Predictions: a temporal twist

Plus: the 2026 list and the 2025 scorecard

“And now we welcome the new year, full of things that have never been” – Rainer Maria Rilke ||

Hello everyone, and HAPPY NEW YEAR!!!!! I hope you were able to spend some time over the holiday season on thoughtful introspection and optimistic projection, or perhaps simply being grateful for the days.

This is an “in-between” email with a slightly different format, as in my household the seasonal festivities are not yet over. Below, I share my predictions for 2026, both with a temporal twist and without – and, reluctantly but in the spirit of accountability, I reveal how I did with my 2025 list.

✨✨

Production note: I will publish the free weekly tomorrow, but have to skip January 5th and 6th (Epiphany is a big deal in my extended family, and the Cabalgata – the procession of the three kings as they arrive in Madrid – is a cherished tradition). Back to normal scheduling on the 7th!

✨✨

My latest op-ed on American Banker shares how I think stablecoins will shape banking over the coming year (paywall, sorry!) – “Stablecoins will be a key element of banking infrastructure in 2026”

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

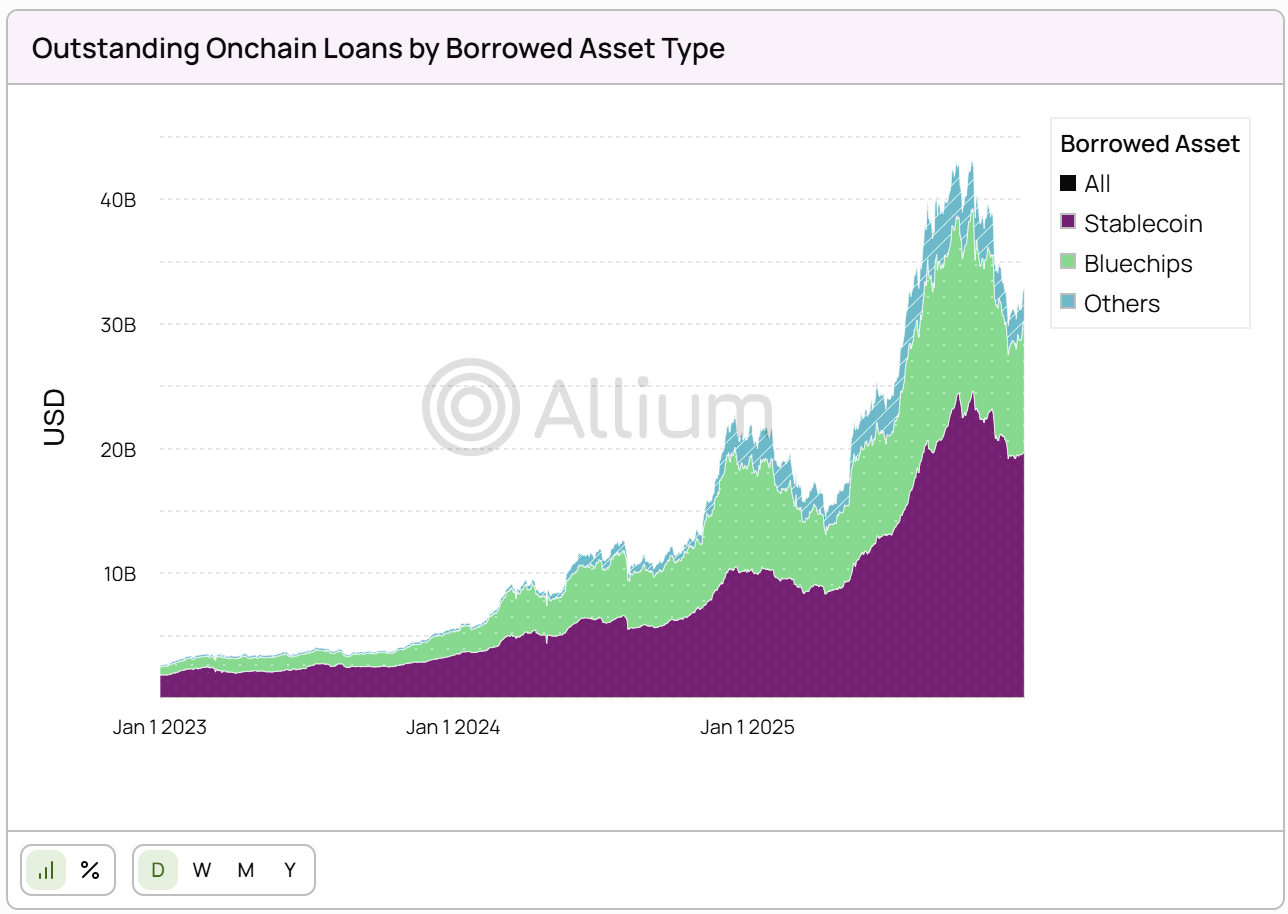

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets. Looking at the data, outstanding onchain loans reached over $40Bn this year, with stablecoins making up more than half of borrowed assets.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

Predictions: a temporal twist

2026 Predictions

The 2025 scorecard

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes. Plus links, a music recommendation (‘cos why not?), and more.

If you’re a premium subscriber, thank you!! ❤

Predictions: a temporal twist

By now, you have no doubt had your fill of 2026 predictions, and are well aware of how they are no more than a fun intellectual exercise that wraps experience, extrapolation, hopes and fiction up in a festive bow for seasonal enjoyment. I don’t mean to sound cynical – I enjoy the exercise as much as the next person, but I confess I don’t extract actual meaning from them beyond a deep appreciation for the sharing of ideas and the erection of signposts. The 2025 scorecards tend to be much more inspiring and illuminating in that they remind us of our biases and blind spots, how no-one knows what’s coming, and that we’re all figuring this out together.

So, in that spirit, below I share my list for 2026, keeping it brief. I also humbly offer my 2025 scorecard (mixed). But before I do that, I’m going to do something that feels more practical and that I haven’t seen others do: offer some six month predictions.

See, it’s actually easy to come up with predictions so far ahead: it’s almost impossible to imagine what the world will be like a year from now, which makes it easier to project just about any tech-related scenario that fits our priors. And no-one realistically expects them to land. I’m happy to put my longer-term blindfold dartboard throws in writing and end up being wildly wrong on most as I understand that’s the nature of the seasonal game (and it is kinda fun). But these predictions mean little.

While still a roll of the dice, it’s much easier to imagine ourselves and our surroundings on a closer date, say June 30th. Largely, this is due to reduced possibility overwhelm. It’s not a stretch to imagine tomorrow, even though we know that anything could upend our situation between now and then – statistically, the probability of a major change is low. But 365 tomorrows?

If each day is a possible fork in the road for geopolitics, macro, crypto and more, then a large number of forks becomes meaningless. Fewer forks means the potential divergence from trends is orders of magnitude lower – think of fractals (with each fork having other forks), and you get an idea of just how much.

✨✨

So, where will markets and development be on June 30th?

Even that shortened timeframe can overwhelm with possibilities as well as trend bias, so my preferred approach requires an imagination flex: it’s June 30th – where are crypto and macro now?