Stablecoins and lending

Plus: credit concerns, gold frenzy, transparency and more

“If you don’t know where you are going, any road will get you there.” – Lewis Carroll ||

Hello everyone, and happy Friday!!! I hope you’re all taking care of yourselves - markets look ugly (more on this below) and, everywhere else, things are changing fast. You’ll need stamina for what’s ahead.

My latest op-ed in American Banker (paywall, sorry), Zero-knowledge’ proofs could revolutionize banking compliance, looks at what zero-knowledge proofs are and how they can change how we understand compliance and the ownership of information.

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides vetted blockchain data to answer your hardest macro questions, like:

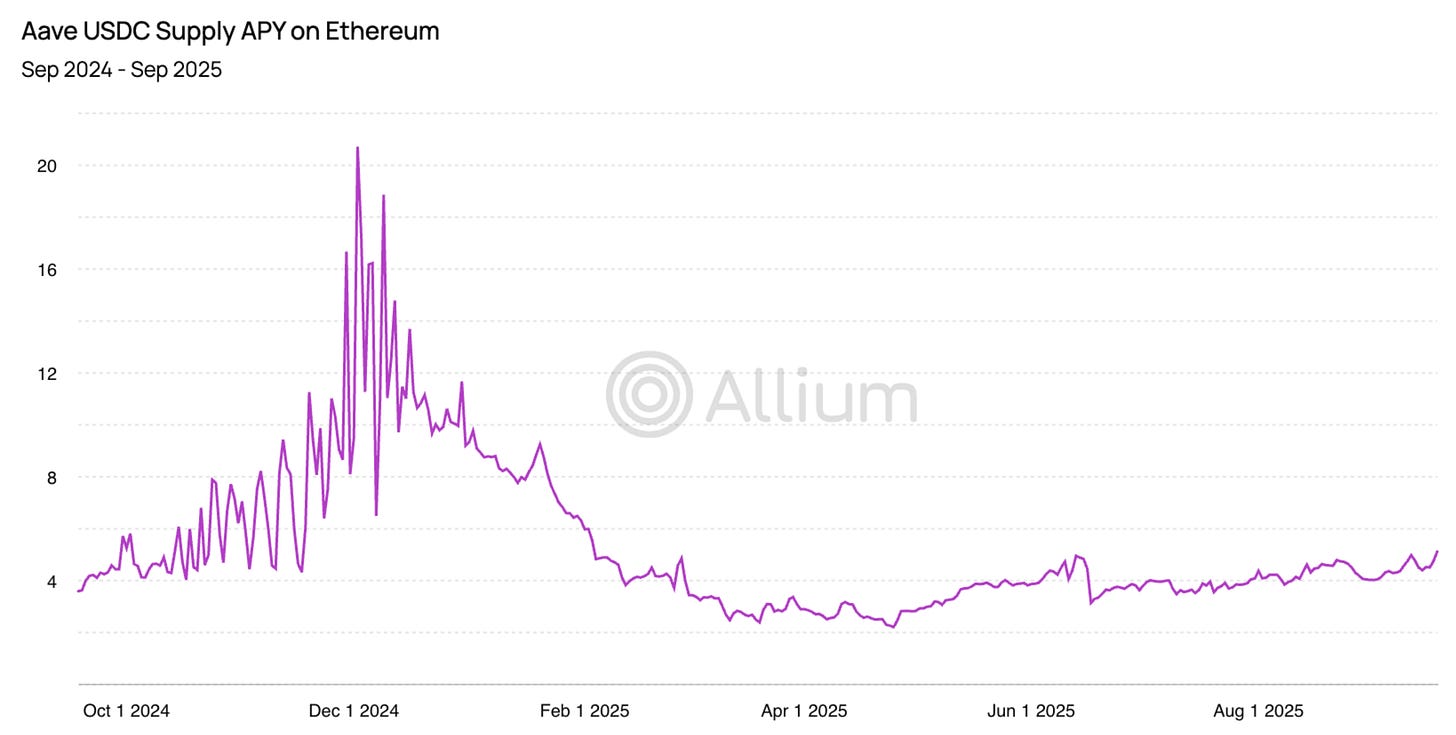

“How has the lending interest rate of USDC for Aave on Ethereum changed ahead of Fed rate cuts?”

Our data covers 100+ chains and is internally checked for accuracy every 5 minutes. We handle the pipelines and edge cases so you can uncover insights faster with a single, verified data source. Teams like Visa, Stripe, and Grayscale trust Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

Stablecoins and lending

Macro-Crypto Bits: credit fears, gold craziness, transparency

Also: protests, a new type of bank, blurring market boundaries, common market

WHAT I’M WATCHING:

Stablecoins and lending

To date, mainstream attention on stablecoin adoption has been focused on the use case for payments: faster, more transparent, possibly cheaper. This is understandable as payments is an activity that affects us all, and the opportunity to improve on something we do daily is compelling.

It has focused less on the main stablecoin use case today: crypto trading. Also understandable, as this affects a relatively small (but active) subset of the potential market.

Less understandable is why mainstream attention has largely overlooked a stablecoin use case that has already seen astonishing growth in recent years, and that will end up forming a bedrock of the intersection between banking and blockchain in years to come.

I’m talking about lending.

This is also a financial activity that affects us all in one way or another – even if you don’t have a mortgage or other large consumer loan, you probably use a credit card. And if you work, your business or employer is likely to use trade finance, have significant commercial or industrial loans, or at least a credit facility.

And yet, we don’t hear as much about it, even though the application is as compelling as for payments, if not more so. True, payments are more fluid and the potential pool of participants is vast. But lending is also a systemic financial function that could use a makeover – what’s more, given the tilt away from bank lending towards opaque private credit funds, the makeover is getting increasingly urgent (I’ve been wanting to write more about this angle for a while, will find the time).

The lack of attention may be about to change – Allium has published a report together with Visa on stablecoins and lending that highlights some detailed numbers as well as the advantages and potential growth.

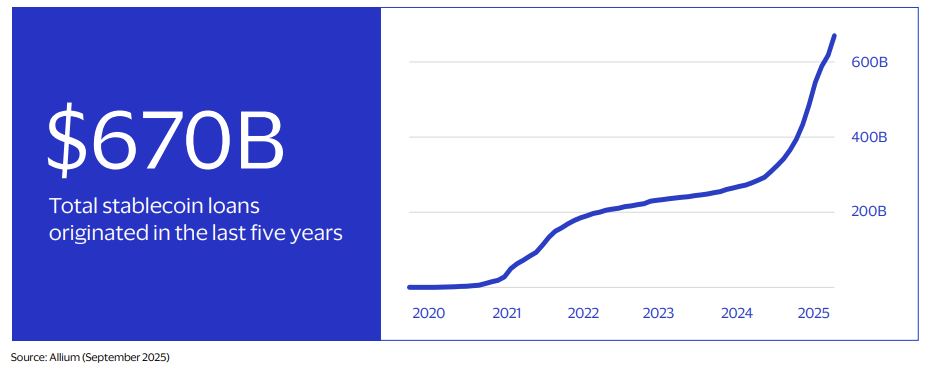

Stablecoin lending is well known among crypto natives who use any of the wide range of decentralized lending applications. According to the report, the amount of stablecoin loans originated over the past five years has reached roughly $670 billion, $51.7 billion in August alone.

(chart via Allium)

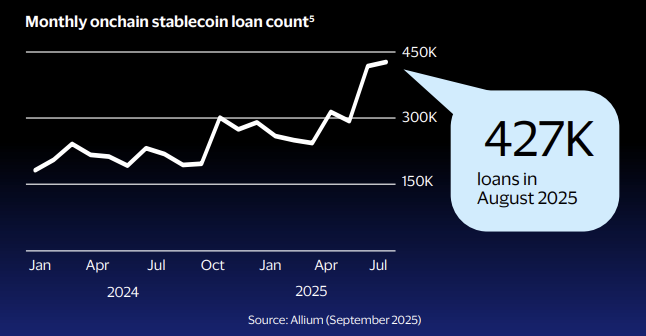

What’s more, the number of loans has been steadily increasing over the past few years, hitting 427,000 in August, more than double the level of a year ago.

(chart via Allium)

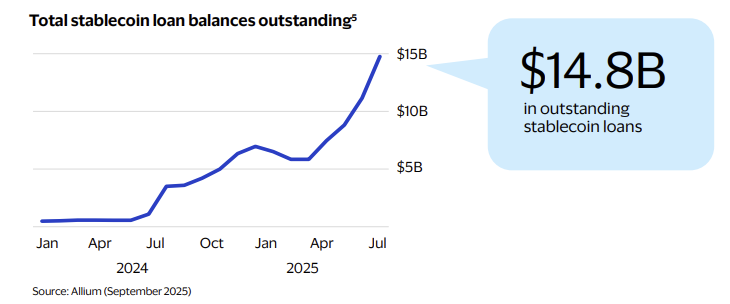

The amount of stablecoin loans outstanding has soared in recent months to $14.8 billion.

(chart via Allium)

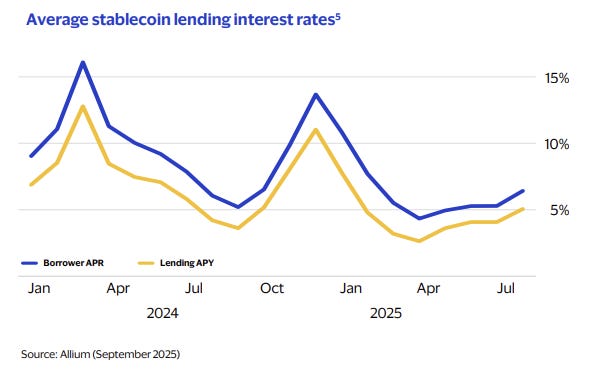

The 12-month average yield for lenders has climbed in recent months to 5.0%, while the 12-month average borrowing rate has risen slightly to 6.7%.

(chart via Allium)

How is this relevant to the traditional banking industry? Through the efficiencies of onchain applications, which can be adapted to a compliance environment.

DeFi lending has many different models, but here’s how a stablecoin-fuelled platform could work:

Investors send tokens to a smart contract that deposits them into a lending pool. They typically start earning interest on this amount immediately.

Borrowers can access this pool of lendable funds by posting onchain collateral (such as crypto assets or tokenized securities) to another smart contract, which calculates the amount of loan available according to the collateral’s volatility.

The smart contracts automate loan servicing and can adjust rates according to supply and demand. They can also monitor collateral values in real time and handle liquidation if necessary. And they can distribute the yield to lenders. What’s more, smart contracts don’t have office hours, they’re operational 24/7.

And the potential risk is controlled: the loan is distributed in stablecoins, while the collateral is easy to seize and liquidate in case of a sharp drop in its value. Plus, the system is transparent, allowing for real-time monitoring of flows.

Essentially, the role of a lending department would be replaced by collateral ratios and automated liquidations.

I often get asked about where banks will fit into the stablecoin ecosystem. It’s unlikely to be through stablecoin issuance, I just don’t see how that makes sense for banks either operationally or strategically. That said, there are plenty of other ways for banks to get involved.

Stablecoin lending is one. Not only will it deliver a potentially meaningful source of fees; it will also be a key incentive for banks to embrace decentralized finance principles, even if tentatively and with compliance checks.

What’s more, the inevitable convergence between traditional and onchain finance comes at a time of turmoil within traditional banking structures, given geopolitical changes as well as the building risk in markets. Put differently, some see a threat – others see an opportunity.

(NOTE: Allium are sponsors of this newsletter – they didn’t ask me to feature the report, I’m doing so because I genuinely found it a welcome change from the usual stablecoin narratives. They share data I haven’t seen elsewhere, such as detailed breakdowns of stablecoin lending by token and chain. Check it out if you’re interested in more detail.)

🌻If you find this newsletter at all useful (or even if you just like my music recommendations), would you mind sharing with colleagues and friends and nudging them to subscribe? I’d appreciate it! 🤗

Macro-Crypto Bits

Short-form thoughts on key macro/crypto twists: