No, China is not banning tokenization

plus: confusion around collateral, crypto ETF flows, and more

“We have to encourage the future we want rather than trying to prevent the future we fear.” – Bill Joy ||

Hello everyone! I hope you’re all taking care of yourselves.

🥌

If you speak Spanish and are interested in a less frequent, shorter (and free for now!) update on developments in the crypto-macro intersection, you can subscribe to Cripto es Macro here.

🥌

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

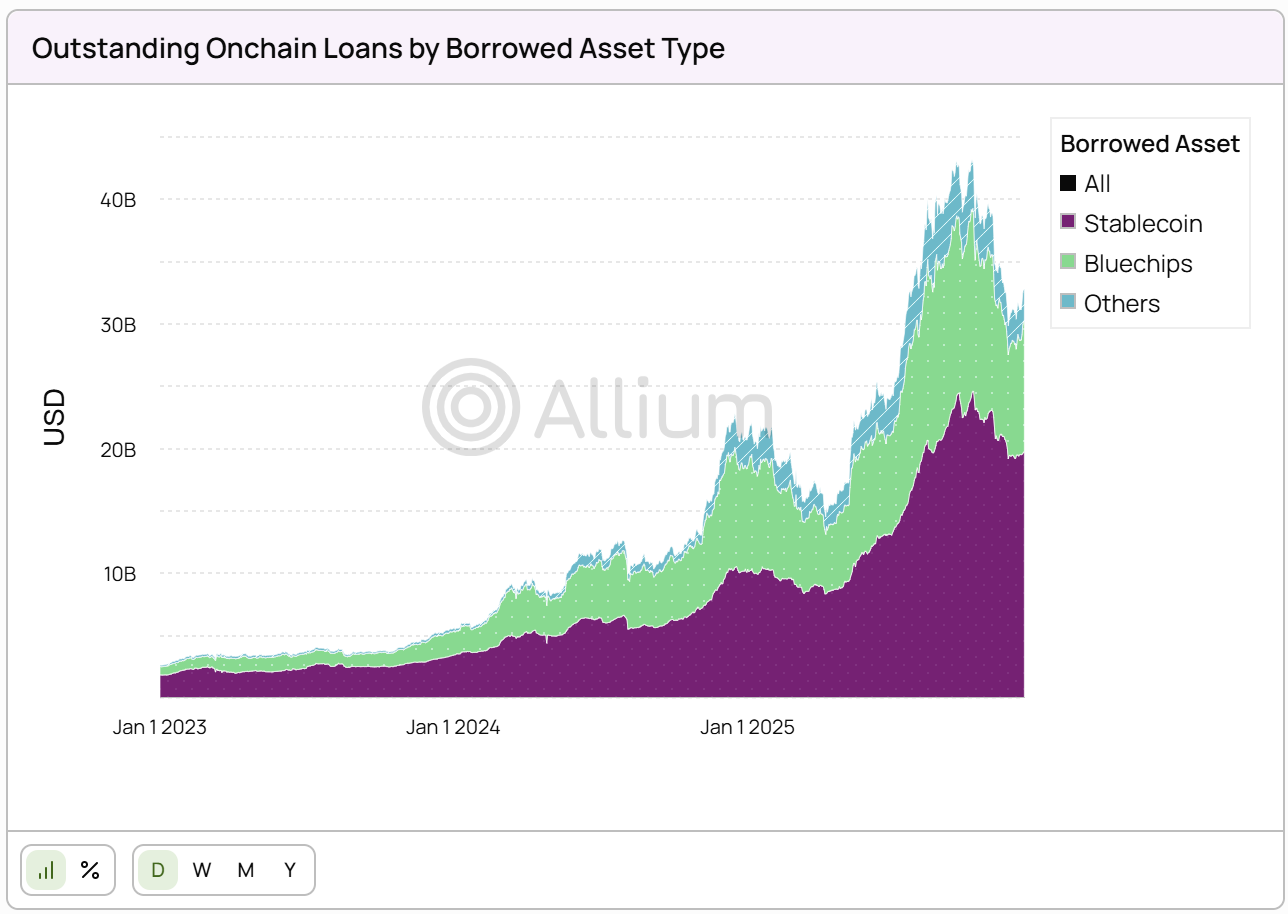

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets. Looking at the data, outstanding onchain loans reached over $40Bn this year, with stablecoins making up more than half of borrowed assets.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

No, China is not banning tokenization

Confusion around stablecoins as collateral

Markets: ETF flows

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes. Plus links, a music recommendation (‘cos why not?), and more.

If you’re a premium subscriber, thank you!! ❤

WHAT I’M WATCHING:

No, China is not banning tokenization

As if the crypto ecosystem wasn’t depressed enough, over the weekend reports emerged that China was banning both stablecoins and tokenization more broadly.

While the reports are not incorrect, they overlook the nuance in the official statement.

On Friday, Chinese authorities announced a clampdown on tokenization of real world assets both onshore and by overseas entities. The statement was signed by the People’s Bank of China, the China Securities Regulatory Commission and six other departments, so we know it carries weight.

On Sunday, China Daily (the CCP’s official English language media) offered the following summary:

“China has officially banned onshore activities related to real-world asset tokenization … as part of broader efforts by regulators to crack down on illegal activities, contain financial risks and impose clearer rules on emerging digital asset activities to safeguard financial stability.

Overseas RWA tokenization of domestic entities will also be subject to strict compliance requirements, a landmark move that will pave the way for regulated, risk-controlled digital asset innovation, analysts said.”

Note that the focus is on risks. This is in line with the authorities’ determination to dampen financial speculation, out of concern it could trigger social unrest and resentment – the country is still recovering from the damage of the real estate boom and bust of a few years ago.

The China Daily report quotes an official statement as saying:

“Speculative activities related to virtual currencies and RWA tokenization occurred from time to time, posing new challenges and new situations for risk prevention and control.”

It adds that fending off these risks is necessary in order to “safeguard national security and social stability”.

This is not a ban on all tokenization or stablecoin issuance, however. The official notice specifies that there are exceptions, such as activities with regulatory approval and those “conducted based on designated financial infrastructure”.

In sum, authorized tokenization is allowed. Unauthorized tokenization isn’t.

This should not surprise us. Nor is it an unreasonable stance. Even in the US, tokenizers have never been able to do whatever they want, not even under the current Administration.

And the risks carry a heavier weight in China. At the risk of generalizing, the Chinese do like to gamble – in part, it’s an ancient tradition as well as a reflection of the cultural respect for luck, and in part it’s a reaction to the lack of other get-rich-quick opportunities such as meme stocks and high-leverage derivatives.

And because Chinese savers have no problem with speculative bets, they often fall prey to scams – many of you probably remember the ICO craze of 2017, with stories about grandmothers getting scammed out of their pension because of an opportunity they heard about at the tea shop. The damage there triggered a national ban on ICOs.

What the authorities are doing is banning is tokenization they can’t control.

This is not about tokenization. It’s about speculation.

Only, there’s probably something else going on here as well, with potentially bigger picture impacts.

According to an expert quoted in the South China Morning Post, RWA tokenization schemes were also being used to move funds offshore. Given China’s strict capital controls, the authorities have to clamp down on outflow channels as they emerge.

This could be taken as proof that China does not want a tokenized market to emerge, as it would be too hard to control.

Or, it could be taken as a sign that China is working on regulated tokenization. In the 14th Five Year Plan (2021-2025), blockchain featured prominently as part of the financial modernization drive and the creation of “Digital China”. The 15th Five Year Plan (2026-2030) has less emphasis on blockchain and more on “digital finance”, but work has been ongoing on tokenized trade finance, interbank settlement and government services. Hong Kong – a separate jurisdiction, but one that wouldn’t do anything China didn’t approve of – has been one of the most active regions in the world in tokenized assets, and last November was behind the largest digital bond issuance to date (HK$10 billion, or US$1.3 billion). And in December, a leasing subsidiary of a Chinese bank issued a RMB 4.5 billion (US$640 million) digital bond settled in e-CNY.

Of course, all this work is carried out on permissioned blockchains, not public networks. We can’t count on China to encourage decentralized finance, given its priority of stopping capital flight and preventing excessive speculation.

But tokenization is not banned in China, despite what the headlines would have you believe. Unregulated tokenization is, but China is not alone in that.

Where it will stand apart is in its focus on domestic applications. China’s tokenization work is not about expanding markets, unlike other initiatives that emphasize the potential connectivity of blockchain networks and the “democratizing access” of tokenization. China’s blockchain work is about modernization and efficiency.

What’s more, it is well in the lead in terms of official support for industrial distributed ledger applications, while other markets focus on global payments and trading opportunities.

In the development of any new technology, different approaches will produce different outcomes. Since we’re talking about financial and industrial competitiveness, this will matter for the global realignment – yet another example of how crypto technologies impact geopolitics.

⛸⛸ If you find this newsletter at all useful, or even if you just like my excellent music recommendations, would you mind sharing it with your friends and colleagues, and nudging them to subscribe? I’d appreciate it! 😃⛸