Roundup: big stablecoin moves

plus: Kevin Warsh, a gold freak-out and more

“Now, here, you see, it takes all the running you can do, to keep in the same place. If you want to get somewhere else, you must run at least twice as fast as that!” – The Red Queen, Lewis Carroll ||

Hi all! Wow, January in the bag… What an exhausting month. But it feels like it was just a warm-up. Yikes.

❄

A late send today, apologies - this one is long as I offer the monthly stablecoin development roundup, and I didn’t want to bump anything until Monday.

❄

My op-ed in American Banker this week (paywall!) suggests that branded stablecoins are kinda like loyalty points, and are poised to usher in a further breaking down of traditional “money” definitions. “Stablecoins could boost the utility of customer loyalty programs”

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

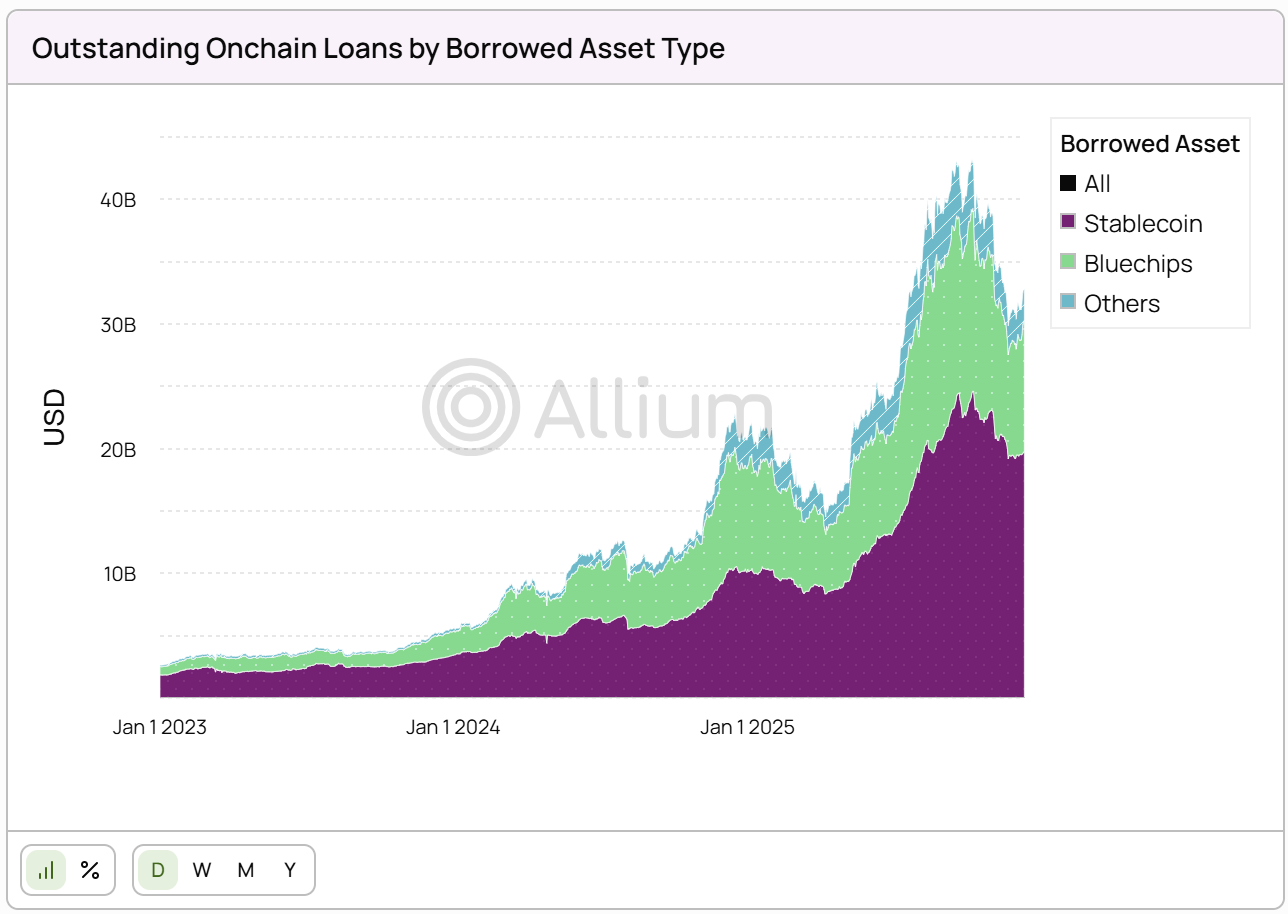

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets. Looking at the data, outstanding onchain loans reached over $40Bn this year, with stablecoins making up more than half of borrowed assets.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

Stablecoin roundup:

big moves from the past month in stablecoin issuance, infrastructure development, deposit tokens and adoption

So it’s Kevin Warsh

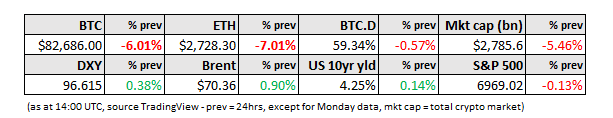

Markets: whoa

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes. Plus links, a music recommendation (‘cos why not?), and more.

If you’re a premium subscriber, thank you!! ❤

WHAT I’M WATCHING:

Stablecoin roundup

We’ve hit the end of the month so, as promised, I’m restarting the monthly look-backs at key developments in certain segments of the crypto-macro overlap. First up is – of course – stablecoins, with tokenization, CBDCs and regulation on their way. My aim is to extract the moves that matter from the daily noise, and to sketch out development trends and overlooked narratives.

Here goes:

New stablecoins in January

Wyoming: FRNT

(This has to be one of the wildest stories of the month.)

Launched last August, Wyoming’s state-backed stablecoin FRNT is now available to the public.

This is a standout issuance for many reasons, both structural and political.

The token has official backing and compelling use cases – paying state contractors via traditional methods, for example, can take weeks, while FRNT should in theory compress that to minutes. Public payroll could become cheaper to distribute, tax refunds could arrive faster, and so on.

But despite that, takeup is not guaranteed.

Apart from the usual user suspicion of any change involving money, and the likely reluctance to change habits, there is considerable onboarding friction. Initially FRNT will only be available for purchase on Kraken, so users will have to open accounts. Also, Kraken will sell FRNT only on the Solana blockchain. A partnership between the state and crypto card issuer Rain will allow holders to spend FRNT anywhere Visa is accepted – but on the Avalanche blockchain. Holders can switch their FRNT from Solana to Avalanche (and Ethereum, Base, Arbitrum, Optimism, and Polygon) via the Stargate app, which I presume means they’d need to open an account there, too.

Why would they want to do that?

Here’s where it could get interesting. The GENIUS Act bans issuing banks and non-banks from paying yield. Wyoming argues that it is not covered by this ban as it is, essentially, a sovereign issuer. This means it could distribute interest. It has no intention to do so just yet, though. For now, any interest earned on reserves will help fund the state’s school system.

But, hang on, if it’s a sovereign issuer, doesn’t that make FRNT a sort of CBDC? Representative Tom Emmer thinks it does, and his vehement opposition is reportedly one of the reasons public access was so delayed. But there is no central bank issuer here, digital money is not “created”, and FRNT is backed by US treasuries – not at all like a CBDC.

Could the US Administration stop Wyoming from paying interest on FRNT? I’m not a lawyer (nor am I American), but from what I gather, states have to comply with laws passed by Congress, but not with Executive Orders, which are binding on federal agencies but not states. But, of course, a lot of pressure could be applied to comply, and it gets especially fuzzy when an EO is an interpretation of an existing law.

Confused yet? The grey areas are so interesting.

Tether: USAT

The other big issuance of the month was from Tether, which launched its dollar token USAT, available to US-based institutions. I wrote about this earlier this week so won’t go on much more, other than to add that USAT could end up encouraging more use of USDT offshore as the US regulatory approval of USAT confers a shine of respectability on USDT. They are two separate assets operating in different jurisdictions, but perception matters.

See also:

Tether: USAT touchdown (Jan 2026)

Fidelity: FIDD

Long rumoured to be in the works, earlier this week Fidelity Investments confirmed the launch of its stablecoin in coming weeks. The Fidelity Digital Dollar (FIDD) will be issued on Ethereum by the asset manager’s national trust bank, for which it got provisional authorization last month. FIDD will be available on participating exchanges, but here’s a twist: the national trust bank’s retail and institutional clients will be able to buy and redeem FIDD on one of Fidelity’s digital assets platforms (it has three: Fidelity Digital Assets, Fidelity Crypto, and Fidelity Crypto for Wealth Managers platforms). This is unusual, normally redemption is limited to a few authorized participants, with most stablecoin users buying and selling stablecoins on exchanges.

Also, according to the statement, FIDD will be freely transferrable to any Ethereum address – I’m not sure how compliance will work here, details to come, I expect.

This issuance is interesting in that it is the first large asset manager to issue a US dollar stablecoin. It has a massive network of potential users, and a trusted brand. But pickup might be slow as the use of stablecoins for payments is still nascent, the main use by far is still trading, and I expect only a very small percentage of Fidelity customers are active in DeFi and crypto markets. Those that are will need a strong reason to switch from their current stablecoin of choice.

Universal Digital: USDU

The United Arab Emirates has its first regulated dollar-backed stablecoin. Issued by Universal Digital, USDU is registered with the region’s central bank as a Foreign Payment Token, which means it can be used by institutional and professional clients (including foreign entities) for settlement of trades on UAE crypto exchanges. This may sound limited, but given the region’s growing crypto activity, the token is likely to pick up meaningful volume, especially as professional traders switch from using unregistered stablecoins (USDT, USDC and others) to the central bank-authorized USDU. The token should also benefit from compliant, bank-approved onramps and integration into the financial system, although the regulation stipulates it can’t be used for domestic or cross-border payments.