“The bird that sleeps on the back of the hippopotamus does not think about losing its perch until the hippopotamus actually moves.” – James Dale Davidson ||

Hello all! I hope you had a great weekend, and are welcoming autumn with open arms – I gather it officially started yesterday. I will miss the relative peace of summer. And watermelon. But I’m excited about pomegranates, artichokes, and pulling out my sweaters. And crunchy leaves are amazing.

Today’s email is later than usual due to an unexpected schedule squeeze, apologies! Below, I look at why the approval of BTC spot ETF options is a big deal. I also squint at political disruption, and how more governments are realizing that retail CBDCs are not worth the bother.

If you find Crypto is Macro Now in any way useful or informative, would you mind hitting the like button below? ❤ I’m told it feeds the almighty algorithm, so I’d be really gratful!

IN THIS NEWSLETTER:

BTC spot ETF options!!

The twilight of retail CBDCs?

The political tea leaves

If you’re not a premium subscriber, I hope you’ll consider becoming one! It’s the price of a couple of New York coffees a month, and you get ~daily commentary on how macro moods are influencing crypto markets, and also on how crypto is impacting the macro economy.

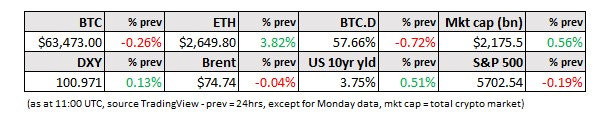

WHAT I’M WATCHING:

BTC spot ETF options!!

On Friday, the SEC gave the ok for Nasdaq-listed options on BlackRock’s IBIT spot BTC ETF. This was both long-awaited (the proposals were first filed in January) and expected – the regulator had already allowed the trading of options on BTC futures ETFs, so the only reason to deny those on the spot ETFs would be to do with legal differences between the respective filing Acts (the futures ETFs are filed under the ’40 Act, the spot ETFs under the ’33 Act).

It’s also a big deal for the outlook for BTC demand and liquidity.

Options primer

Keep reading with a 7-day free trial

Subscribe to Crypto is Macro Now to keep reading this post and get 7 days of free access to the full post archives.