“The information you have is not the information you want. The information you want is not the information you need. The information you need is not the information you can obtain. The information you can obtain costs more than you want to pay.” – Peter L. Bernstein ||

Hi everyone! I hope you had a good weekend. Things are starting to get enticingly autumnal here – I share a pic most mornings over on X (@noelleinmadrid) if you want to track the changing seasons in Madrid (and who wouldn’t…).

There won’t be a recording today, as I have to head off to the dentist (I broke a tooth, no idea how). Plus, so many charts would make it choppy.

Below, I look at the impact on rates expectations of Friday’s jobs data, and how that unexpectedly did not fluster BTC much. I also touch on the question of whether Bitcoin can be considered “speech” and thus protected.

IN THIS NEWSLETTER:

What weak jobs market?

Is Bitcoin “speech”?

If you’re not a premium subscriber, I hope you’ll consider becoming one! It’s the price of a couple of New York coffees a month, and you get ~daily commentary on how macro moods are influencing crypto markets, and also on how crypto is impacting the macro economy.

WHAT I’M WATCHING:

What weak jobs market?

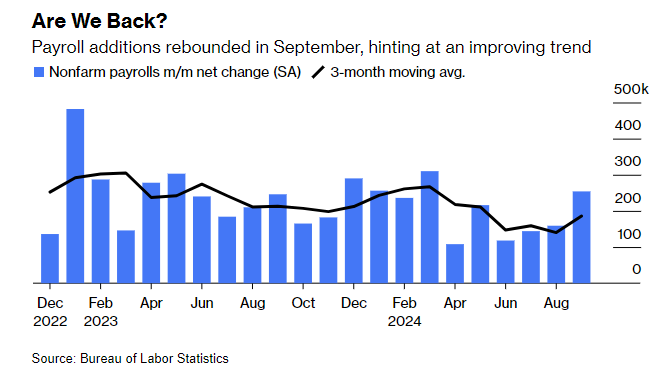

Although signs of a sharply weakening jobs market were notably absent in the data drip leading up to the key September US employment data released on Friday, markets were still taken aback by the strength of the numbers.

Non-farm payrolls were expected to climb by 147,000 – they rose by 254,000, the most in six months and notably higher than the upwardly revised 159,000 (from 142,000) in August.

(chart via Bloomberg)

Even more surprising was a drop in the unemployment rate, from 4.2% to 4.1%, with steady labour force participation.

And average hourly earnings growth had been expected to dip slightly, from 3.9% year-on-year in August to 3.8%. Instead, it accelerated to 4.0%.

A 50bp rate cut in November is now off the table, as we can see from the whiplash in market pricing of the odds.

(chart via Bloomberg)

Just a week ago, CME futures were signalling in a 35% probability of a double cut at the next FOMC meeting, with a 0% chance of no cut at all. Now, the odds are 0% and 15% respectively.

(chart via CME FedWatch)

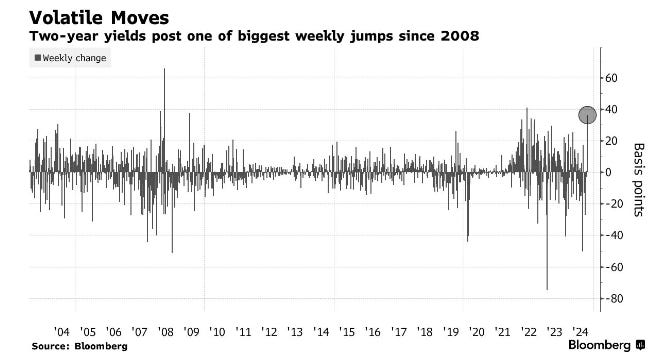

To get a idea of how much this caught the market offside, the intraday jump in the 2-year treasury yield was one of the steepest since 2008! Earlier today, both the 10-year and the 2-year yields popped above 4.0% for the first time since August.

(chart via Bloomberg)

I still think the Fed will skip in November: remember that this Fed is cautious, sometimes egregiously so. And there is no compelling reason to cut again so soon.

The Fed has made clear that it wants to head back to neutral, but in a speech last week, Powell stressed that this would be a slow, careful process. The 50bp cut at the last FOMC meeting was surprising to most and signalled confidence that inflation was heading down to the target 2.0%.

But the stickiness of September’s wage gains suggests a risk that it could take longer than expected. Even before last month’s uptick, the Atlanta Fed wage growth tracker shows that the strength of the jobs market reflected in the price of labour is still running at levels much higher than the pre-pandemic average.

(chart via the Atlanta Fed)

The resolution of the dockworker’s strike, at least for now, has removed an inflationary risk. It did, however, remind officials of the risk of politics interfering with the maintenance of price stability.

And the surge in the oil price last week as the conflict in the Middle East intensified threw in another reminder that geopolitics might also have something to say about inflation. The Brent Crude benchmark is now back above $80/barrel for the first time since August – this is still lower than earlier this year, but Iran is OPEC’s third largest producer and any disruption to its production, or to Persian Gulf shipping, would be bad news. Energy prices are not a key component of the core inflation indices the Fed pays attention to, but they do influence inflation expectations which can impact consumer behaviour.

(Brent Crude chart via TradingView)

Plus, the 4.1% unemployment rate is now notably lower than the Fed’s consensus target of 4.4% at year end. This gives the central bank plenty of breathing room, and removes any rate cut urgency.

Given the high uncertainty around the US election (two days before the next FOMC decision), the committee could (and should, in my opinion) choose to wait and see what happens, given the impact the winner could have on the inflation outlook.

Plus, the next official jobs report comes out on November 1, just before the November 6-7 FOMC meeting, which leaves little time for more data to be absorbed into the decision-making process.

What’s more, there will probably be a fair amount of market volatility that week – why add to it with a contentious decision? Over the next few weeks, the Fed could drill down on its messaging regarding “slow” rate cuts, which should swing market expectations even more in favour of a breather.

The path is downward, though, and a pause in November will make it more likely that we’ll get a resounding double cut to end the year.

BTC’s reaction to the release was unexpectedly encouraging – as jumbo rate cut hopes were dashed, you’d think that liquidity-sensitive BTC would also get hit, right? But, apart from some relatively mild initial volatility, it didn’t. Since the report, it has been grinding higher, and even enjoyed an upward spike when the Asian markets came online earlier today (since faded, but it was notable).

(BTC chart via TradingView)

Could we finally be seeing the “decoupling” of BTC from rates expectations? It’s way too soon to tell, and the cynic in me says probably not – but it’s encouraging to see that longer-term narratives are gaining enough strength to sometimes overcome short-term reactions. Longer-term, the tailwinds are strong.

Is Bitcoin “speech”?

Keep reading with a 7-day free trial

Subscribe to Crypto is Macro Now to keep reading this post and get 7 days of free access to the full post archives.