Rates expectations don’t make sense

plus, mainstream crypto acceptance is pivoting fast

“There is a crack in everything, it’s how the light gets in.” – Leonard Cohen ||

Hello everyone, I hope you’re doing well! It’s hard to believe the US election was just one week ago… feels like months.

Today I share some bits and pieces that highlight just how fast things are changing.

I also have to mention some market craziness I’m seeing.

No audio today, as it would be a very clunky read given the format and number of charts.

If you’re frustrated that most of the past couple of weeks have been very markets-heavy, stay with me! I have got some thoughts on stablecoins, Tether and tokenization ready to share, but the mood shift has felt more timely - these are unique market moments.

IN THIS NEWSLETTER:

Happening fast

Rates expectations don’t make sense

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as audio, relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

Rates expectations don’t make sense

After yesterday’s US CPI print that showed sticky inflation – core CPI growth remained steady, but the headline index growth accelerated – I really thought rates expectations would moderate.

They did the opposite.

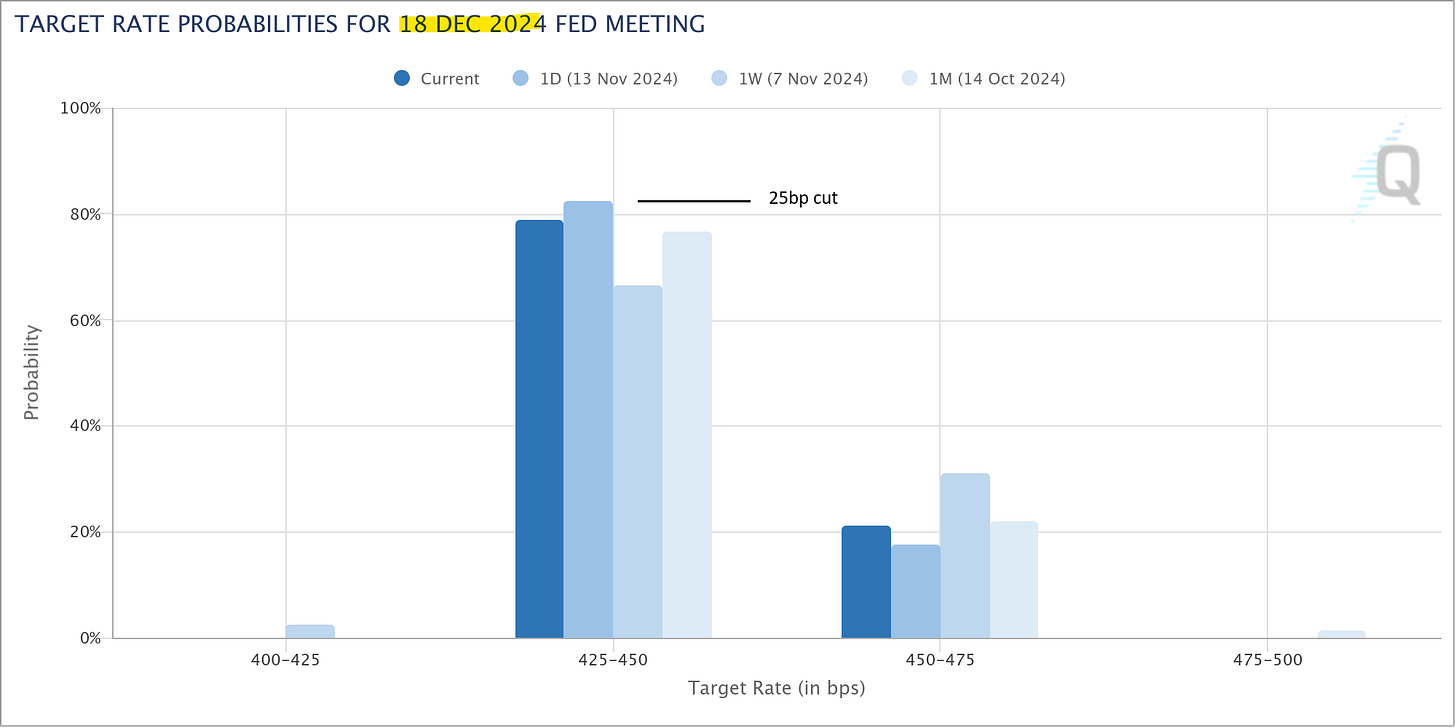

The CME-priced odds of another 25bp cut in December went up from around 65% to over 80% – this has since moderated, but only ever so slightly.

(chart via CME FedWatch)

This is bewildering. I did not see anything in yesterday’s data to suggest a greater likelihood of another rate cut before the end of the year.

We haven’t seen any disinflation in either the month-on-month or year-on-year data since June.

(chart via Bloomberg)

Supercore inflation, which strips out energy, food and housing (to get a services-based index, more sensitive to wage inflation) came down on a month-on-month basis, but year-on-year it ticked up, and stubbornly remains above 4%.

(chart via Bloomberg)

Plus, if you listen carefully, you can hear the scramble of economists rushing to lift their October PCE inflation estimates, already expected to show upticks. Today’s US October Producer Price Index data, a measure of wholesale inflation which feeds into the PCE calculation, came in notably higher than consensus forecast, which was already notably higher than September’s figures.