No, CBDCs aren’t “stabilizing forces”

plus: crypto regulation, GDP, tariff frenzy and more

“Poor and free rather than rich and enslaved. Of course, men want to be both rich and free, and this is what leads them at times to be poor and enslaved.” – Albert Camus ||

Hello all!!! Sigh, another month down – anyone else out there sometimes feel a little bit sad that time is flying by so fast??

Holy cow is there a lot to talk about today, and of course I won’t get to it all which means my backlog is getting even heavier. Wasn’t summer supposed to be light on news?

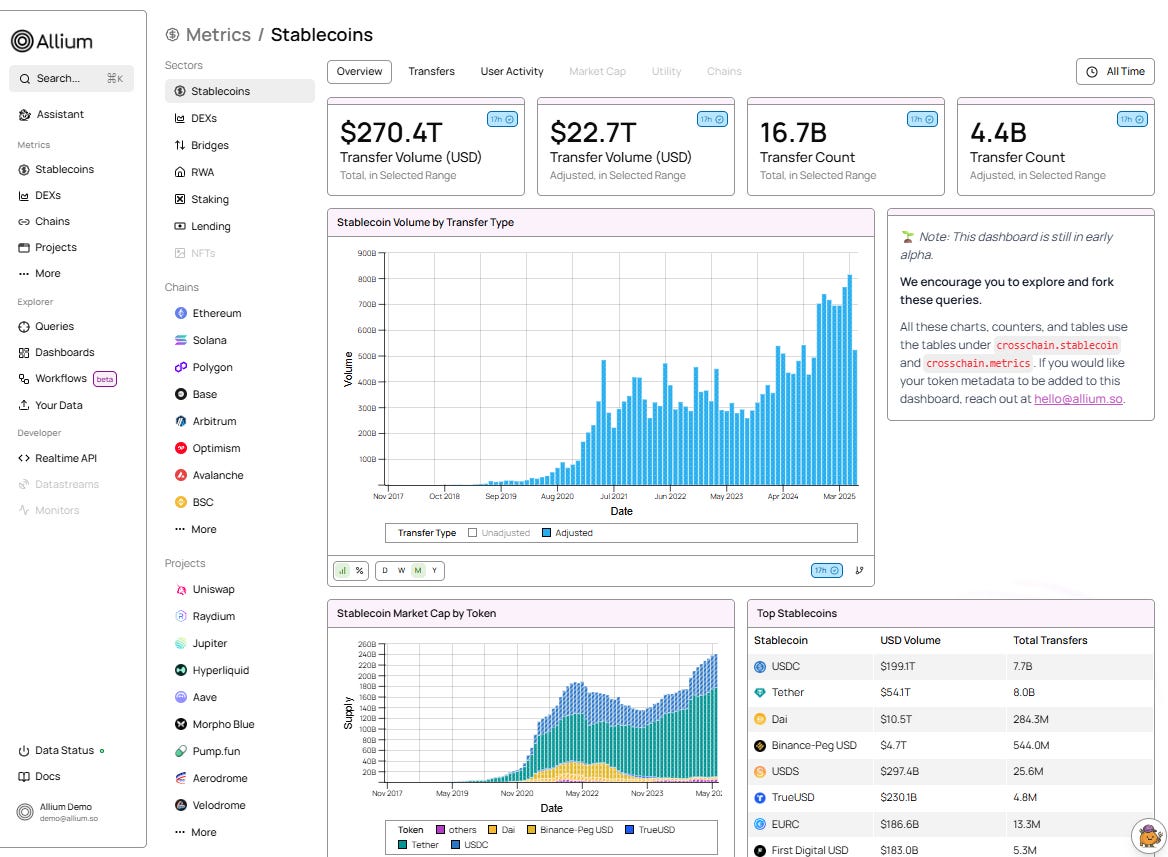

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides blockchain data and analytics for institutions and fintechs, helping teams generate key insights from on-chain activity. Leaders like Visa, Stripe, and Grayscale rely on Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

No, CBDCs aren’t “stabilizing forces”

Crypto: the White House report

Macro-Crypto Bits: tariff frenzy, FOMC dodging, GDP)

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

No, CBDCs aren’t “stabilizing forces”

Normally, I dismiss pieces put out by the Bloomberg Editorial Board because they tend to be narrow and out of touch.

But today they outdid themselves with an opinion praising the European Union’s digital euro initiative as the salvation of finance. The title alone is quite something: “Who Needs a Digital Euro? Everyone Who Uses Money”. I know that headlines are often chosen by editors for clicks, but in this case it does sum up the content. I mean, holy cow.

Here’s just a selection of the absurd claims:

“Deposits are obligations of banks, which may be too fragile to be reliable stewards of the currency.”

So, let’s siphon deposits away from commercial banks for the sake of greater security?

“If people struggled to use private euros and couldn’t get their hands on euros issued by the central bank, they could lose confidence in the currency.”

I can 100% confirm, as a European, that this is not something we think about at all. No consumer has ever wondered, “gee I would feel so much better about my grocery payments if I could use central bank currency”. Institutions prefer central bank money for large transfers, but they already have efficient access to that. Consumers want convenience, and even central bank-backed surveys show trust is declining.

“If they turned to alternatives such as dollar-denominated stablecoins, the ECB could lose control over monetary policy in the euro area.”

As if there weren’t dozens of alternative ways to combat this, without spending billions on developing a digital euro that consumers don’t want.

“By contrast, the mere existence of a central-bank digital currency — exchangeable for private money — would be stabilizing, even if hardly anyone used it.”

Leaving aside that there’s no guarantee it would be exchangeable for private money, the lack of use would be destabilizing, for the following reason: if the digital euro turns out to be unpopular (which it will), the ECB will have no choice but to pressure the EU to make its use mandatory – it can’t afford failure here. And if it becomes mandatory, more of us will turn to unregulated alternatives, increasing overall financial risk.

“If connected to other central-bank digital currencies, it could significantly reduce the cost and complication of cross-border payments, including remittances.”

Ugh, this is simply not true – the number of middlemen in a transfer to another CBDC jurisdiction may be lower, or it may not, it would depend on the design of each system, and it’s unlikely there will be global harmony here. There would need to be bilateral agreements in place, not to mention retail CBDCs the recipients want to use – also unlikely. Meanwhile, today anyone can use stablecoins to achieve the same effect.

“Users will access it through banks or other providers, with stricter privacy-protection standards than existing payment apps.”

Um, according to who? Ah yes, of course, the ECB.

“Offline transactions will provide a level of anonymity very close to cash.”

In theory, sure, but in application we would have to trust official assurances. And anyway, recent reports suggest they’re struggling to get this part to work.

“[The ECB] will also need to do more to gain the trust of potential users.”

By insisting they download a token designed by the very organization that has cost the banking sector billions in adaptation for a payment service that is not needed nor wanted?

“Much better to have a government-issued digital currency and not need it than to need one and not have it.”

That’s… naïve. “Not needing it” won’t be an option.

In sum, this editorial argues that the ECB should be supported in its attempt to push private participants out of the retail payments market, no matter how much economic damage this does to banks and fintechs. It also assumes that central bank mission creep is good for everyone, and insinuates that private enterprise can't be trusted. If this came from a German or French financial regulator, I wouldn't be quite as surprised - I for sure didn't expect it from the Bloomberg Editorial Board. I expected stewards of a US financial publication to understand why private enterprise should be allowed to compete for consumers, without state entities muscling into a market. The US cannot pass its anti-CBDC bill fast enough.

Crypto: the White House report

Back in January, just three days after his inauguration, President Trump created the President’s Working Group on Digital Asset Markets, to be led by Crypto & AI Czar David Sacks and staffed by a wide range of cabinet officials and agency heads. He tasked it with producing a report with recommendations for official policy regarding digital assets, and he gave it a deadline of 180 days. Yesterday, just a week late, it delivered.

It's a long report (166 pages!!), and I confess I’ve only skimmed it. But I caught enough to see that it’s a powerful roadmap. Of course there will be gaps and proposals that crypto lawyers, builders and investors will object to – but it establishes signposts on the road.