Onchain capital raises: the market trend I’m waiting for

plus: global crypto adoption, Japan's CPI, mixed market messages and more

“Unless someone like you cares a whole awful lot, nothing is going to get better. It’s not.” – Dr. Seuss ||

Hi all, and happy Friday!!!

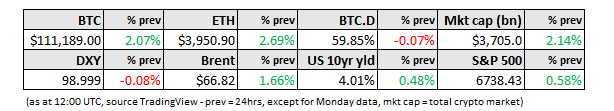

And happy CPI day. 😝 We could see fireworks later, as it’s the first official US data point we’ll have had in a while. Or, it could be a nothingburger if all comes in as expected. Oh, the suspense.

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides vetted blockchain data to answer your hardest macro questions, like:

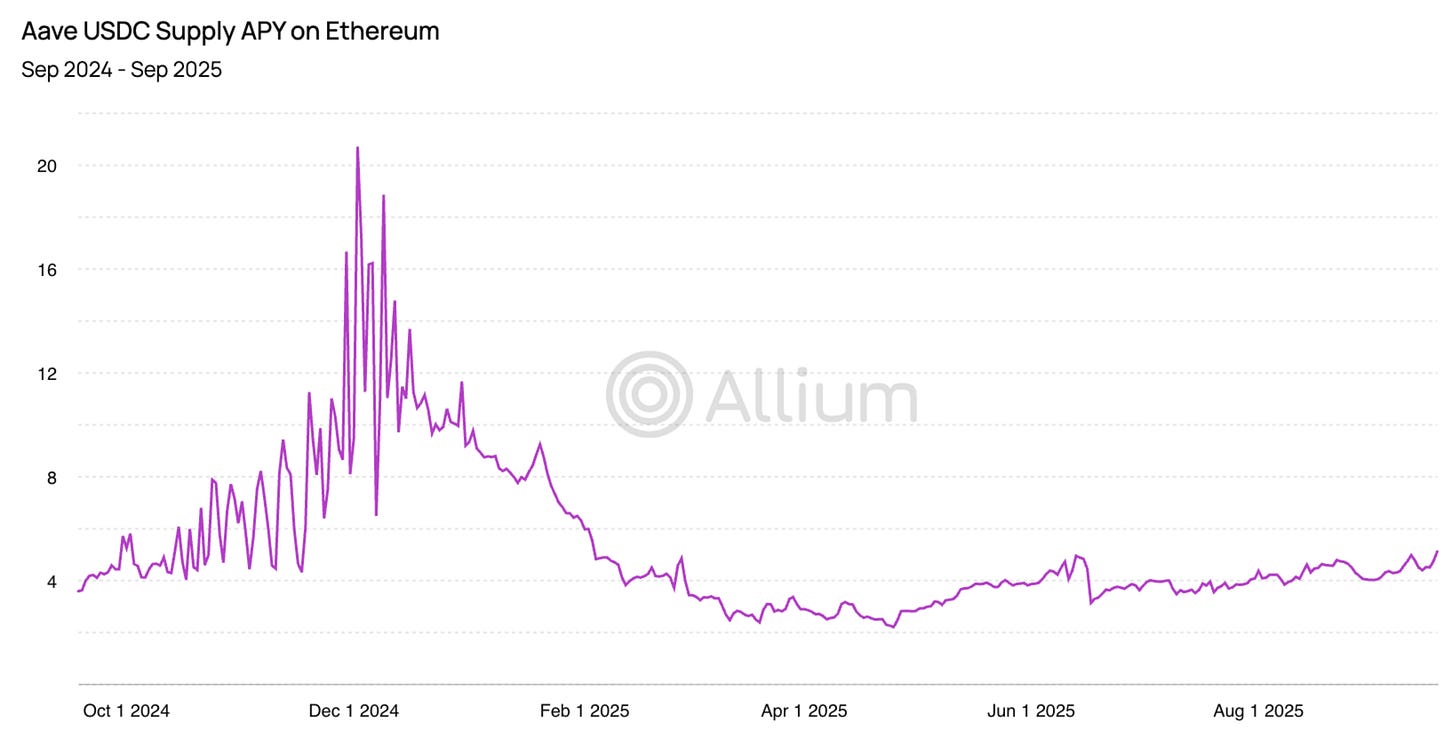

“How has the lending interest rate of USDC for Aave on Ethereum changed ahead of Fed rate cuts?”

Our data covers 100+ chains and is internally checked for accuracy every 5 minutes. We handle the pipelines and edge cases so you can uncover insights faster with a single, verified data source. Teams like Visa, Stripe, and Grayscale trust Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

Onchain capital raises: the market trend I’m waiting for

Global crypto adoption

Macro-Crypto Bits: markets, Japanese inflation, European growth, currency arbitrage

Also: prediction markets (again!), tariff spats (again, sigh), legacy funds and more

WHAT I’M WATCHING:

Onchain capital raises

Yesterday, I briefly mentioned Coinbase’s announcement that it had reached an agreement to buy fund raising platform Echo for roughly $375 million. This move is worth looking at more closely, for what it says about where markets are heading.