Monday, Sept 30, 2024

macro signals, jobs week, BTC vs gold narratives

“Not ignorance, but ignorance of ignorance, is the death of knowledge.” – Alfred North Whitehead ||

Hello everyone, good morning, and happy Monday! I hope you all had a great weekend. Outside is just beautiful where I am, bright and crisp.

Today’s newsletter offers a macro update, and a review of why this matters for crypto and how gold’s narrative is not as different as it may seem. Since the text is really chart-heavy today, there won’t be an audio version.

IN THIS NEWSLETTER:

Macro signals

The mood uplift

BTC’s narrative relative to gold

If you’re not a premium subscriber, I hope you’ll consider becoming one! It’s the price of a couple of New York coffees a month, and you get ~daily commentary on how macro moods are influencing crypto markets, and also on how crypto is impacting the macro economy.

WHAT I’M WATCHING:

Macro signals

We’re heading into jobs week, with August openings data out tomorrow, ADP private non-farm payrolls on Wednesday and weekly unemployment claims on Thursday, all building up to the Friday’s climax of official US September employment numbers.

Consensus forecasts have the unemployment rate holding steady at 4.2%, with non-farm payrolls growing by a net 144,000, slightly higher than August’s 142,000.

Even if that turns out to be correct, the growth is still relatively soft. Daily Chartbook shared a chart of Bank of America’s “NFP momentum indicator”, which takes the three-month moving average of NFP gains and divides it by the 12-month moving average, to get a feel for the underlying growth momentum. The last time it was this low was during the 2008 Great Financial Crisis.

(chart by BofA via Daily Chartbook)

However, it does not yet seem soft enough to warrant another 50bp cut in November, although CME futures are pricing in a not-insignificant 40% odds of that happening.

The latest reported weekly initial unemployment claims were the lowest in four months, the four-week average is heading down, and continuing claims are steady.

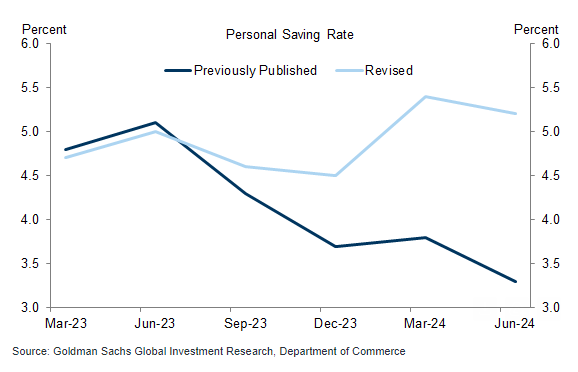

Further breathing room comes from last week’s upward revision in the US personal savings rate.

(chart via @MikeZaccardi)

It’s a large increase, but these are not unusual – they are relevant to economic forecasting, however.

Speaking of which, the Atlanta Fed has upped its expectation of Q3 GDP growth to 3.1%, its highest prediction for this period so far (although this wasn’t so much due to the savings rate as to an increase in net exports and private inventories).