Project Crypto: Even more than expected

plus: market jitters, catalysts, VIX, tariffs, PCE, jobs

“It does not do to leave a live dragon out of your calculations, if you live near him.” ― J.R.R. Tolkien, The Hobbit ||

Hi all, and happy Friday! Welcome to August!

Wow, on so many levels – yet another big news day, to put it mildly, and apologies for the late send. The firehose so far this summer has been epic. You know, a few slow news days (remember them?) would really help me tackle my backlog. Just sayin’.

I did want to write about Hong Kong’s stablecoin law, which goes into effect today, but I have run out of space and time. Sigh, Monday then.

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides blockchain data and analytics for institutions and fintechs, helping teams generate key insights from on-chain activity. Leaders like Visa, Stripe, and Grayscale rely on Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

Project Crypto: Even more than expected

Macro-Crypto Bits: market jitters, catalysts, VIX, tariffs 😩, PCE, jobs

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

Project Crypto: Even more than expected

Just amazing. Hard on the heels of the President’s Working Group crypto report released on Wednesday, yesterday we heard from SEC Chair Paul Atkins on his expectations for market reform. They are deeper and broader than most of us expected or even dared to hope for.

Regular readers will know that I got into this industry back in 2014 out of interest in marketplace evolution, and that I’ve been saying for ages the US has a lot of catching up to do in the exploration of tokenization. I’ve also argued hopefully that digital asset progress in other regions such as the Middle East and Asia will encourage the emergence of a multipolar world in terms of securities market hegemony, which in turn will have an impact on where innovation flourishes.

That thesis got overturned yesterday. We knew that the US would eventually get around to rethinking outdated securities laws to allow for greater experimentation in not just tokenization but also onchain issuance. I confess I didn’t expect it to happen so quickly, or with such thoroughness. I also confess, I couldn’t be happier to be wrong.

Yesterday, Chair Atkins gave a speech introducing “Project Crypto”, an SEC commitment to “swiftly develop” proposals to implement the recommendations in the White House crypto document released the day before.

This involves drafting “clear and simple rules of the road for crypto asset distributions, custody, and trading for public notice and comment.” It involves “using interpretative, exemptive, and other authorities to make sure that archaic rules and regulations do not smother innovation and entrepreneurship in America.”

Those sentiments may sound familiar, but Project Crypto is more than the encouraging statements we’ve heard so far – it gives them substance and clarity. The commitment is gob-smacking in the scope of its embrace of new market technologies, and outlines an acceleration of the pace at which the boundaries between traditional and new markets are blurring:

“Many of the Commission’s legacy rules and regulations do not make sense in the twenty-first century—let alone for on-chain markets. The Commission must revamp its rulebook so that regulatory moats do not hinder progress and competition—from both new entrants and incumbents—to the detriment of Main Street.” (my emphasis)

Atkins outlined four main areas of focus, each of which are long-standing pain points for crypto builders and investors everywhere.

1) Crypto asset distributions. Atkins wants to “bring crypto asset distributions back to America”, and has asked his team to set guidelines for all types of onchain distributions including tokenization, ICOs, airdrops and rewards. In complete contradiction to the previous SEC, Atkins declared that “most crypto assets are not securities”, but clear rules are needed to determine which are, and how they could “flourish within American markets”.

2) Choice in custody services. Atkins has asked staff to work on adapting the existing web of rules to facilitate greater user-centric choice, including self-custody which he considers “a core American value”. He acknowledges that current custody regulations just don’t work for crypto assets.

3) Service flexibility. Not only does Atkins believe that custody should not have to be separate from trading, he wants to remove rules that channel types of trading into narrow licenses. There’s no reason, he argues, that non-security crypto assets shouldn’t be able to trade on the same platforms as security crypto assets. And he wants this to extend beyond the SEC’s authority to include CFTC-regulated services and platforms.

4) Decentralized finance. Although he prefers to call them “onchain software systems”, Atkins has directed staff to update regulations in order to encourage the use of decentralized finance (DeFi) applications in financial markets. The SEC should not, he argues, “interpose intermediaries for the sake of forcing intermediation where the markets can function without them”. He advocates for a reworking of Reg NMS, a broad market access and order execution framework that he dissented against when it was enacted in 2005: his objections back then included the overbearing and limiting nature of market structure uniformity, the unnecessary complexity and the redundant regulatory costs. Now, he is proposing a rethink that removes distortions and supports innovation.

This last point for me is the most jaw-dropping. Atkins is essentially saying that current market regulation will be totally rewritten, that DeFi will be a feature of financial markets, and that he’s not going to wait around for the CLARITY Act to pass Congress before amending archaic rules.

When you combine the potential of greater DeFi use with more flexible markets and with greater encouragement for tokenization and onchain issuance of a range of asset types, you are looking at an almost unrecognizable market landscape. Of course there will be new risks; but the speed at which financial innovation can now build on itself should deliver sufficient opportunity and efficiency to warrant easing up on the brakes.

I know I’ve often said that finance evolves slowly, as it should given its systemic nature.

But when surrounded by radical change anyway, in politics, trade and centres of influence, arguably the biggest risk is losing the competitive edge of size.

And new innovation in US markets will boost markets everywhere, not just because market regulators in many other competitive jurisdictions are likely now to follow the SEC’s example. It’s also because funds flow to opportunities wherever they may be, and the more to choose from, the better for all.

Macro-Crypto Bits:

This section offers brief comment on some of the news items I’ve seen today that are relevant for the macro and crypto narratives I talk about. I’ll try to keep this short, but there is SO MUCH going on.

Markets: watch the VIX

Sentiment has taken a hit.

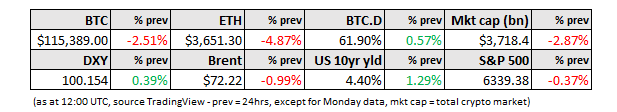

Yesterday’s S&P 500 action was unusually choppy, with a strong open on the back of signs of economic resilience more than wiped out during the course of the day. And futures are pointing to a bad US open.