NFPs: the drama and the overreaction

plus: what's ahead this week, market reactions, and more

“We tend to use a new technology to do an old task more efficiently. We pave the cow paths.” – Paul Saffo ||

Hello everyone! August already feels different from July, especially now that the insanity of last week is hopefully over. I’m hoping to take some days off here and there to unwind a bit and clear out cupboards and catch up on some reading and writing. No travel planned until later this month when I’m in Budapest for a wedding 🎉 , but I absolutely love staycations.

So, seizing the opportunity while I can, this newsletter will miss publication on Friday, and possibly next Friday also (which is a public holiday here anyway), I’ll confirm next week.

✨ Tune in later today for the Bits & Bips livestream, where Steve Ehrlich, Ram Ahluwalia and I chat about macro and crypto… gee, whatever will we have to talk about this week? We kick off at 4:30pm ET, and you can watch here, it’ll also get streamed on our X handles. ✨

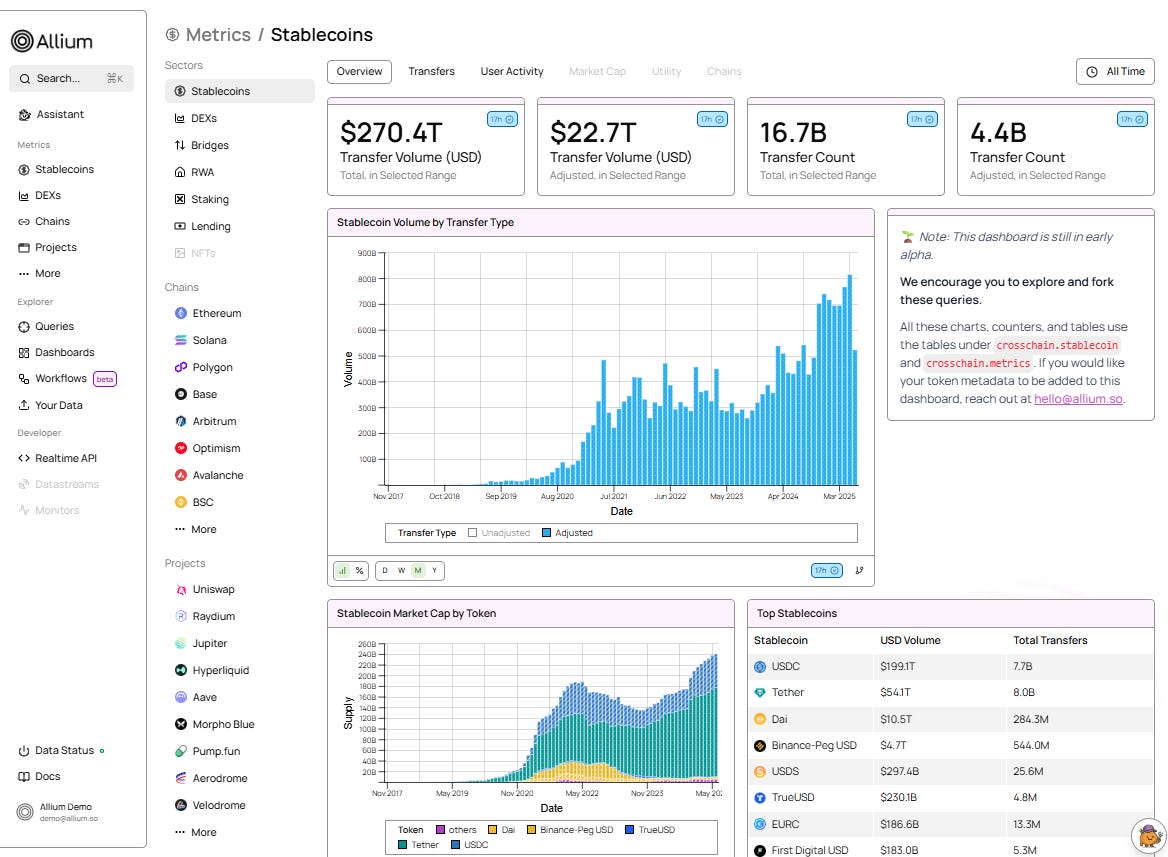

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides blockchain data and analytics for institutions and fintechs, helping teams generate key insights from on-chain activity. Leaders like Visa, Stripe, and Grayscale rely on Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

(No tariff comment today!!! 😀Weird I find that exciting, I know, but tariff exhaustion has set in.)

(But given the length of today’s email, Hong Kong stablecoins gets moved to tomorrow. 😔)

Coming up: trade data, Fedspeak, jobs outlook, Japan’s plenary

NFPs: the drama and the overreaction

Market reactions

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

Coming up:

This week is blissfully light on macro data compared to last week, a welcome respite.

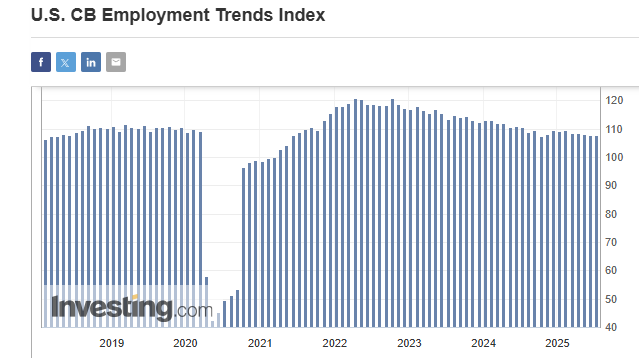

Today, we get the US Conference Board Employment Trends Index (ETI), a leading indicator of hiring intentions, suddenly thrust into the spotlight given the jobs report drama on Friday (see below). Data is taken from both objective and subjective market indicators such as initial unemployment claims, job openings, the number of temporary jobs, the percentage of those in part-time positions not by choice, the percentage of firms struggling to fill open positions, the percentage of respondents that say jobs are hard to get, industrial production and trade sales. June’s index remained flat at 107.83, signalling cautious stability. A notable move away from this in either direction today would be significant.

(chart via Investing.com)

Also today, we get US factory orders for June, but this is a noisy number these days.

And we get the latest quarterly Senior Loan Officer Opinion Survey (SLOOS) from the Federal Reserve, which takes the temperature of credit demand and availability. This is relevant not just for economic activity but also for overall liquidity, so – while just a survey – it’s worth keeping an eye on as the respondents are on the front line of money creation.

On top of all that, we get the minutes from the latest meeting of the Bank of Japan – I’ll be looking for signs of political uncertainty influencing rate decisions, especially since when the Japanese bond market sneezes, we all catch a cold.

I’m sure I’m not the only one breathing a sigh of relief that the US Senate starts its summer recess today.

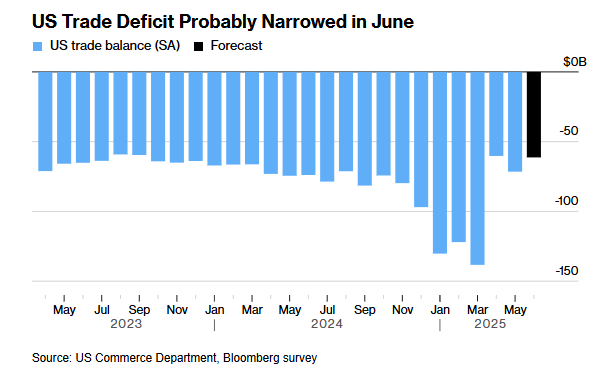

Tomorrow, Tuesday, we get the US trade balance for June – again, noisy given the volatile uncertainty.

(chart via Bloomberg)

More relevant will be the ISM and S&P Global indicators of services activity, as services play a much larger role than manufacturing in the US economy. These have been showing signs of moderately expanding services activity, contracting employment and rapidly increasing prices. So, we should probably brace ourselves for further confirmation of stagflationary trends.

On Wednesday we get speeches from at least three Fed officials (Cook, Collins and Daly), which will be scrutinized for signs of deepening dissent on rates, why Governor Kugler is stepping down, and more. I expect we’ll hear support for Fed Chair Powell’s strategy of being cautious while retaining flexibility.

We also get (early Thursday European time) China’s trade surplus figures, and Japan’s 30-year bond auction, not exactly the most liquid instrument. The question is how much more can be stuffed onto bank balance sheets.

On Thursday, we see the latest weekly data on US unemployment claims, which could further support the narrative of a slowdown but not a crash.

Also, we find out the latest US Unit Labor Cost measures for Q2, an indicator of productivity gains and wage pressure.

We get wholesale inventories and trade – again, noisy for now.

And we get the latest New York Fed consumer inflation expectations – these are relevant in that they can signal spending plans as well as credit demand.

Just as well, because later on Thursday we get an update on US consumer credit demand, expected to show a strong jump. If that’s what we get then, again, why are we hoping for rate cuts when current levels are not impeding credit growth?

Also, we hear from Atlanta Fed President Raphael Bostic, who back in May said he thought there would only be one rate cut this year, at the time a non-consensus position. But, this year, he doesn’t vote on the FOMC.

Friday should be mercifully quiet, with only China’s CPI on the data radar.

But there could be some political drama from Japan, with the ruling Liberal Democratic Party holding a joint plenary meeting to discuss the significant setback in the recent legislative elections. Despite building pressure on Prime Minister Ishiba to resign, he insists that’s not on the table. If there are any surprises at the plenary, we could see a volatile yen, which would spill over into other markets, just as we all head off into the weekend.

NFPs: the drama and the overreaction

Everyone knows the payrolls number is noisy – as recently as last Wednesday, Fed Chair Powell said that’s why he doesn’t pay much attention to the jobs number, preferring to focus on the unemployment rate.

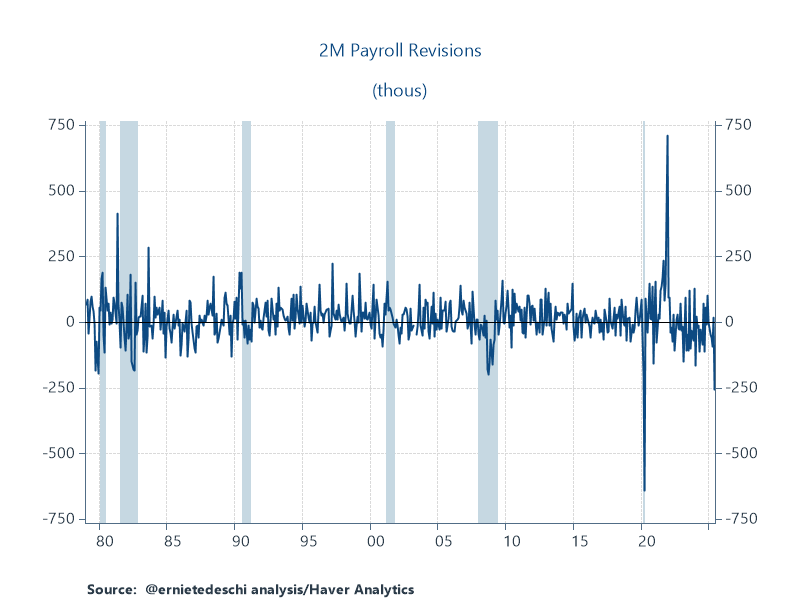

We got a loud reminder of this on Friday with the downward revision of June’s non-farm payrolls, from 147,000 to 14,000. That’s … a lot. Even more shocking was the downward revision for June and May combined: 258,000, the steepest since May 2020.

(chart via @ErnieTedeschi)

Yes, that revision is crazy, and yes, there are signs of a softening in the labour market. But certainly not enough to warrant the general market freak-out we got.

First, I’ll show how the jobs numbers were softer but not terrible. Then I’ll rant about the the reaction.