is more broad-based than originally thought, and that the rate hikes are not yet working.

(chart via the St. Louis Federal Reserve)

The latest data, plus the market breather mentioned above, supports sticking with rate hikes for now, a focus we are likely to see reinforced in statements this week. From what I can gather, we have 15 public comments from Fed officials this week (starting off with five today alone) – I cannot remember a time when we had so much Fed communication going on.

I’ve heard some claim that the Fed won’t blink until the tight labour market rolls over. I don’t agree – Powell has signalled a willingness to let unemployment rise, and it has not yet shown signs of approaching the 4.4% predicted by the institution’s economists for 2023. The US unemployment rate for September is out on Friday and is expected to hold steady at 3.7%.

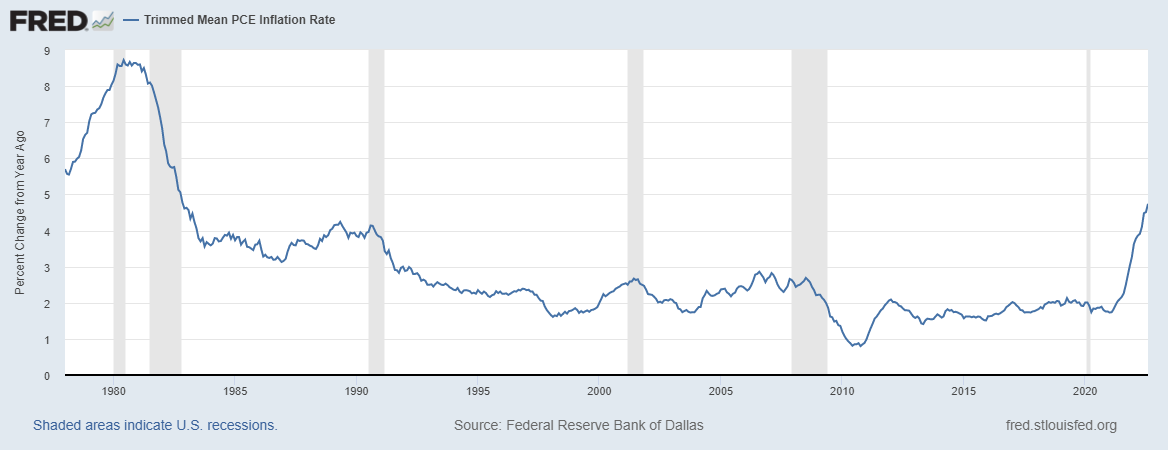

Back to BTC, which fell just over 3% in September, a relatively robust performance for a usually negative month – September has been red for the asset more times than any other month, and the few times it has been positive, returns have been meagre.

(table via bitcoinmonthlyreturn.com)

Looking ahead, October is usually not a terrible month. This is not a “usual” year, however.

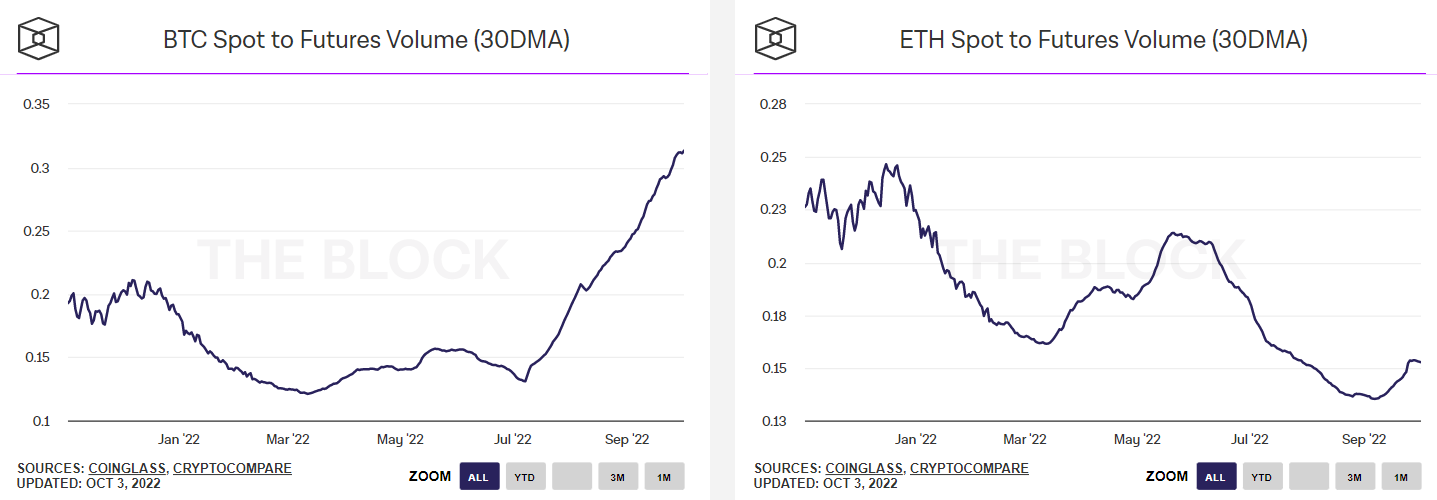

Nevertheless, data is gently suggesting that interest in BTC is picking up. Last week we looked at the increase in spot volumes compared to those of ETH. Zooming out to early summer, we can see that accumulation (reflected in spot volumes) has been more of a market driver than speculation (reflected in futures volumes, obviously with caveats) for BTC – not so much for ETH.

(charts from The Block Data)

Speaking of futures, the annualized daily basis for BTC futures on Binance jumped last week after spending much of the past two months in negative territory, pointing to a notable positive shift in sentiment.

This is also seen in the perpetual futures market, with BTC funding rates once again climbing, indicating more interest in long positions.

(charts from The Block Data)

NEWS

According to a tweet from Tether CTO Paolo Ardoino, the stablecoin issuer has increased the weight of US Treasuries in its reserve backing to just over 58% as of the end of September, up from 43% at the end of June. This is significant for two reasons: 1) it strengthens the quality of the reserves backing the $68 billion of USDT outstanding, possibly putting to rest fears of a collapse of the market’s largest USD-linked asset; and 2) the emergence of a different type of significant player in the US Treasury market could end up alleviating the currently tight liquidity as well as the volatility. The top two USD-linked stablecoin issuers – Tether (USDT) and Circle (USDC) – have over $110 billion in market cap between them, mostly backed by US Treasuries. This is a drop in the $23 trillion ocean of US government debt, but it’s not nothing, and stablecoin growth is likely to resume as market activity picks up.

Crypto platform BitMEX is planning on launching its delayed exchange token BMEX by the end of the year, according to comments by the firm’s CEO. The initial plan to launch in July was pushed back due to market conditions, so its renewal could be a sign the platform sees sentiment picking up. This is supported by a 16% jump in crypto exchange volumes in September, according to The Block’s Legitimate Volume Index, the largest monthly jump since May. BMEX tokens will give holders perks such as discounts on trading fees, similar to FTX’s token FTT (which is down almost 60% in USD terms, as fiat-based crypto exchange volumes have continued to weaken).

Speaking of FTX, you remember when back in May it proposed direct clearing of crypto swaps? The idea is that the CFTC would allow FTX to hold margin accounts for its derivatives customers, effectively cutting out centralized clearing houses and adding the efficiency of automatic liquidations. The CME was one of the organizations opposing the idea for the additional market risk it would introduce. Now it seems the CME is proposing a similar arrangement, which enhances the chances the FTX petition will get approved. If so, this would be a big shake-up of the US derivatives market structure, triggered by a crypto platform. It will probably not be the last.