Stablecoins and power

plus: Bitcoin's IPO, what's ahead this week, gold and more

“Technology does not drive change. It is our collective response to the options and opportunities presented by technology that drives change.” – Paul Saffo ||

Hello everyone, and happy November!!! Wait… November already???? I hope you’re all doing well and had a good weekend.

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides vetted blockchain data to answer your hardest macro questions, like:

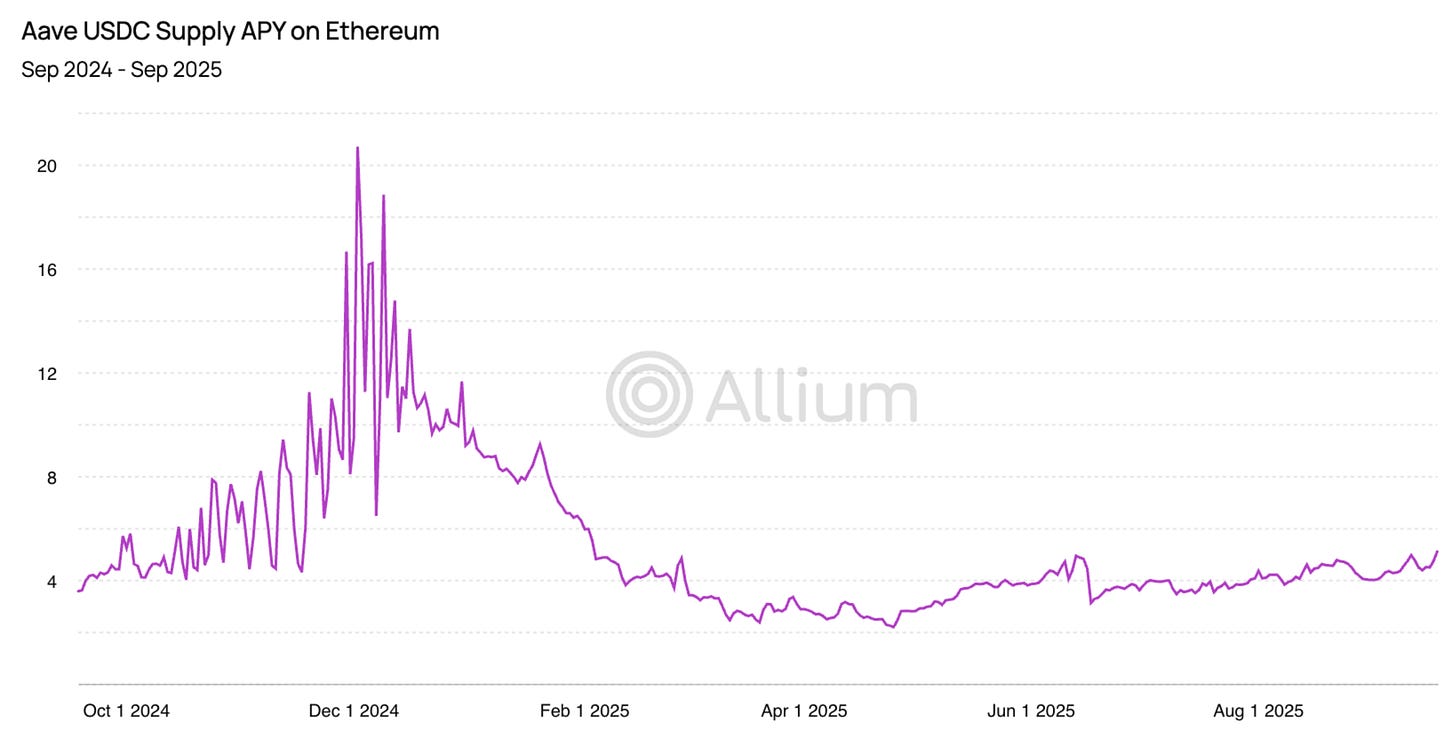

“How has the lending interest rate of USDC for Aave on Ethereum changed ahead of Fed rate cuts?”

Our data covers 100+ chains and is internally checked for accuracy every 5 minutes. We handle the pipelines and edge cases so you can uncover insights faster with a single, verified data source. Teams like Visa, Stripe, and Grayscale trust Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

Coming up this week: lots of Fedspeak, Supreme Court, US jobs, ISM, China inflation

Stablecoins and power

Bitcoin’s “IPO”

Macro-Crypto Bits: DXY and gold

If you’re not, you could be getting a lot more out of these newsletters!

WHAT I’M WATCHING:

Coming up this week:

Given the jug of cold water Chair Powell threw on the probability of a December rate cut last week, more attention than usual will be paid to what Fed officials say in public comments. This week, we hear from:

Governor Lisa Cook (today, and no doubt she’s relieved that it seems Trump has stopped trying to fire her),

San Francisco Fed President Mary Daly (also today),

Fed Governor Michelle Bowman (Tuesday, speaking in Madrid which feels relevant to me since I live here, but probably doesn’t to you),

Fed Governor Chris Waller (Thursday)

Fed Governor Michael Barr (Thursday)

Philadelphia Fed President Anna Paulson (Thursday)

St. Louis Fed President Alberto Musalem (also Thursday, what a day),

New York Fed President John Williams (Thursday and Friday CHECKTK)

Dallas Fed President Lorie Logan (Friday)

Fed Vice Chair Philip Jefferson (Friday, this is exhausting)

and Fed Governor Stephen Miran (Friday – he will address stablecoins and monetary policy at the Harvard Club of New York).

Monday sees the kickoff of the three-day Global Financial Leaders’ Investment Summit in Hong Kong – Goldman Sachs CEO David Solomon, BlackRock CEO Larry Fink (for the first time) and Citadel CEO Ken Griffin are just some of the financial dignitaries flying in for some panel time. The theme this year is “Trekking through Shifting Terrain” which, yep, just about sums it up. It will apparently open with a video address by China’s Vice-Premier He Lifeng.

We also get the US ISM manufacturing activity indices for October.

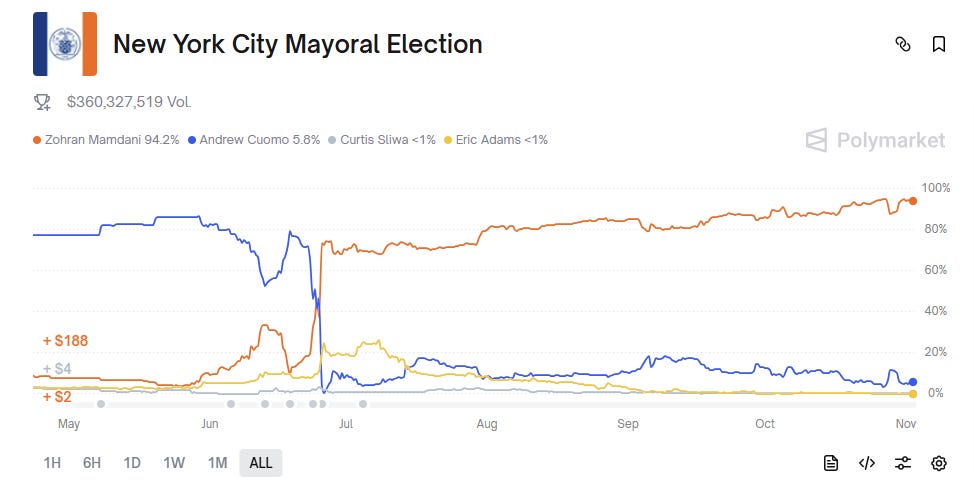

On Tuesday, New Yorkers vote for their mayor – Polymarket bettors are certain Zohran Mamdani will win, and the latest polls put him at just over 40% of the vote. This should be interesting.

(chart via Polymarket)

On Wednesday, the Supreme Court hears arguments for the lawsuit against the US Administration that argues the use of IEEPA to apply tariffs to imports is unlawful. Two previous courts have ruled against the government on this, so the outcome here is not clear, and there’s a lot riding on the decision. I’ll have more to say on this tomorrow.

We also get the private ADP data on non-farm, non-government payroll gains for October – the consensus forecasts point to a slight increase after two months of declines.

There’s the release of US ISM services activity indices.

And we get the minutes from the recent Bank of Japan meeting, which should give some insight into how likely a rate hike is in December.

On Thursday, Challenger, Gray & Christmas release their report on job cuts last month. We’ve seen several sizeable layoff announcements from large firms over the past few weeks, but these take time to trickle through to the data – nevertheless, we should probably brace ourselves, because if we don’t see the numbers impacted now, we will soon.

Friday brings the latest University of Michigan consumer survey, which will probably be bleak.

On Saturday, we get China’s latest inflation and economic activity data.

Stablecoins and power (podcast notes)

At its root, one’s stance on stablecoins reflects one’s stance on power.

That’s a big statement for a humble newsletter, and one that I will be returning to often in coming months – but I was listening to a podcast yesterday that argued CBDCs were much more democratic. Once I’d recovered from the instinctive recoil, it made me think. Of course I strongly disagree but, digging deeper, the reasoning is not as alarming as it may at first seem. It stems from the belief that democratically elected governments should have influence over the central bank, which in an ideal world would be more representative than ceding the creation of money to private businesses.

Thinking along those lines implies a deep suspicion of free markets, but that, too, reflects one’s stance on power, on who should have it: the bureaucrats or the technocrats?