Monday, Sept 9, 2024

employment data, rates, and a pivotal week

“Fanaticism consists of redoubling your effort when you have forgotten your aim.” – George Santayana ||

Hello everyone, and happy 9/9! I do love symmetry. ❤

You’re reading the premium daily Crypto is Macro Now newsletter, in which I look at the growing overlap between the crypto and macro landscapes. If you’re not a full subscriber, I hope you’ll consider becoming one?

It turned out to be a markets-focused newsletter today – I look at the message in Friday’s US jobs data, why this week will be pivotal (it’s not the CPI), and what all this means for rates and crypto. I have deep dives in some nerdy-yet-important topics planned for later this week, and the CBDC roundup will drop either tomorrow or Wednesday (it depends on how long it ends up being). 😊

IN THIS NEWSLETTER:

Employment data: still no clear path

Rates: let’s get this started

A pivotal week, but not because of the data

The newsletter has a new feature to announce: referrals! You can now send out referral links, and if five of your contacts sign up (for the free or the premium), you get a free subscription for a month. If twelve sign up, you get three months, and if you reach 20, you get six months. I know many of you have been doing this anyway, and I am GRATEFUL. Now, I feel the time has come to introduce some incentives.

WHAT I’M WATCHING:

Employment data: still no clear path

By now you’re probably seen/heard that Friday’s official US employment data came in weakish, but not so weak as to send up the flares.

The highlights:

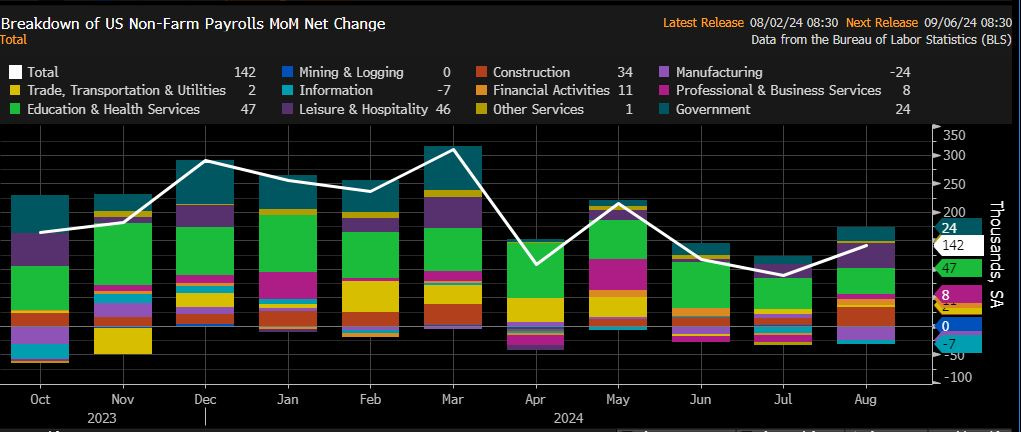

Non-farm payrolls for August were weaker than expected, at 142,000 vs 164,000, but notably higher than July’s 89,000.

Most of the gains came in education & health services, leisure & hospitality, with construction delivering a surprisingly strong showing (given recent weakness in housing starts).

(chart via Bloomberg)

July’s growth was revised down from 114,000 – the new number is the weakest jobs increase since December 2020. So far this year, all reads except that of March have been revised lower.

Employment is still increasing, but the trend is definitely decelerating.

The rolling three-month average of NFP gains is now 116,000, the lowest since June 2020.

(chart via Bloomberg)

Only 9,000 of the increase came from government jobs, a lower percentage than usual. But government jobs are still one of the main drivers of employment increases. The below chart of quarterly public sector employment growth in percentage terms shows how unusual the current payroll padding is – ominously, this tends to peak shortly before recessions.

(chart via the St. Louis Fed)

The unemployment rate, which comes from a separate household survey, decreased as expected from 4.3% to 4.2%. This is good news, but not enough to celebrate – if you extend the rate to two decimal places, the improvement is only from 4.25% to 4.22%.

It’s worth remembering that the Fed doesn’t expect the unemployment rate to reach 4.2% until the end of 2025.

The employment level reflected in the household survey (which counts the number of working persons rather than the establishment survey’s tally of jobs) was stronger, showing a 168,000 increase, vs a 67,000 increase in July.

Average hourly earnings increased by 3.8%, slightly more than the expected 3.7% and July’s 3.6%. That it’s heading up could be a concern, but this is the third consecutive month with annual wage growth within the Fed’s target of 3-4%, so it’s unlikely to stop a cut next week.

Speaking of which…