Monday, September 26, 2022

Never mistake a clear view for a short distance. – Paul Saffo

MARKETS

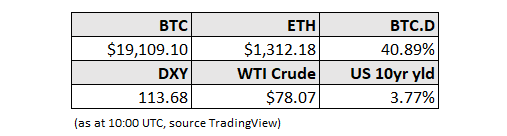

The slight breather in the DXY index on Monday morning after its dash upwards last week (+4.0% between last Friday’s close and yesterday’s peak of 114.13 – currently down 0.8% from there) is giving oxygen to a BTC bounce, currently up 1% from a 24hr low of $18.7k just a few hours ago.

ETHBTC is down to similar levels as back in July, when we were all still placing bets on whether Ethereum’s merge would even happen this year. Given the shift in ETH’s fundamentals since then (lower supply inflation, higher yield), this doesn’t make much sense.

After last week’s bond market meltdowns, the TLT long bond index is now at its lowest point since December 2013, when inflation expectations per the University of Michigan survey were at 3% (vs 4.8% in August 2022) and the Fed Funds rate was less than 0.1% (vs over 3% today).

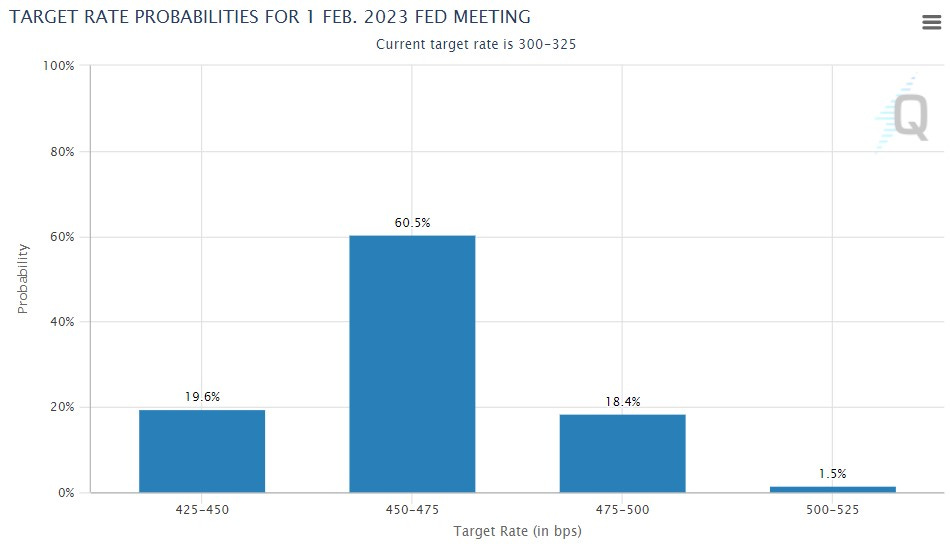

Things may feel bleak in markets at the moment, but traders have not lost all optimism yet, at least regarding the US market – assuming that the Fed goes through with its signaled 125bp hike between now and the end of the year, then CME futures point to a consolidation of expectations around a meager 25bp in the first FOMC meeting of 2023.

This does not say much about what the Fed will do, just what traders think the Fed will do, which is often very wrong. For instance, in early July (not even three months ago), the market was signaling only a 3% probability that the current range would be where it is.

Elsewhere, traders are preparing for a worse-than-expected scenario as the pound continues to drop against just about everything. Apparently, the market is now pricing in 120bp of hikes for the November meeting – double the consensus heading into Chancellor of the Exchequer Kwarteng´s budget announcement. Some analysts are predicting an emergency hike before then. (Chart from Bloomberg)

NEWS

USDT has gone live on the Polkadot blockchain. This brings the number of chains on which it is active up to 15, unless I’m missing some*: it’s also on Ethereum, Tron, Solana, Avalanche, Algorand, Kusama (the Polkadot “canary” chain), NEAR, EOS, Tezos, Polygon, Blockstream’s Bitcoin layer-2 Liquid Network, Omni (a largely deprecated version of Bitcoin), Statemine and Bitcoin Cash’s Simple Ledger Protocol – by far most of USDT is transacted on Ethereum and Tron. USDC, for comparison, is available on nine chains. On the one hand, it’s not the number of chains that matters for market liquidity, but the volume of transactions (which has been declining in the bear market). On the other hand, we could end up with leading stablecoins acting as a type of “bridge” between ecosystems. Keep an eye out for improvements in switching technology.

(*which is possible – there’s a lack of consistency in reporting on these even on Tether’s web page, the Polkadot announcement misses some that were mentioned in previous announcements – it also mis-states the name of the Bitcoin Cash network)

Vitalik Buterin, creator of Ethereum, said at a conference on Friday that he expects zcash and dogecoin to follow in Ethereum’s footsteps and transition from proof-of-work to proof-of-stake consensus before long. Indeed, both are relatively small networks that could push such a change through the governance process, and the main use case for both is not as a store of value (it’s private transactions and, well, fun, respectively). So such a transition could be possible, especially now that Ethereum has paved the way. The downside is that this could further increase pressure on Bitcoin to do the same, from observers that don’t understand the technology, governance set-up or value proposition of the original blockchain network.

More information is emerging about the bankruptcy of Bitcoin mining infrastructure company Compute North. It seems that the nail in the coffin was driven home by the company’s main lender. I don’t know the full story of why the lender pulled the promised funding, but this is a reminder of how important credit conditions are for crypto miners, especially for Bitcoin, which requires significant capital outlay. Conditions are tightening, with many lenders retreating from financing this segment. But others are stepping in – last week we saw Maple Finance unveil a Bitcoin miner lending pool. Another issue is the rising cost of what financing may be available. This matters for the price of BTC since cash-strapped miners may need to resort to selling some of their holdings, adding to market sell pressure. Some might be able to avoid this by selling stock, such as Cipher Mining (which announced on Friday its intention to sell up to $250 million of equity “from time to time” as market conditions allow – this will not be easy with current sentiment) and Iris Energy (which also announced on Friday a $100 million two-year equity deal with investment bank B. Riley).