Some clarity on CLARITY

Plus: markets react, US inflation and more

“Being absolutely right and being spectacularly wrong feel exactly the same.” – Scott Adams ||

Hello everyone! I hope you’re all taking care of yourselves. This week is so crazy I woke up totally unsure of what day it was.

Apologies for the late send today – still adjusting to my New Years Resolution to get this out by 8:30am. 😑Where did the morning go…

🤓 I did a fun recording yesterday for the AllInCrypto podcast - I’ll let you know when the episode is out.

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

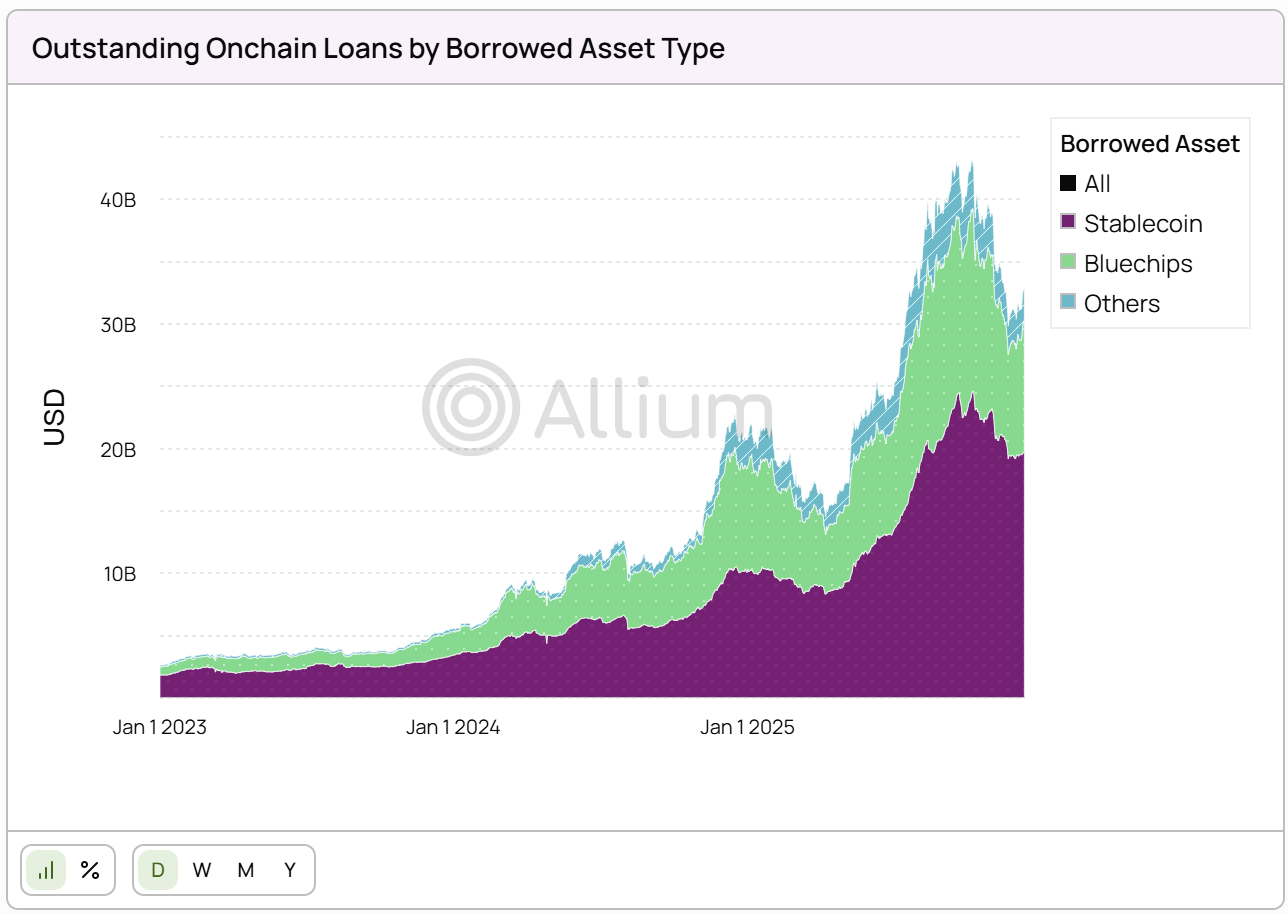

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets. Looking at the data, outstanding onchain loans reached over $40Bn this year, with stablecoins making up more than half of borrowed assets.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

Some clarity on CLARITY

Markets: finally, a reaction

Macro: US inflation

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes. Plus links, a music recommendation (‘cos why not?), and more.

If you’re a premium subscriber, thank you!! ❤

WHAT I’M WATCHING:

Some clarity on CLARITY

Yesterday must have been a particularly frenetic day on Capitol Hill as the Senate Banking Committee scrambled to craft language for and collect proposed amendments to the CLARITY Act crypto markets framework which heads into a markup session on Thursday.

This will debate the latest version of H.R. 3633, which updates the bill passed by the House of Representatives last July to include bipartisan amendments from Senate Banking Committee members. The full text was released by Committee Chair Tim Scott’s office yesterday, and 137 amendments had been submitted by the 5pm deadline (38 by Senator Warren who is probably still working on raising her anti-crypto army). I’m not sure how the Thursday session will go, but it’s unlikely that all will get consideration unless everyone talks and decides on things really fast.

If you want to torture yourself by sitting through the markup session, I believe it will be livestreamed here.

Stablecoin yield has reportedly been the most contentious issue – the GENIUS Act bans yield but not rewards, and the banking industry sees that as a “loophole” that has to be closed by including provisions in the crypto market structure bill, even though it has nothing to do with crypto market structure.

Things are in flux and may change, although for now it looks like there are limitations but not a ban on stablecoin rewards. According to the draft, they will be allowed under certain circumstances. Platforms won’t be able to pay users to simply hold stablecoins, but they will be able to reward them for membership in a loyalty or incentive program, for stablecoin use and other forms of “ecosystem participation”.

This limitation is of course frustrating to all of us who see the banking industry shooting itself in the foot so as to protect its expensive face, putting appearance before progress. Putting a moat around profits at the expense of the consumer and of financial innovation will not be remembered kindly by either history books nor the institutions held back by an anti-progress mindset. Plus, pretty much no-one with even a passing familiarity with how banks work truly thinks stablecoins represent an “existential threat”, and institutions that insist otherwise only serve to remind all observers that they are unlikely to be key players in tomorrow’s markets.

Yet it’s not a total banking win; stablecoin use can be rewarded, an opportunity we can be sure the industry will make good use of.

As I’ve often argued before, stablecoin yield is not an existential issue for the consumer, especially if the access restriction rules get relaxed on holdings of tokenized assets – which they should because they currently make no sense. Why do regulations bar retail investors from most tokenized money market fund issuance? It can’t be because of risk. Anyway, I digress…