Permissioned stablecoins: why?

plus: Japan, stagflation, markets, IPOs, staking and more

“The pessimist complains about the wind; the optimist expects it to change; the realist adjusts the sails.” – William Arthur Ward ||

Hello everyone, I hope you’re all doing well!

Here in sunny Madrid, I’m fantasizing about retreating to a lonely Mediterranean island with barrels of coffee and not resting until I have gotten to grips with every single major macro/stablecoin/tokenization/regulatory/adoption development from the past couple of months. Only 1) that island doesn’t exist and 2) it would probably take me until Christmas. So, over the next few days I’ll be working down my list, tackling the backlog as much as my daily word and hour limits allow.

Programming note: this newsletter will skip publication on Friday, but I’ll be back with the free weekly on Saturday.

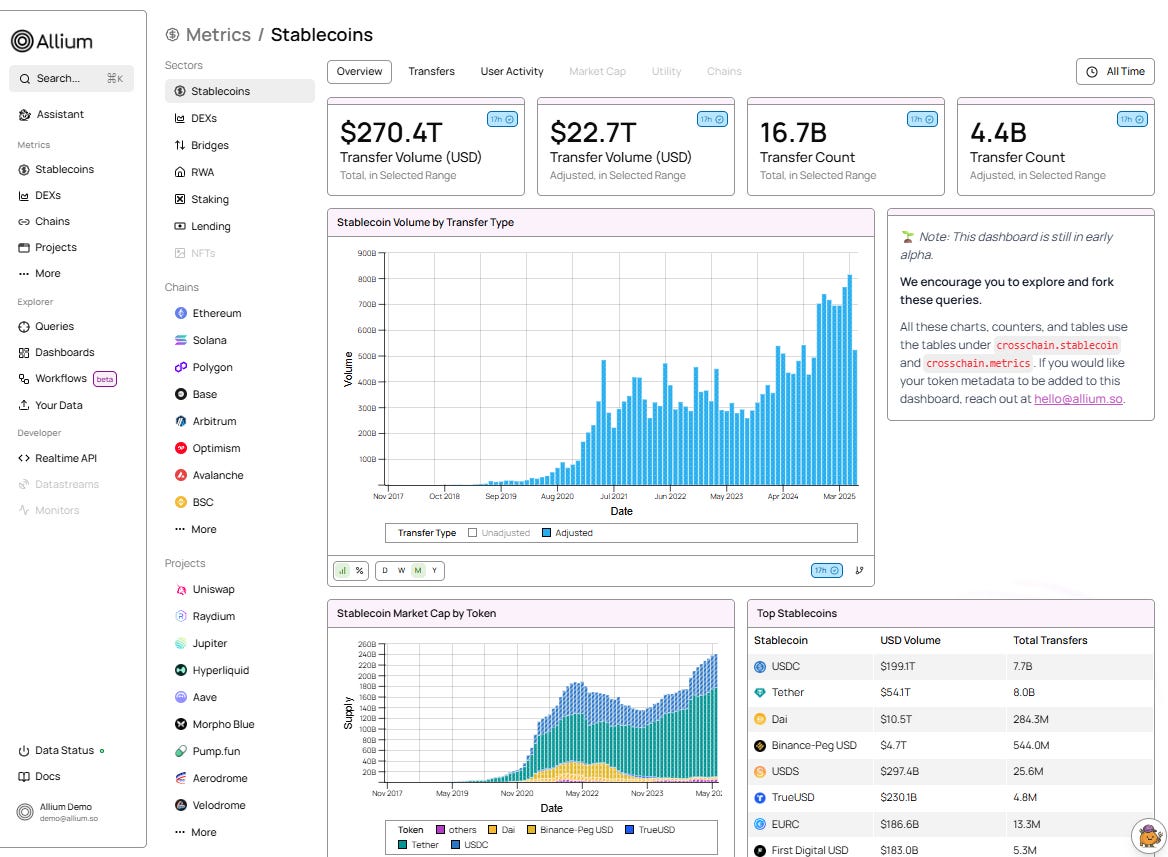

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides blockchain data and analytics for institutions and fintechs, helping teams generate key insights from on-chain activity. Leaders like Visa, Stripe, and Grayscale rely on Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

Permissioned stablecoins: why?

Macro-Crypto Bits: Japan, stagflation, IPOs, markets, staking

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

Permissioned stablecoins: why?

It turns out that $126 billion AUM asset manager WisdomTree has a stablecoin, and I have to confess I didn’t know that. WUSD launched quietly a couple of years ago to make transactions within the retail-facing WisdomTree Prime app more efficient – users could convert dollars into the WisdomTree dollar token on Stellar, and use this to buy any of the available digital assets; they could receive proceeds from a sale in WUSD to more easily swap into another asset; and they could also elect to get dividends distributed in the dollar token.

A couple of weeks ago, WisdomTree announced an expansion of its stablecoin plans: WUSD has rebranded to USDW, and will soon be operative on other blockchains. The platform now allows users to onramp and offramp with other stablecoins, specifically USDC and PYUSD. Put differently, retail users can send USDC or PYUSD to the WisdomTree app and convert it into USDW for use within the ecosystem, and can reverse the operation to exit the app. (Buying WisdomTree tokenized assets with other stablecoins was, if I understand correctly, already an option for institutional clients.)

It’s always worth asking why any financial application needs a blockchain. At first glance, WisdomTree’s tokenized assets and stablecoin only operate within the digital app, so any transfers could be seamlessly handled via centralized adjustments to the ownership ledger.

And, on top of the considerable development expense, the operational cost advantages for WisdomTree are not obvious given that ownership records are kept onchain as well as in traditional book entry form.

But here is why I think this is not just a blockchain-for-the-headline plan, why the blockchain investment makes strategic sense: