New charters and banking upheaval

plus: crypto liquidity, Fed independence and what's ahead for the week

“Don’t judge each day by the harvest you reap but by the seeds that you plant.” – Robert Louis Stevenson ||

Hello everyone! I hope you all had a great weekend. Here we are, the home stretch into the New Year…

My latest op-ed for American Banker (Here’s what is really behind all these stablecoin ‘risk’ reports – paywall, sorry) suggests that global institutions aren’t as worried about “risk” as they are eager to plant their risk-preventing stakes in the ground.

🎀 Programming note: this newsletter will take a short break as of next Monday inclusive, back on the 29th! 🎀

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

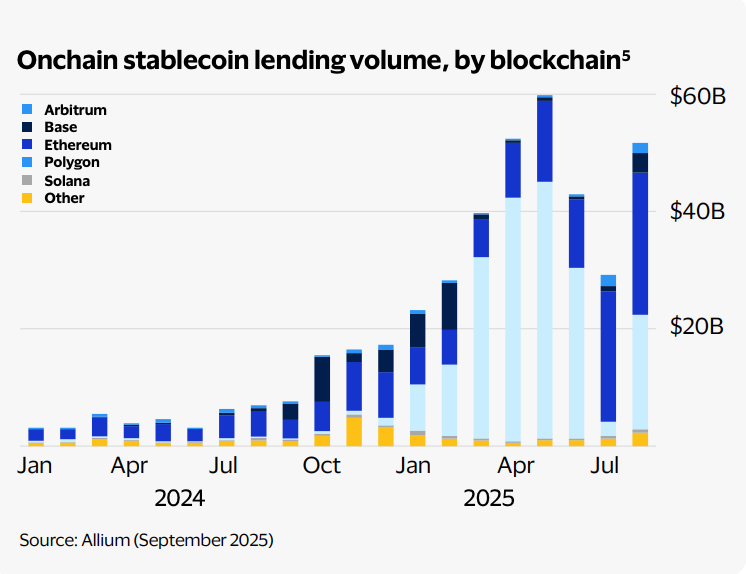

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets, as stablecoin lending volumes reached over $50bn in August 2025.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

Coming up this week: macro data, geopolitics, interest rates and more

New charters and banking upheaval

Markets: low liquidity

Macro: an independent Fed

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes.

If you’re a premium subscriber, thank you!! ❤

WHAT I’M WATCHING:

Coming up this week:

A packed week as we wind down for the holidays.

Today, the SEC hosts a roundtable on financial surveillance and privacy with a roster of impressive speakers, most of whom are not high-profile except to those who follow the real work being done on the topic. The agency seems to be taking this seriously. The session kicks off at 1:00pmET, and you should be able to find the livestream here.

And at 9:30amET, Fed Governor Stephen Miran speaks at an event at Columbia University on the inflation outlook – apparently you can watch that here.

Tuesday brings the first official US jobs data release since the government entered shutdown in October. This will include payrolls data for October and November, and the unemployment rate from November. Consensus expectations point to a 50,000 payrolls increase and a 4.5% unemployment rate, slightly higher than in September and than the Fed’s mean projection for 2025.

We also get US retail sales, expected to be robust as consumers spend for the holiday season.

And starting tomorrow, the International Economic Forum of the Americas (IEFA) hosts its flagship European event with the Conférence de Paris, bringing together leaders across politics, business and finance to discuss “global challenges” (there are a few).

On Wednesday, we get the much-trumpeted new product release from Coinbase, to be announced via a livestream – Bloomberg reported over the weekend that leaks suggest it will include prediction markets and tokenized equities. The intriguing part for me is the potential unification of various asset groups on one platform. But as always, the details matter. And “tokenized equities” still feels more like a wrapper than something new. Open to being shown I’m missing something here.

On Thursday, we get the first post-shutdown US CPI report, but it will be incomplete and won’t show the monthly progression as data was not collected for October.

Also on Thursday, the Bank of England is expected to deliver the last rate cut for a while, joining the majority of developed economy central banks around the world that seem to be entering an extended pause. The European Central Bank also delivers a rate decision, expected to be a hold.

And on Thursday, EU leaders gather in Brussels to try to force through approval to lend frozen Russian funds to Ukraine, to be paid back only if Russia repairs the damage it has caused. This is meeting stiff opposition from the US as well as several EU members, including Belgium where most of the frozen funds are held. But the EU is getting desperate. Either it is strong enough to suppress opposition and weaken its reputation as a safe jurisdiction for financial assets; or it isn’t, which will reinforce its reputation for weakness on the global stage. This is a crazy lose-lose situation.

On Friday, the Bank of Japan meets to decide on interest rates, with odds pointing firmly to the first hike since January. This in itself is priced in, but a key variable is the tone and language Governor Ueda will use in his press conference, which will be scrutinized for hints as to when the next hike might come.

And we get the final estimate of the University of Michigan December consumer survey.

New charters and banking upheaval

Last week brought a big step forward in the emergence of a new banking landscape.