Stablecoins, CBDCs and a unified European market

plus: BTC, gold, yields, job, sea beds and more

“We are stuck with technology when what we really want is just stuff that works.” – Douglas Adams ||

Hello everyone, and happy Friday!! This week has FLOWN by. I hope you have good downtime planned for the weekend – what’s coming my feel like a sprint, but it’s really a marathon.

Apologies for the late send today. Our senior dog isn’t doing very well, so I confess to spending a fair part of the morning hovering and fretting.

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides vetted blockchain data to answer your hardest macro questions, like:

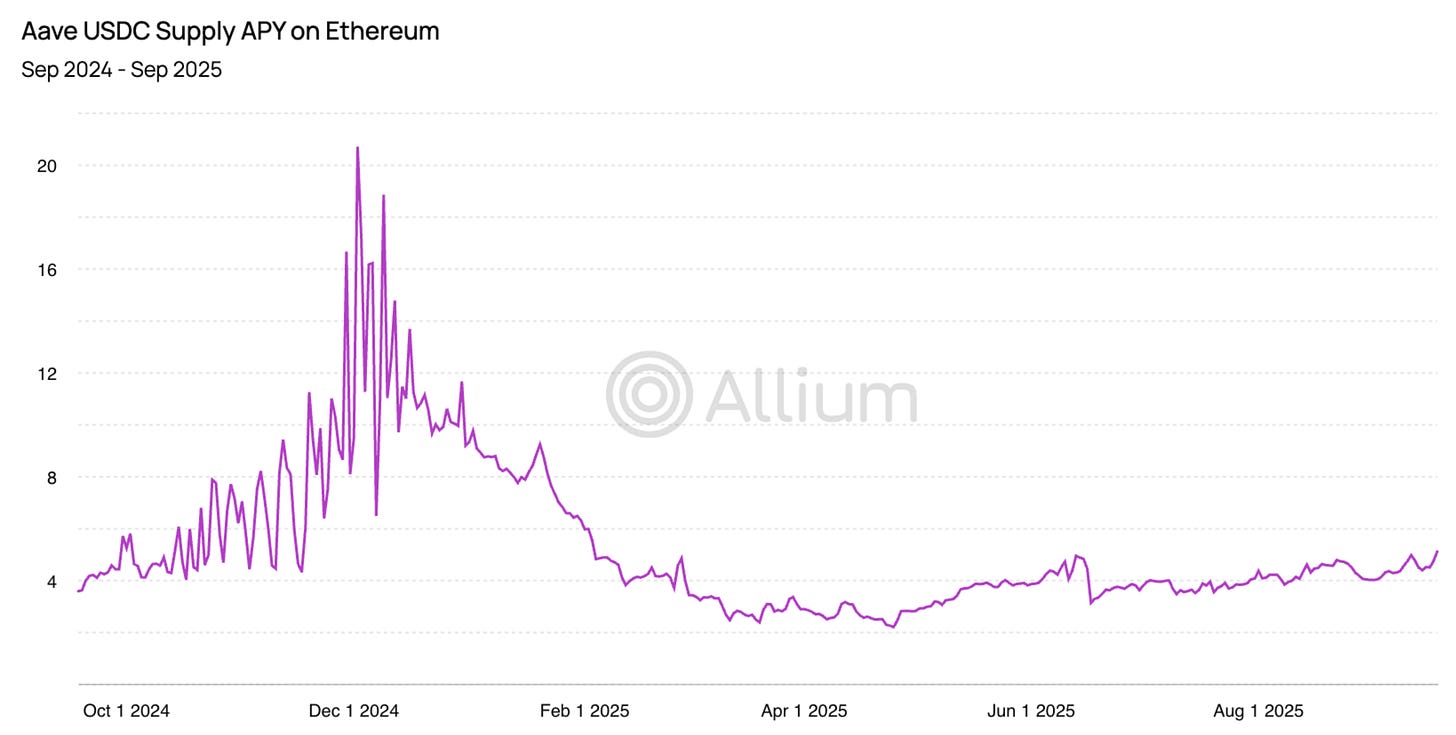

“How has the lending interest rate of USDC for Aave on Ethereum changed ahead of Fed rate cuts?”

Our data covers 100+ chains and is internally checked for accuracy every 5 minutes. We handle the pipelines and edge cases so you can uncover insights faster with a single, verified data source. Teams like Visa, Stripe, and Grayscale trust Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

Stablecoins, CBDCs and a unified European market

Macro-Crypto Bits: gold, yields, jobs and BTC

Also: Argentina, Japan and sea beds

WHAT I’M WATCHING:

Stablecoins, CBDCs and a unified European market

Few outside our bloc realize that the European Union is a union in name only.

We have a common currency and a centralized central bank that oversees the region’s monetary policy as well as its systemically important financial institutions.

But we don’t have banking union: each member state has its own banking regulator. Progress has been made towards a more unified landscape over the years, and there is a common “rule book” – but not much incentive to follow it. Nation states retain control over deposit insurance, and domestic banking regulators are responsible for their country’s smaller banks. There is no common policy regarding sovereign debt exposure, risk weighting flexibility, rescues vs bail-ins, and other key sector features.

We also don’t have capital markets union, even though there is more or less universal acceptance it’s a good idea. What’s in the way is reluctance from smaller financial hubs to lose national relevance, and the need for a unified tax policy on capital gains and dividends – nations see this as impacting budgetary control. What’s more, any controversial change on anything is on hold these days as key European nations navigate the treacherous shoals of political polarization. And capital markets work, so why pull on that contentious thread?

The result is no vibrant EU marketplace, not even for EU government debt. This curtails the potential market for raising capital, perpetuating the reliance on banks rather than public platforms. It limits the pool of potential investments for savers. And it severely constrains the ability of the European Union to raise common funds, such as for defence spending.

Earlier this week, the President of the German central bank Joachim Nagel gave full-throated support to the idea of a common defence budget and the issuance of common debt. But the German government is opposed, reluctant to have to “carry” weaker nations. (This could change as Germany itself becomes weaker.)

Beyond the ability to raise funds for joint military spending, the lack of a deep, liquid market for government debt is claiming another casualty: euro-backed stablecoins.