Stablecoin scaremongers

plus: "unhinged", US inflation, complacency, vibes and more

“Periods of tranquillity are seldom prolific of creative achievement. Mankind has to be stirred up.” – Alfred North Whitehead ||

Hi everyone! I hope you’re all taking care of yourselves, October can be stressful.

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

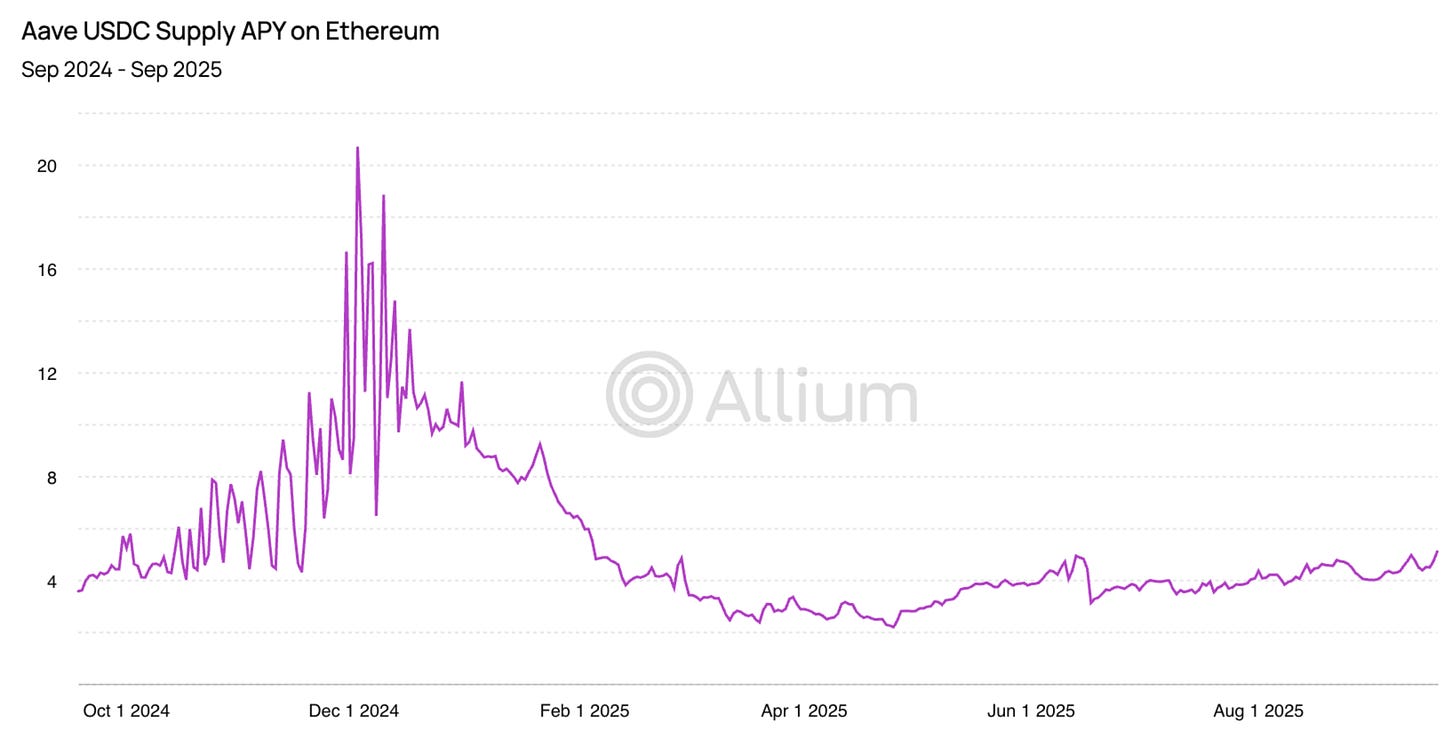

Allium provides vetted blockchain data to answer your hardest macro questions, like:

“How has the lending interest rate of USDC for Aave on Ethereum changed ahead of Fed rate cuts?”

Our data covers 100+ chains and is internally checked for accuracy every 5 minutes. We handle the pipelines and edge cases so you can uncover insights faster with a single, verified data source. Teams like Visa, Stripe, and Grayscale trust Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

Playgrounds and mirrors: the US/China spat gets crazier

Stablecoin scaremongers

Macro-Crypto Bits: US inflation, business mood, market complacency

Also: another bank stablecoin, another provocation

WHAT I’M WATCHING:

Stablecoin scaremongers

Global regulators outside the US are nowhere close to giving up the fight against stablecoins. Even regimes that have passed stablecoin regulation such as Japan and Hong Kong are going painfully slowly, in the name of preventing market dislocation.

And, of course, global organizations are presenting a unified and increasingly panicked front against the innovation threatening the existing financial structure, despite the opportunity for faster cross-border payments, greater transparency, more flexible programmability and many other features that could improve the circulation of money while lowering operating costs.

IMF

In its World Economic Outlook report released this week, the IMF again warns that stablecoin success could destabilize global finance, arguing that a run on any given issuer would trigger a fire sale of government debt and other backing assets – overlooking that a much more likely result is a transfer from one stablecoin to another, which would minimize traditional market disruption. There could be short-term volatility as positions are adjusted, but not much more.

And, why would there be a run if the stablecoins are backed by government debt and other “safe” assets, unless there is doubt that the assets are safe? In which case it won’t be stablecoins triggering the crisis. This is a flimsy argument that justifies the reach for more control through, you guessed it, a “comprehensive, risk-based regulatory and supervisory framework”. In other words, more regulation.