Stablecoins and the new Gresham’s Law

Plus: the jobs report, stablecoins for treasury, and more

“When you want to know how things really work, study them when they’re coming apart.” – William Gibson ||

Hi everyone! 💥 Apologies for the late send, just as I was about to hit the button, Substack suffered a network outage - just fixed now, but still glitchy so it may be a while before you get this. How’s your day going? 💥

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

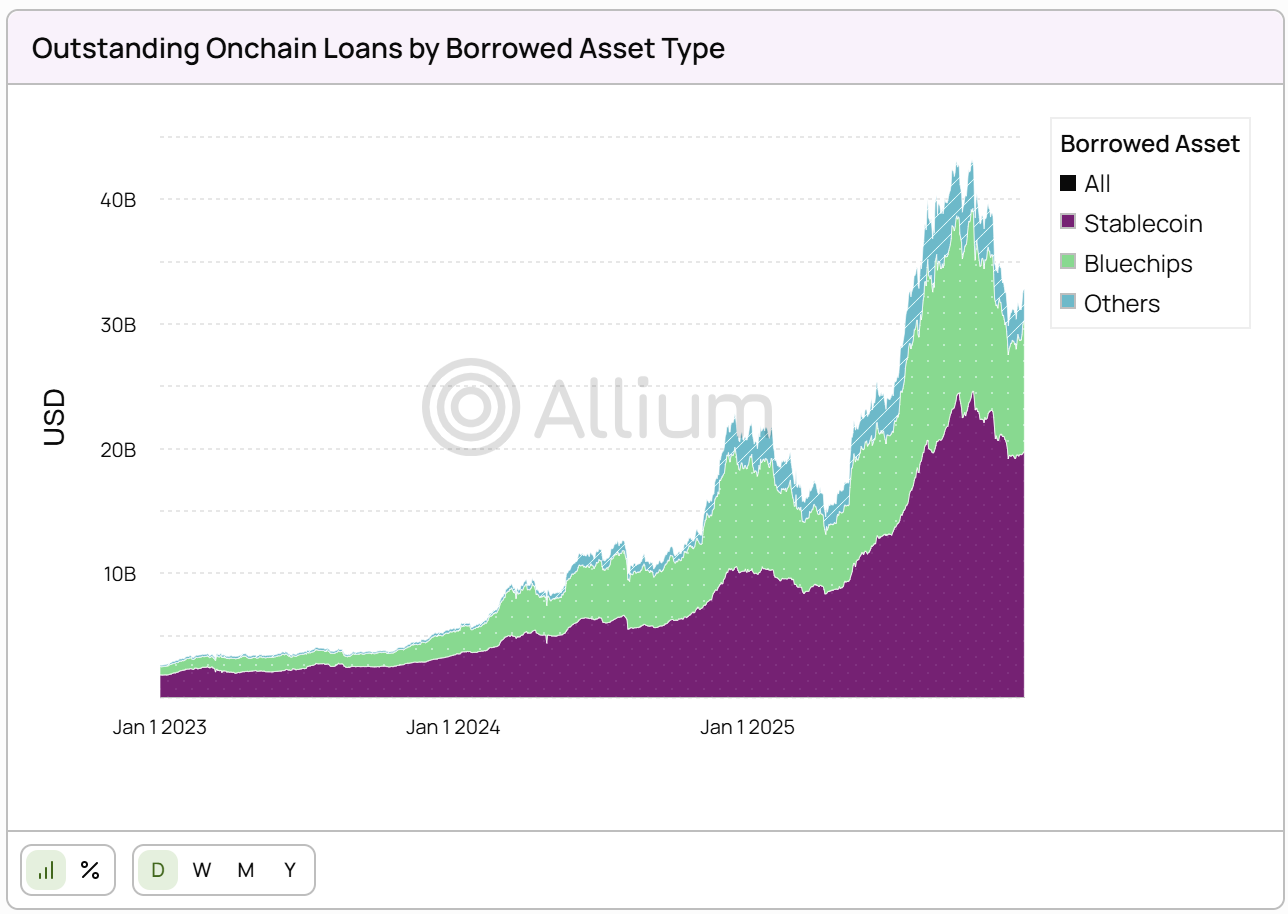

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets. Looking at the data, outstanding onchain loans reached over $40Bn this year, with stablecoins making up more than half of borrowed assets.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

Stablecoins and the new Gresham’s Law

Broadridge: stablecoins for treasury

Macro: wow, that jobs report

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes. Plus links, a music recommendation (‘cos why not?), and more.

If you’re a premium subscriber, thank you!! ❤

WHAT I’M WATCHING:

Stablecoins and the new Gresham’s Law

(The below is a rough summary of notes I took while listening to a Macro Musings interview, in which David Beckworth chatted to Dan Awrey about his recent book “Beyond Banks: Technology, Regulation, and the Future of Money”, now on my list. Dan’s ideas are so relevant to the evolution of stablecoins in the US, and the intersection of technological innovation and financial regulation more broadly, that I felt they were worth sharing. This is in note form and I’m running late today, so forgive the choppiness.)

It took centuries of experimentation to come up with the current business model for banks and payments – the result is pretty good credit-based money, but it created a path dependency in giving control of the payment system to banks who were not prepared for the technological disruption from the Internet Age.