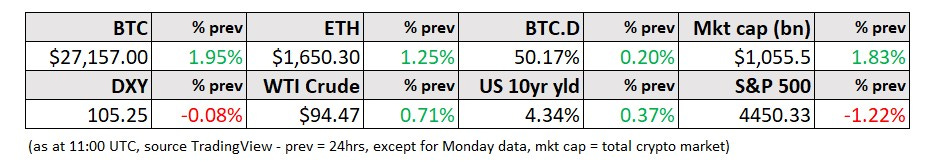

Monday, Sept 18, 2023

bitcoin and "dissident tech", a state regulator muscles in, Japan supports token financing

“Whenever people agree with me I always feel I must be wrong.” – Oscar Wilde ||

Hello everyone! I hope you all had a great weekend, and are ready for a week of macro shifts (or maybe more of the same?) and crypto progress (with some setbacks, unfortunately – see below).

You’re reading the premium daily version of Crypto is Macro Now. In this newsletter, I give some depth on factors I’m keeping an eye on that highlight the growing overlap between the crypto and macro landscapes – my focus is on how crypto is affecting the global economy, and vice versa. There is often a market discussion as well. Nothing I say is investment advice!

If you’re not a subscriber, I do hope you’ll consider becoming one! It would help enable me to continue to share what I learn as I work on figuring out where we’re going. It’s only $8/month for now (I will be raising prices in the autumn), with a free trial – the price of two cups of coffee in NY!

And if you find this newsletter useful, would you mind hitting the ❤ button at the bottom? I’m told it boosts the distribution algorithm.

Programming note: apologies, I have to miss publication tomorrow, back in your inbox on Wednesday!

IN THIS NEWSLETTER:

NYDFS wants to set more rules

Japan supports token financing

Bitcoin utility and global democracy

WHAT I’M WATCHING:

NYDFS wants to set more rules

According to a report in the Wall Street Journal this morning, the New York State Department of Financial Services (NYDFS) will publish proposed guidance today for crypto exchange token listing and delisting policies. The proposal is open for comment until Oct. 20.

Why it matters:

The immediate impact on crypto markets could be further rotation into BTC, as it consolidates its status as the “safe” crypto asset. This is possibly the driver of BTC’s price jump this morning, judging from the timing of the report (although smaller tokens are also surging, so it could be something else) – as of 10:00am UTC, BTC was almost touching $27,000, for the first time this month.

(chart via TradingView)

The reasoning behind this rotation, and its longer-term impact, however, do not bode well for the ecosystem as a whole, for many reasons:

We have a state regulator taking control of the criteria used by exchanges as to which tokens are robust enough to be granted access to the New York market. This is a state regulator that has not demonstrated a deep understanding of the potential or the underlying technology. It is also a state regulator that wants to dampen risk by gating access rather than by ensuring the fair distribution of relevant information.