No, Bitcoin is not a Labubu

Plus: the slippery slope of censorship, jobs data and more

“The basic causes of change are precisely those that are not subject to conscious control.” – James Dale Davidson ||

Hello everyone! I hope you’re all doing well. If, like me, you’re looking forward to a breather next week, hang in there, not long now…

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

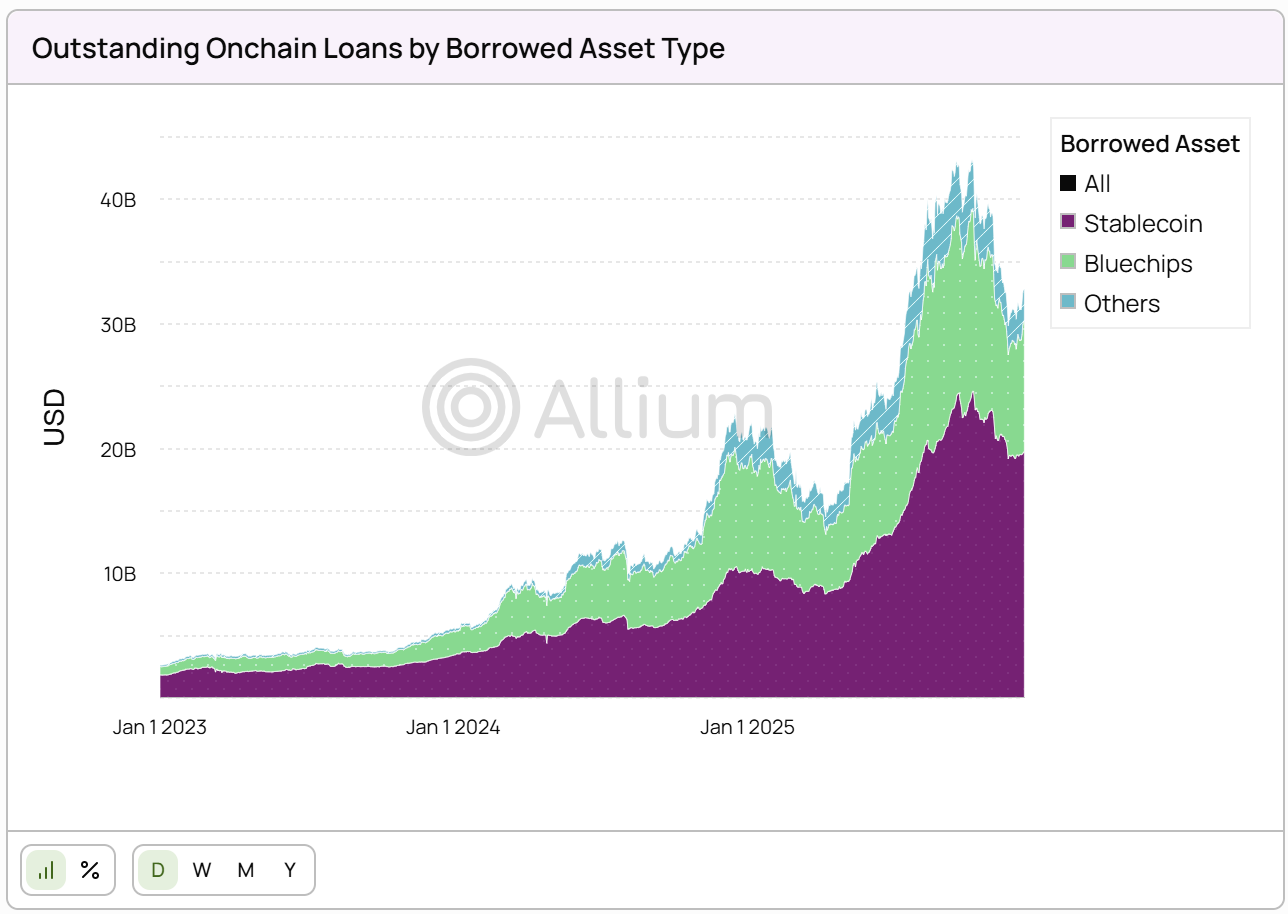

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets. Looking at the data, outstanding onchain loans reached over $40Bn this year, with stablecoins making up more than half of borrowed assets.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

No, Bitcoin is not a digital Labubu

The slippery slope of censorship

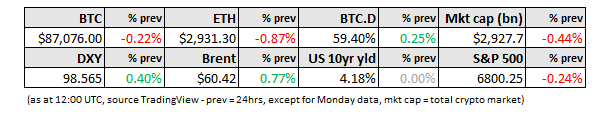

Macro: jobs fluff

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes.

WHAT I’M WATCHING:

No, Bitcoin is not a digital Labubu

One day I hope to understand why smart people can be so confident on a topic on which they have done close to no research that they will happily say things in public that make them look not smart at all.