Russia wins, Europe stirs?

plus: the Fed, macro data, markets and more

“It must be admitted that there is a degree of instability which is inconsistent with civilization. But, on the whole, the great ages have been the unstable ages.” – Alfred North Whitehead ||

Hello everyone! I hope you all had a good weekend and managed to get some downtime. This is a big week, likely to be emotional for many – I know, I know, peace is a lot to hope for, but it’s hard not to.

I was invited onto Yahoo Finance TV on Thursday, along with Axios’ Brady Dale – we talked about market drivers, the ETH run and more. I have no idea how to find the clips, though. And I was on Bloomberg’s Asharq Business Middle East channel yesterday morning.

Production note: I’m away for a wedding Wednesday-Sunday, so this newsletter will take a short break after tomorrow.

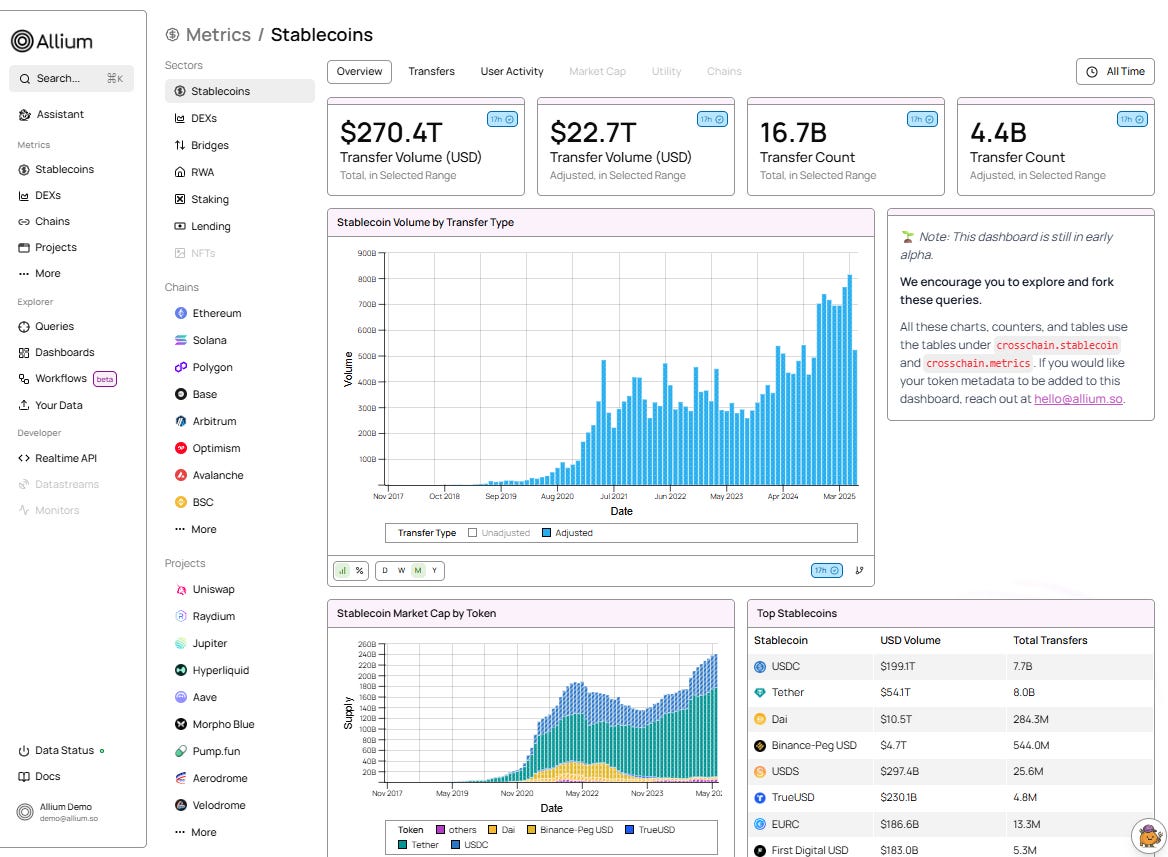

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides blockchain data and analytics for institutions and fintechs, helping teams generate key insights from on-chain activity. Leaders like Visa, Stripe, and Grayscale rely on Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

Coming up: war negotiations, a new Fed framework, FOMC minutes

Russia wins, Europe stirs?

Macro-Crypto Bits: PPI, retail sales, consumer sentiment, import prices, markets

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

Coming up:

This week is bookended by two big events, one with potentially major impact on geopolitics and military spending, and the other with a potentially major impact on US monetary policy and the outlook for rates.

Today, President Trump will meet with Ukraine’s President Zelenskyy in the Oval Office at 1:15pm ET. They will then move to the East Room for a meeting at 3:00pm ET with European leaders. The objective is to convince all parties to agree to Russia’s terms for peace and bring an end to a painful war now well into its fourth year. More on this below.

The other big event this week is the annual symposium held in Jackson Hole, Wyoming, which kicks off on Thursday evening and will see central bank chiefs from around the world gather to discuss policy, economics and strategy. This year’s theme is “Labor Markets in Transition: Demographics, Productivity, and Macroeconomic Policy”.

Even more significant than debates on how the jobs market is changing underneath the numbers, this symposium should deliver more detail on the Federal Reserve’s new policy framework, including changes as to how it sees its goals and the means to achieve them. Back in 2020, Chair Powell introduced the central bank’s Flexible Average Inflation Targeting (FAIT) framework, which set a 2% average inflation rate over time as the monetary policy target. Speaking at 10:00am ET on Friday, he is expected to announce its sunset, and reveal what will take its place. We might also get some hints as to the mood within the FOMC regarding rate cuts – but that’s probably too much to hope for. Last year, Powell did signal a readiness to start cutting. But this year, uncertainty is much, much higher.

Other than lots of central bank stuff, the week is light in terms of economic data releases.

On Wednesday, we get the minutes from the last FOMC meeting, which produced dissents from two governors for the first time since 1993 – we could get some insight into how many other committee members are leaning towards more cuts.

On Thursday, we get the preliminary read on August manufacturing and services activity in the US from S&P Global, with both expected to show some softening.

We also get the US Conference Board’s Leading Index for July, expected to show the sixth consecutive negative-to-flat read.

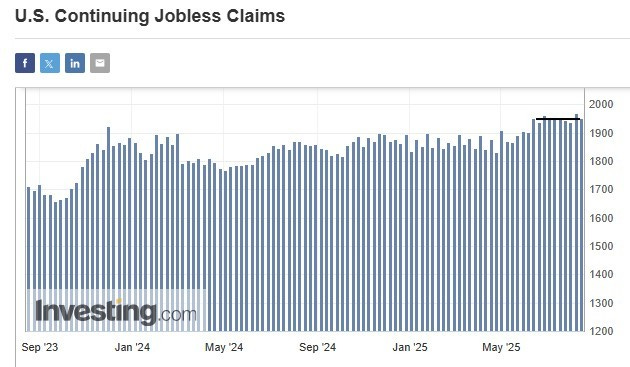

And we get weekly jobless claims, a noisy report much scrutinized for signs of a trend. Of the batch, continuing claims is the data point to keep an eye on as it points to the number of people persistently unable to find work. So far, this has been relatively stable, higher than in the aftermath of the pandemic, but notably lower than the average during the inter-crisis period.

(chart via Investing.com)