Monday, Sept 25, 2023

bumpy ride ahead, EU complaining about crypto regulation, two new sections, and back on Thursday!

“Although our intellect always longs for clarity and certainty, our nature often finds uncertainty fascinating.” – Carl von Clausewitz ||

Hi everyone! You’re reading the daily premium Crypto is Macro Now newsletter, where I look at the growing overlap between the crypto and macro landscapes. There’s also usually some market commentary, but nothing I say is investment advice!

Today I’m introducing TWO new features:

The “#uh-oh”. I’m medium- and long-term optimistic, but I do think we need to brace for some short-term turmoil ahead. In this new section, I’ll highlight one daily item that made me go “uh-oh”. It’s not meant to depress anyone. Rather, it’s meant to trigger the cathartic release of facing potentially bad news head-on.

The “#crazy”. Every day I see a headline that makes me go “what??”. Sometimes it’s crypto shenanigans, other times its macro weirdness or scientific astonishment. I’ll share one or two with you, so that together we can marvel at how strange things are getting.

If you’re not a subscriber, I do hope you’ll consider becoming one! It would help enable me to continue to share what I learn as I work on figuring out where we’re going. It’s only $8/month for now (I will be raising prices in the autumn), with a free trial – the price of two cups of coffee in NY!

And if you find this newsletter useful, would you mind hitting the ❤ button at the bottom? I’m told it boosts the distribution algorithm.

Programming note: I’m afraid I have to skip publication tomorrow (Tuesday) as well as Wednesday. I’m at a conference (Stellar Meridian, come say hi if you’re there!) and publishing while out and about is a nightmare, I’ve tried it before. Back in your inbox on Thursday!

IN THIS NEWSLETTER:

A bumpy ride for the next few days

Just us? Not fair. The EU urges other jurisdictions to get a move on

Two new sections: #uh-oh, and #crazy

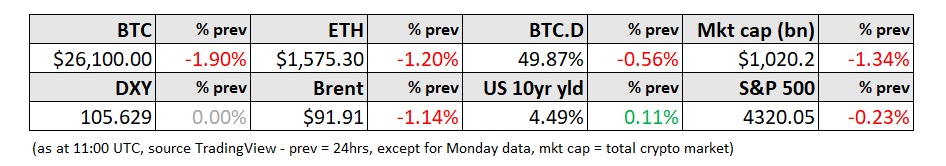

WHAT I’M WATCHING:

A bumpy ride for the next few days

This week is set to be a jittery one for markets.

Macro:

On the macro front, we get US housing market indicators and the latest CB consumer confidence index on Tuesday, manufacturing data on Wednesday, US GDP revisions and more housing information on Thursday, and then on Friday we get to obsess over the latest PCE index. As with the US CPI, this is expected to show continued upticks in the headline levels, while core PCE continues to moderate. Given the recent moves in energy and house prices, I’d be surprised if there aren’t some negative surprises in there.

We also have a few days left to fret about the impact of the looming US government shutdown, due to start at the beginning of the US fiscal year on October 1 unless a funding agreement can be reached by Sunday. This will involve the furlough of hundreds of thousands of workers, reduce government services across the country, dent economic activity that relies on those services, and build on the already high public distrust of government capacity.

Meanwhile, the steady climb of the US dollar and the almost 30% climb in the Brent Crude benchmark oil price since its local low in early May should be enough to bring down some earnings forecasts, potentially also impacting valuations. These are likely to be further downgraded as analysts factor in a higher discount rate, given the increasing probability that rates will remain higher for longer.

(chart via TradingView – Brent Crude is up ~8% over the past year)

Crypto:

In crypto markets, investor attention is more focused on macro liquidity indicators (not looking good) than on the potential for a bitcoin spot ETF approval. Although Bloomberg analysts place the probability of approval at 75% before the end of 2023, 95% before the end of 2024, this is not priced in, which shows how macro concerns still prevail.