No, the PBOC is not banning stablecoins

plus: what's ahead this week, market confusion, stablecoin issuance and more

“A crooked tree lives its own life, but a straight tree is turned into wood.” – Chinese proverb, allegedly ||

Hello everyone! I hope you all had a good weekend. We seem to have avoided any sharp moves in crypto markets, something to be grateful for.

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

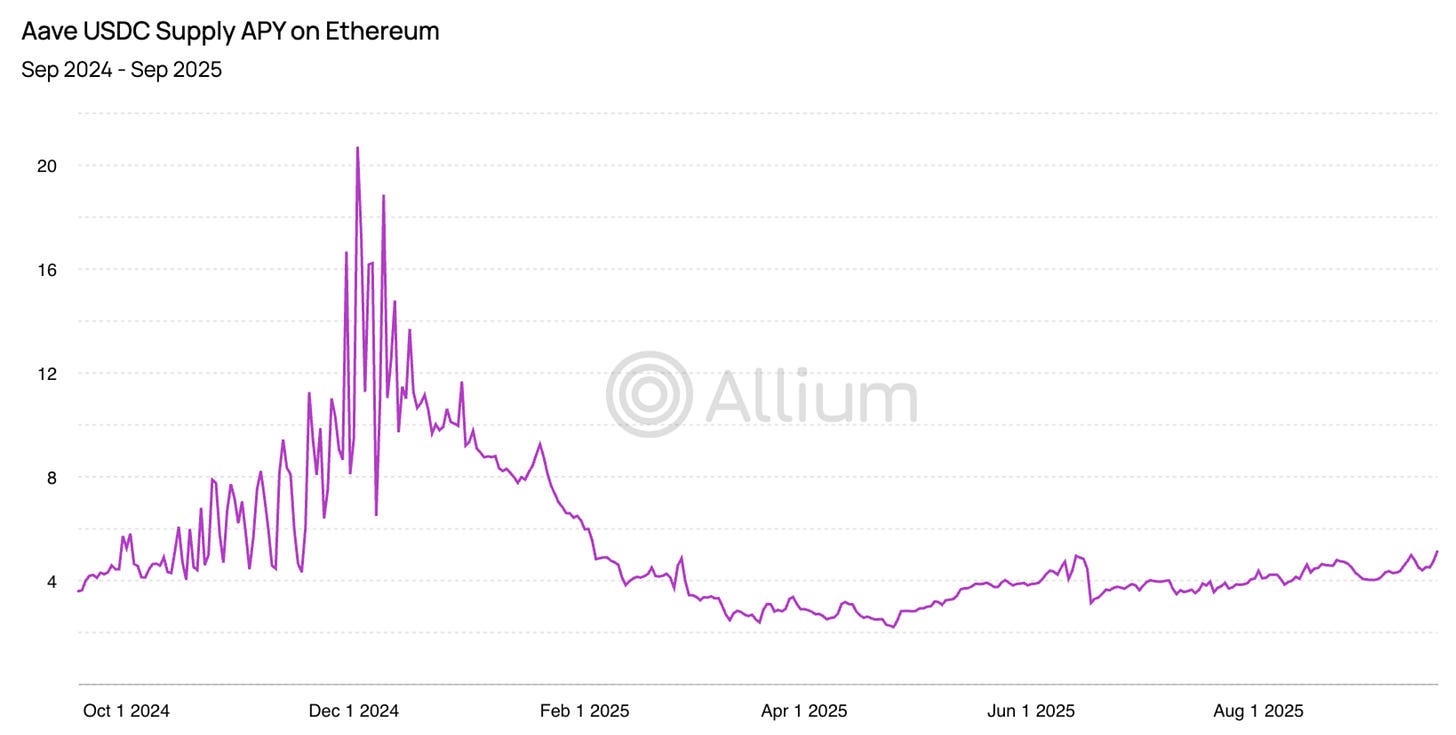

Allium provides vetted blockchain data to answer your hardest macro questions, like:

“How has the lending interest rate of USDC for Aave on Ethereum changed ahead of Fed rate cuts?”

Our data covers 100+ chains and is internally checked for accuracy every 5 minutes. We handle the pipelines and edge cases so you can uncover insights faster with a single, verified data source. Teams like Visa, Stripe, and Grayscale trust Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

Coming up: Fed conference, CPI, earnings, elections, big meetings and more

No, the PBOC is not banning stablecoins

Macro-Crypto Bits: markets confused, China’s growth

Also: FIFA tokens, Japan’s stablecoin consortium, Stripe’s bank and more

WHAT I’M WATCHING:

Coming up:

We’re in for a big week, despite the lack of official US economic data (with one notable exception) given the government shutdown.

Monday sees the start of China’s Fourth Plenum, which will present the outline of the 15th five-year plan (with more detail coming in March 2026). I’ll be looking out for clues as to its policies regarding internationalization of the yuan (see below), and any hint of the internal importance of its CBDC. The talks and speeches go on until Thursday.

We also get the US Conference Board leading index for September.

And Zions Bancorp reports earnings, which will be scrutinized for signs of additional stress after last week’s disclosure of an extraordinary $60 million loss due to “apparent misrepresentations and contractual default” on two loans.

On Tuesday, the US Federal Reserve hosts a conference on payments, with panels on bridging traditional finance and digital asset ecosystems, stablecoin use cases and tokenized products. Speakers include CEOs and other senior executives of crypto firms Coinbase, Circle, Chainlink, Paxos, Fireblocks as well as many tradfi firms working in the tokenization space. It will be broadcast live, you can find the agenda and the relevant links here.

And the Japanese Parliament will vote on the country’s next prime minister.

On Wednesday, Senate Democrats are hosting a crypto roundtable with CEOs from Coinbase, Galaxy, Kraken, Uniswap and Chainlink, as well as other key sector representatives.

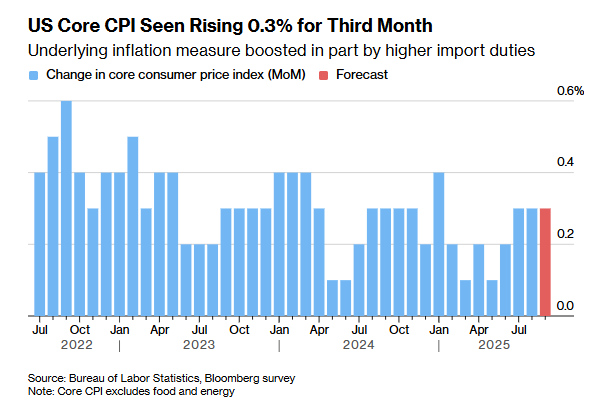

And on Friday, we get the big economic data point of the month: US CPI for September, released later than usual because of the shutdown – workers were called in to prepare this report as it is essential for the calculation of next year’s cost-of-living adjustments for Social Security recipients.

(chart via Bloomberg)

On Saturday, unless tempers flare or schedules change, US Treasury Secretary Scott Bessent is due to meet with Chinese Vice Premier He Lifeng in Malaysia.

Sunday sees the kickoff of the annual Association of Southeast Asian Nations (ASEAN) Summit, with world leaders including President Trump converging on Kuala Lumpur for three days of trade, economic and strategy talks.

No, the PBOC is not banning stablecoins

Yesterday, the Financial Times reported that at least two mainland companies that had announced plans to issue stablecoins under Hong Kong’s legal framework – JD.com and Ant Group – have withdrawn their applications at the behest of the People’s Bank of China (PBOC).

At first glance, this looks like an official clampdown on yuan stablecoins. It’s not.

According to multiple sources, the government is concerned about tech companies issuing currencies. Note that this concern is not specific to China – even in the supportive US framework, tech companies need to jump through hoops to get special approval. But in China, it takes on a more systemic interpretation, given the role of the leading tech platforms in citizens’ daily lives. On the Alipay app (operated by Ant Group), to pick an example, users can do, well, just about anything, from shopping to medical appointments to buying stocks to finding a date to getting a ride. Imagine the power of an Alipay stablecoin.

But wanting to stop tech companies from issuing currency is not anti-stablecoin. Rather, the PBOC wants to make sure it can control their issuance and use.

Over the weekend, the China Daily – a media outlet owned by the Chinese Communist Party (CCP) and its main international mouthpiece – gave some colour as to how “China’s accelerating drive of finance digitalization” was progressing and evolving.

The article quotes Zhu Xiaoneng, Party secretary of the School of Finance at Shanghai University of Finance and Economics, as saying: “digital assets and stablecoins will redefine the logic of capital market operations.” He went on to stress the advantages of tokenization, insisting that “stablecoins are the key to unlocking this new ecosystem.”

It’s worth repeating that this was published in the party’s English language media outlet. That doesn’t sound anti-stablecoin to me.

And in recent months, we’ve have a handful of current and former officials warning of increased dollarization via USD stablecoins, as well as reports from “insiders” on PBOC plans to establish a framework and targets for stablecoin use.

Today saw the kickoff of China’s Fourth Plenum, which will outline the main themes of the next Five Year Plan. One of them is expected to be a deeper push into digital technology. Another is likely to be greater internationalization of the yuan.

Just last week, Chinese authorities announced support for greater yuan use as a financing currency for foreign institutions, which would facilitate payment of cross-border trade in renminbi.

And three weeks ago, the deputy governor of the central bank unveiled three platforms to encourage use of the digital yuan in cross-border payments, one of which focuses on adoption of the central bank-issued digital currency.

The other two seem to leave the door open, or perhaps slightly ajar, to other digital currencies. One is a blockchain service platform for onchain payments and cross-chain interoperability. The other is a digital asset platform that will connect traditional finance to standardized digital asset services.

Of course, any stablecoins would need to be fully interoperable with the digital yuan, but it’s possible that the authorities realize the additional flexibility and perhaps international trust that bank-issued stablecoins could bring. Given the control of the CCP over the country’s financial system, these technically wouldn’t be totally private – but choice, even if controlled, can boost acceptance while enhancing innovation.

In sum, the PBOC caution reported in the Financial Times doesn’t represent a retreat or a clampdown. In fact, I think it shows an encouraging determination to support stablecoins and tokenization in a careful manner, shifting focus away from pilots and technical experimentation to institutional integration.

The China Daily piece quotes Zhu as saying:

“Digital finance in the future will be defined not just by technology, but by institutions.”

Put differently: tech companies, take a beat. The banks have got this.

See also:

China’s evolving crypto policy (Jan 2025)

If you find this newsletter useful, or even if you just like my music recommendations, would you mind sharing it with colleagues and friends and nudging them to subscribe? 😁 I’d appreciate it!