Powell pivots, markets shift, macro moves

plus: NVIDIA, Germany, Intel, prices and more

“If something cannot go on forever, it will stop.” – Herbert Stein ||

Hello everyone, I hope you’re all doing well! I had an AMAZING time in Hungary, absolutely love Budapest (had never been!), and I can’t remember the last time I danced so much. It’s good to be back, though. I gather stuff happened while I was away.

To all my UK readers, I hope you have a great bank holiday.

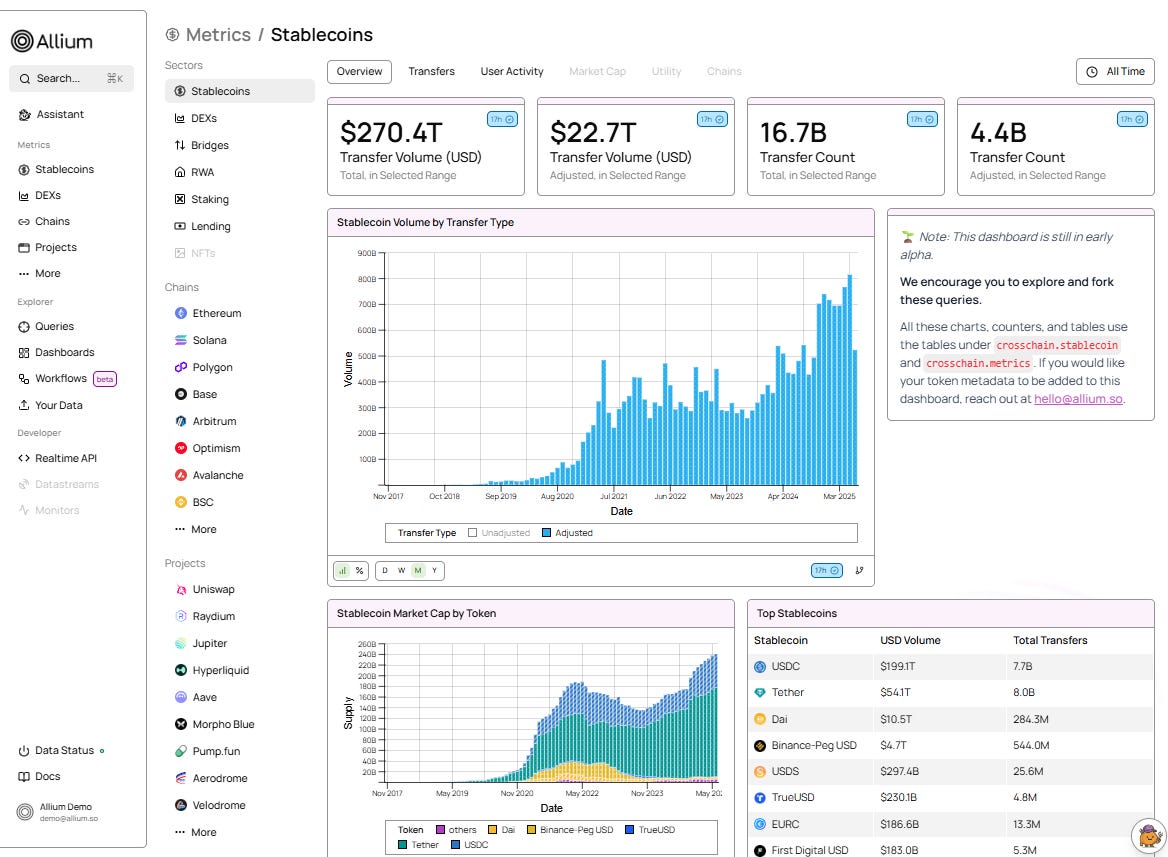

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides blockchain data and analytics for institutions and fintechs, helping teams generate key insights from on-chain activity. Leaders like Visa, Stripe, and Grayscale rely on Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

Coming up: inflation, NVIDIA, SCO summit, GDP, sentiment

Powell’s pivot?

Macro-Crypto Bits: ETH all-time high, stock valuations, Fed minutes, PMIs, global shifts and more

Global shifts: a new section on big-picture details

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

Coming up this week:

We have a relatively quiet week ahead (she says hopefully), with the UK on holiday today and the US gearing up for Labor Day weekend. The big macro events will be PCE inflation out on Friday, but that rarely produces sharp surprises, and NVIDIA earnings on Wednesday, which just might. In geopolitics, all eyes will be on the Shanghai Cooperation Organization summit which kicks off in Tianjin over the weekend.

Today, South Korea’s President Lee Jae Myung meets with President Trump at the White House – will we see even more commitments to invest billions in the US? I still think these promises make good headlines but don’t mean much when it comes time to hand over money.

Tomorrow, we get the latest US Consumer Board confidence indicators for August, expected to show a slight weakening but not to crisis levels.

We also get US durable goods orders, although this will still be hard to read given the pre-tariff acceleration.

On Wednesday, the 50% tariff on goods coming from India is due to take effect, unless there is an extension.

And NVIDIA reports earnings – given the company’s size and relevance in the AI race, this is now as much a macroeconomic event as a company announcement. (More on this below.)

On Thursday, we get the final read of US Q2 GDP – the preliminary report last month came in at a higher-than-expected 3.0% annualized, which is pretty good.

We also get the noisy weekly unemployment claims data, which is taking on more of a protagonist role now that Fed watchers pivot to obsessing about the US job market (more on this below).

And Bitcoin Asia 2025 kicks off in Hong Kong.

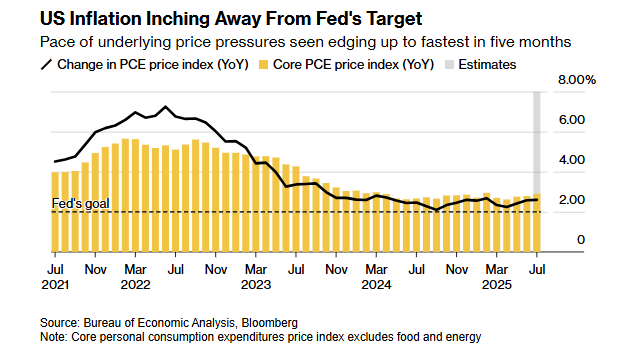

Friday brings the week’s other big macro event: US Personal Consumption Expenditure, the Fed’s preferred inflation gauge. Both the July headline and core (ex-food and energy) indices are expected to hold June’s increase of 0.3% month-on-month. Year-on-year, the core index increase is expected to accelerate slightly to 2.9% from 2.8% in June.

(chart via Bloomberg)

We also get the final University of Michigan consumer confidence read for August – the preliminary report showed inflation expectations picking up again, while sentiment measures weakened slightly.

Finally, Saturday brings the big geopolitical event: the Shanghai Cooperation Organization (SCO), the Eastern response to NATO, kicks off its annual summit in the Chinese city of Tianjin. This will be the largest gathering hosted by the SCO since its foundation in 2001, with China’s President Xi Jinping welcoming leaders from Russia, India, Iran, Pakistan, Turkey, Malaysia, Kazakhstan, Vietnam and many other affiliated states, as well as the heads of the UN and ASEAN.

Powell’s pivot?

On Friday, Fed Chair Jerome Powell surprised the market by hinting that he might actually support a rate cut at the FOMC meeting in September. He is widely regarded as being more cautious than many other committee members and I had thought that, given the public pressure he is under from the US president, he would go out of his way to not say anything about rates at all.

I was wrong. After a standing ovation from all present, Powell reminded the audience that there were still strong risks to inflation, but that the impact from tariffs was likely to be “relatively short-lived”. Even more relevant, he said that “downside risks to employment are rising”, which could “warrant adjusting our policy stance”. Boom. But a muffled one.

The market took this as confirmation a cut was coming in September. Bond yields and the DXY dollar index dropped sharply…